Trading lower after an impressive earnings report, La Rosa Holdings Corp. (NASDAQ: LRHC) stock may present a bargain too good to ignore. The numbers posted indeed support that bullish assessment. Moreover, they show that La Rosa Holdings' growth trajectory continues to steepen at an accelerating pace.

Supporting evidence includes LRHC reporting a 117% year-over-year increase in total Q1 revenues, more than doubling from $6 million to $13.1 million. That's not the only standout. La Rosa also achieved a 211% increase in real estate services revenue, reaching $10.2 million, up from $6.9 million last year. Perhaps the best news for investors with a forward-looking perspective is that the company's guidance remains decidedly bullish, reiterating that it expects to generate a $100 million annualized revenue run rate by the end of 2024.

Revenue increases toward that goal are accruing. Primarily from La Rosa's September 1, 2023, increase in transaction fees, monthly agent fees, and annual fees, which should significantly boost real estate brokerage services revenue in 2024, in addition to the growth in the broker network. That's one of many value drivers inspiring investor interest.

Growth Through Accretive Acquisitions

The company's earnings also shows that La Rosa is growing much faster than probably any early investor ever expected. That includes value from its acquiring 51% of franchisee Prestige, making it the tenth acquisition since its public listing last year. Like the nine others, this one is also a top-performing office, which generated 2023 revenues of $4.7 and, more importantly, positive net income. This asset adds more than financial strength.

It also significantly strengthens La Rosa's market position in Polk County, Florida, particularly by capitalizing on the selling strength of Prestige's 162 agents, which makes them the second-largest brokerage in terms of agent count and the third-largest in real estate sales within Polk County last year. With that in mind, this acquisition could be instrumental in expediting La Rosa's intention of reaching its goal of an annualized revenue run rate of $100 million by the end of 2024. And, remember, this deal adds to already increasing revenue-generating firepower.

LRHC's other acquisitions also contribute to the bullish thesis, which, according to La Rosa, could put bottom-line EPS in the crosshairs as early as the first half of 2025. However, the acquisition trend is likely far from done. In fact, investors may be wise to follow La Rosa's guidance that the string of acquisitions are not a one-off event. On that front, CEO Joe La Rosa has publicly emphasized his strategy to roll up profitable offices, consolidate market presence, and benefit from economies of scale that result from seamlessly integrating newly acquired assets with current portfolio assets.

Redefining The Real Estate Transaction Landscape

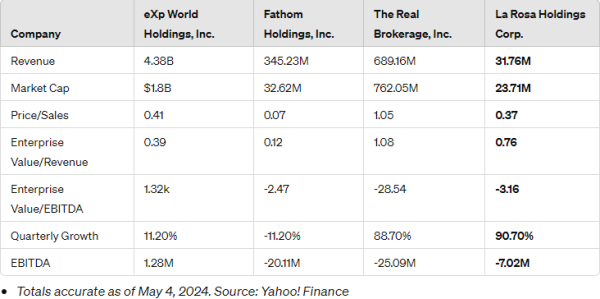

That's allowing La Rosa to do more than grow its revenues, it's showing that this microcap company can indeed compete with the more prominent real estate sector players. In some cases, the company is already performing better than several of its peers. Compared to eXp World Holdings (NASDAQ: EXPI), The Real Brokerage (NASDAQ: REAX), and Fathom Holdings (NASDAQ: FTHM), La Rosa demonstrates that being aggressive but nimble in practice can return quick, more efficient ROI for itself and its stakeholders.

While La Rosa's market cap is smaller than that of the other three listed companies, that's not necessarily bad news. In this case, compared to those noted, it exposes a share price to performance disconnect. This is not based on direct dollar-for-dollar comparisons but on valuing the current and future value of an asset portfolio that does not have the burden of carrying non- or underperforming assets. That's resulted from intelligent decisions that deliver accretive revenue growth and build tangible and manageable market cap increases by efficiently using available capital.

The chart below helps explain the value proposition. Remember, La Rosa Holdings only came public last year, so comparisons are not exactly apples to apples in some respects. Still, they are favorable to La Rosa and its potential. Financial efficiency, particularly evident in its Enterprise Value / Revenue ratio, is a strong indicator of resource management. As shown, while REAX may have a higher ratio, La Rosa's performance in other areas compensates. Its performance in this measure suggests it's generating more revenue relative to its enterprise value, a promising sign for potential growth. This efficiency can support a higher share price, influencing the Price/Sales ratio.

La Rosa's Price/Sales ratio handily beat FTHM's and is on the heels of EXPI. While considerably below REAX, this gap may close significantly after factoring in additional acquisitions. La Rosa's current P/E exposes that its stock may be undervalued relative to its sales, especially with these numbers for all the comps as of the last reporting period. And here's the value kicker—EV / EBITDA.

Yes, La Rosa may have negative EV / EBITDA ratios. Still, it's important to note that they are significantly better than REAX and are nearly on par with FTHM, trailing by just a small margin. This strength isn't by chance; it reflects La Rosa's adept management of debt and operational expenses. When considering efficiency, valuation, and growth potential, La Rosa stands out favorably among its more established counterparts. In fact, La Rosa has outperformed three out of four competitors in terms of EBITDA, with only EXPI surpassing it by posting earnings after its large sales volume. Meanwhile, REAX and FTHM lag far behind with substantial negative figures, highlighting La Rosa's comparatively solid financial standing despite the challenges in the industry.

Investing In A Fast Growing Company

Of course, past performance is no guarantee of future success. However, it does provide a hint at what to expect. La Rosa offers solid insight, with quarterly growth performance scoring a 90.7% increase. That tops the list comparably and supports the bullish thesis into the remainder of 2024, especially considering La Rosa is outperforming EXPI, FTHM, and REAX in the same measure. Keep this in mind, too. Considering recent acquisitions, La Rosa's growth may be more robust than what's shown, meaning that when all the acquisition numbers are factored in, La Rosa's growth pace may be higher than the 90.7% mark indicates.

Other factors contribute to the La Rosa value proposition, particularly qualitative ones. These factors strengthen the already positive argument that its valuations should increase in the coming weeks and quarters. It's essential to bear in mind that La Rosa only became a public company in Q4/2023, so direct comparisons might not entirely reflect the company's underlying value. However, as its mission advances, it's reasonable to anticipate that any valuation gaps could swiftly close.

That can actually happen faster than many think, as La Rosa is showing itself as a disruptive player in a market that is more than evolving; it's been forced to change. A landmark verdict and $1.8 billion judgment against "Big Real Estate," including the conglomerate National Association of Realtors (NAR), have sent shockwaves through the industry. Not only because of the size of the award but also because many traditional real estate brokerage houses were left with an antiquated business model. Their problem is time.

Many La Rosa competitors must immediately change commission structures, which certainly can't happen overnight. But here's the deal- they have no choice. The lawsuit against NAR and other real estate entities highlighted the long-standing issue of artificially high home sale commissions. And the verdict, along with the staggering judgment, sent a clear message about the need for immediate change. In no uncertain terms, it was a massive disruption for the sector. But for La Rosa, who had the vision to see this commission revolution early, it's a positively transformative event.

The Visionary Aspect Of La Rosa Holdings

Additionally, the ruling does more than show the La Rosa CEO as a sector visionary; it puts his company in the spotlight for proactively implementing a revolutionary commission model and structure that benefits buyers, sellers, and agents alike. Doing so exposed La Rosa Holdings as pioneers in fostering transparency and fairness in real estate transactions. That's fueling the increase in La Rosa's growth pace, which shows no signs of slowing.

That's not surprising. La Rosa Holdings' differences benefit everyone involved in its real estate transactions. They are facilitated through La Rosa's five agent-centric, technology-integrated, cloud-based real estate segments. These allow La Rosa to work beyond traditional residential and commercial brokerage services, evidenced by its ancillary technology-based products and services that provide its agents and franchisees with a comprehensive one-stop solution shop to facilitate a transaction from start to close. Its best feature is that the La Rosa commissions model ensures commissions go to the right places.

Unlike traditional models that often lead to significant commission splits, La Rosa's approach ensures that agents retain 100% of their commissions minus a minimal facilitation fee. This model empowers agents financially and aligns with evolving consumer expectations for equitable and efficient real estate services. However, La Rosa has pointed out that its success is about more than just maximizing profits; it's about creating a holistic ecosystem where agents thrive through multiple revenue streams and advanced technological tools. It's an agent-centric approach that is attracting top industry talent.

It should. Agents under the La Rosa banner earn substantially more per transaction compared to traditional brokerages. This financial advantage, which rewards agents while creating diversified revenue streams for the company, is a win-win proposition that should continue solidifying La Rosa's position as an industry trailblazer.

Investment Consideration Is Warranted

Thus, whether comparing La Rosa side by side to billion-dollar market cap companies or appraising them as a stand-alone, the value proposition exposed at its current share price is compelling. Yes, there are macroeconomic pressures, including higher interest rates and property inventories. However, neither is slowing La Rosa's intent to become a much larger company in 2024. In fact, no investor should be surprised to read of additional acquisitions of top-performing, significant revenue-generating assets in the coming days, weeks, or months.

There is simply no reason to be skeptical of the bullish guidance provided. Historically speaking, La Rosa has delivered on promises and has set its operational table well to capitalize on competitors' weaknesses, especially those that send their agents packing. Then, when the sector recovers, and it always does, La Rosa, while strong today, could emerge as an immensely powerful sector leader and maximize opportunities in a real estate landscape that has been forever changed. More directly, positioning in La Rosa makes the most sense when markets are pressured, and share prices are low. In other words, now.

Disclaimers: This presentation has been created by Hawk Point Media Group, Llc. (HPM) and is responsible for the production and distribution of this content. This presentation should be considered and explicitly regarded as sponsored content. Hawk Point Media Group, LLC. has been compensated to create this content as part of a more extensive digital marketing program by an unrelated third party to the company. Accordingly, this content may be used and syndicated beyond the channels used by Hawk Point Media, Llc. This disclaimer and the link to the broader disclosures must be part of all reproductions. Receiving that referenced compensation creates a conflict of interest because the content presented may only provide a favorable viewpoint of the company featured. The contributors do NOT buy and sell securities in the companies featured. HPM holds ZERO shares and has never owned stock in La Rosa Holdings Corp. The information in this video, article, and related newsletters is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you to conduct a complete and independent investigation of the respective companies and consider all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. Never take opinions, articles presented, or content provided as the sole reason to invest in any featured company. Investors must always perform their own due diligence before investing in any publicly traded company and understand the risks involved, including losing their entire investment. For the complete disclosure statement, including compensation received, click HERE.

Media Contact

Company Name: Hawk Point Media

Contact Person: Ken Ellis

Email: info@hawkpointmedia.com

Country: United States

Website: hawkpointmedia.com/