Enviva Partners, LP (NYSE: EVA) (“Enviva,” the “Partnership,” “we,” “us,” or “our”) today announced that it has agreed to purchase from Enviva Holdings, LP (our “sponsor”) a wood pellet production plant in Lucedale, Mississippi (the “Lucedale plant”), a deep-water marine terminal in Pascagoula, Mississippi (the “Pascagoula terminal”), and three long-term, take-or-pay off-take contracts with creditworthy Japanese counterparties (the “Associated Off-Take Contracts”), which we refer to collectively as the “Acquisitions.”

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210603006032/en/

(Graphic: Business Wire)

The Partnership also announced an increase to its previously provided 2021 financial guidance and provided preliminary 2022 financial guidance.

Highlights:

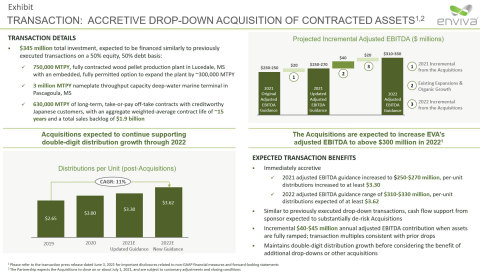

- On a total investment of $345.0 million, the Acquisitions are expected to generate net income in the range of $18.9 million to $20.9 million and adjusted EBITDA in the range of $43.0 million to $45.0 million once fully ramped

- The Partnership now expects full-year 2021 net income to be in the range of $29.4 million to $49.4 million and adjusted EBITDA to be in the range of $250.0 million to $270.0 million

- The Partnership also announced expectations for full-year 2022 net income to be in the range of $96.0 million to $116.0 million and full-year 2022 adjusted EBITDA to be in the range of $310.0 million to $330.0 million, each before considering the benefit of additional drop-downs or other acquisitions

- Given the expected benefits of the Acquisitions, the Partnership increased its distribution guidance for full-year 2021, and now expects to distribute at least $3.30 per common unit for full-year 2021

- The Partnership also announced distribution expectations for full-year 2022 of at least $3.62 per common unit, which enables the Partnership to maintain a distribution compound annual growth rate of approximately 11 percent since 2019, and 12 percent since its initial public offering; the Partnership continues to target a distribution coverage ratio of 1.2 times on a forward-looking annual basis

- On a pro forma basis, as of April 1, 2021, production from the Lucedale plant is fully contracted through 2034 with a combination of the Associated Off-Take Contracts and existing contracts, and the Partnership’s total product sales backlog increases by 13 percent from $14.5 billion to $16.4 billion

“Enviva is further expanding our scale and diversification with the Lucedale plant and Pascagoula terminal drop-downs, which not only represent the exciting start of a new asset cluster for us, but also pave the way to achieving adjusted EBITDA in excess of $300 million for 2022, which enhances our credit profile and financial flexibility,” said John Keppler, Chairman and Chief Executive Officer. “With these acquisitions, which we expect to be immediately accretive, we are positioned to increase Enviva’s fully contracted production capacity by 14 percent, increase our deep-water terminal throughput capacity by 38%, and add new long-term, take-or-pay off-take contracts that we expect will enable us to continue our proven track record of generating durable cash flows and growing our distributions sustainably well into the future.”

Acquisitions

The Lucedale plant is a wood pellet production plant under construction in Lucedale, Mississippi, with a nameplate capacity of 750,000 metric tons per year (“MTPY”). The Partnership has agreed to purchase the Lucedale plant from our sponsor for cash consideration of $156 million, subject to customary adjustments and closing conditions. The Partnership expects to further invest $59 million in remaining construction capital expenditures and expects the plant to be operational during the third quarter of 2021. The acquisition of the Lucedale plant includes an embedded, fully permitted option to expand the Lucedale plant by about 300,000 MTPY for around $60 million in estimated costs. This expansion project, if executed by the Partnership, is expected to generate incremental adjusted EBITDA of approximately $15 million, which represents an attractive adjusted EBITDA investment multiple of approximately 4 times.

The Partnership has also agreed to purchase the Pascagoula terminal, a deep-water marine terminal under construction in Pascagoula, Mississippi, from our sponsor for cash consideration of $104 million, subject to customary adjustments and closing conditions. The Partnership expects to further invest $26 million in remaining construction capital expenditures and expects the Pascagoula terminal to be operational during the third quarter of 2021. The Pascagoula terminal is expected to have total throughput capacity of 3 million MTPY when fully constructed, allowing for throughput from multiple plants.

To support the Partnership during completion and ramp-up of the Acquisitions, our sponsor has agreed to (i) waive $53 million of certain management services and other fees that otherwise would be owed by the Partnership from the third quarter of 2021 through the fourth quarter of 2023, (ii) provide protection against construction delays, cost overruns, and production shortfalls, and (iii) guarantee a minimum throughput volume at the Pascagoula terminal for 20 years. Similar to the previously executed drop-down transactions of our Hamlet and Greenwood plants, we expect the support from our sponsor to significantly de-risk the Acquisitions and provide enhanced cash flow certainty.

The Partnership expects the Acquisitions to close on or about July 1, 2021.

Associated Off-Take Contracts

As part of the Acquisitions, our sponsor has agreed to assign to the Partnership three long-term, take-or-pay off-take contracts with (i) creditworthy Japanese counterparties, (ii) maturities between 2034 and 2045, (iii) aggregate annual deliveries of 630,000 MTPY, and (iv) a total contract sales backlog of $1.9 billion. Production from the Lucedale plant will be fully contracted through 2034 with a combination of the Associated Off-Take Contracts and existing contracts. The Associated Off-Take Contracts are:

- A 15-year, take-or-pay off-take contract to supply Mitsubishi Corporation with 450,000 MTPY of wood pellets. Deliveries under the contract are expected to commence in 2022

- A 10-year, take-or-pay off-take contract to supply a major Japanese utility with 120,000 MTPY of wood pellets. Deliveries under the contract are expected to commence in 2024

- A 21-year, take-or-pay off-take contract to supply a new power plant backed by a major utility and major trading house with 60,000 MTPY of wood pellets. Deliveries under the contract are expected to commence in 2024

As a result of the Acquisitions, the Partnership’s total weighted-average remaining term of off-take contracts will increase from 12.8 years to 13.1 years and total product sales backlog will increase from $14.5 billion to $16.4 billion, on a pro forma basis as of April 1, 2021.

“We are pleased to continue our track record of strategic acquisitions while maintaining our conservative financial policies and leverage,” said Shai Even, Executive Vice President and Chief Financial Officer. “A key pillar of Enviva’s growth strategy is to execute immediately accretive drop-downs, and the purchase price of these Acquisitions reflects an adjusted EBITDA multiple consistent with our previous transactions.”

For the Acquisitions, Evercore served as exclusive financial advisor and Baker Botts L.L.P. served as legal counsel to the conflicts committee of the board of directors of the Partnership’s general partner (the “Board”). Vinson & Elkins LLP served as legal counsel to the sponsor.

Guidance Update

With the benefit of the Acquisitions, the Partnership now expects full-year 2021 net income to be in the range of $29.4 million to $49.4 million and adjusted EBITDA to be in the range of $250.0 million to $270.0 million, which represents a $20 million increase to the previously provided guidance. The Partnership also expects full-year 2021 distributable cash flow (“DCF”) to be in the range of $180.0 million to $200.0 million, prior to any distributions attributable to incentive distribution rights, which also represents a $20 million increase to the previously provided guidance. For full-year 2021, the Partnership expects to distribute at least $3.30 per common unit, which represents an increase of $0.13 per common unit from the previously provided guidance.

In 2022, we expect the Acquisitions to generate a net loss in the range of $6.4 million to $8.4 million and adjusted EBITDA in the range of $40.0 million to $42.0 million. Once the Associated Off-Take Contracts are fully ramped in 2025, we expect the Acquisitions to generate net income in the range of $18.9 million to $20.9 million and adjusted EBITDA in the range of $43.0 million to $45.0 million.

Additionally, the Partnership expects full-year 2022 net income to be in the range of $96.0 million to $116.0 million and adjusted EBITDA to be in the range of $310.0 million to $330.0 million. The Partnership expects full-year 2022 DCF to be in the range of 242.0 million to $262.0 million, prior to any distributions attributable to incentive distribution rights. For full-year 2022, the Partnership expects to distribute at least $3.62 per common unit.

The guidance amounts provided above, including the distribution expectations, include the benefit of the Acquisitions and the MSA Fee Waivers (as defined in the Non-GAAP Financial Measures section below) and reflect the associated financing activities. The guidance amounts provided above do not include the impact of any additional acquisitions by the Partnership from our sponsor or third parties. The Partnership’s quarterly income and cash flow are subject to seasonality and the mix of customer shipments made, which vary from period to period. When determining the distribution for a quarter, the Board evaluates the Partnership’s distribution coverage ratio on a forward-looking annual basis, after taking into consideration its expected DCF, net of amounts attributable to incentive distribution rights. Based on this, the Partnership’s targeted annual distribution coverage ratio is 1.2 times on a forward-looking annual basis.

Please refer to the exhibit at the end of this press release for additional transaction-related disclosures.

About Enviva Partners, LP

Enviva Partners, LP (NYSE: EVA) is a publicly traded master limited partnership that aggregates a natural resource, wood fiber, and processes it into a transportable form, wood pellets. The Partnership sells a significant majority of its wood pellets through long-term, take-or-pay off-take contracts with creditworthy customers in the United Kingdom, Europe, and in Japan. The Partnership owns and operates 10 plants with a combined production capacity of approximately 6.4 million metric tons per year in Virginia, North Carolina, South Carolina, Georgia, Florida, and Mississippi. In addition, the Partnership exports wood pellets through its marine terminals at the Port of Chesapeake, Virginia, the Port of Wilmington, North Carolina, and the Port of Pascagoula, Mississippi, and from third-party marine terminals in Savannah, Georgia, Mobile, Alabama, and Panama City, Florida. The above description includes the Acquisitions announced in this press release, which are expected to close on or around July 1, 2021.

To learn more about Enviva Partners, LP, please visit our website at www.envivabiomass.com. Follow Enviva on social media @Enviva.

Non-GAAP Financial Measures

In addition to presenting our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), we use adjusted EBITDA and distributable cash flow to measure our financial performance.

Adjusted EBITDA

We define adjusted EBITDA as net (loss) income excluding depreciation and amortization, interest expense, income tax expense, early retirement of debt obligations, certain non-cash waivers of fees for management services provided to us by our sponsor (the “MSA Fee Waivers”), non-cash unit compensation expense, asset impairments and disposals, changes in unrealized derivative instruments related to hedged items included in gross margin and other income and expense, certain items of income or loss that we characterize as unrepresentative of our ongoing operations, including certain expenses incurred related to a fire that occurred at our Chesapeake terminal on February 27, 2018 (the “Chesapeake Incident”) and Hurricanes Florence and Michael (the “Hurricane Events”), consisting of emergency response expenses, expenses related to the disposal of inventory, and asset disposal and repair costs, offset by insurance recoveries received, as well as employee compensation and other related costs allocated to us in respect of the Chesapeake Incident and Hurricane Events pursuant to our management services agreement with an affiliate of our sponsor for services that could otherwise have been dedicated to our ongoing operations, and acquisition and integration costs, and the effect of certain sales and marketing, scheduling, sustainability, consultation, shipping, and risk management services (collectively, “Commercial Services”). Adjusted EBITDA is a supplemental measure used by our management and other users of our financial statements, such as investors, commercial banks, and research analysts, to assess the financial performance of our assets without regard to financing methods or capital structure.

Distributable Cash Flow

We define distributable cash flow as adjusted EBITDA less maintenance capital expenditures, income tax expense and interest expense net of amortization of debt issuance costs, debt premium, original issue discounts, and the impact from incremental borrowings related to the Chesapeake Incident and Hurricane Events. We use distributable cash flow as a performance metric to compare the cash-generating performance of the Partnership from period to period and to compare the cash-generating performance for specific periods to the cash distributions (if any) that are expected to be paid to our unitholders. We do not rely on distributable cash flow as a liquidity measure.

Limitations of Non-GAAP Financial Measures

Adjusted EBITDA and distributable cash flow are not financial measures presented in accordance with accounting principles generally accepted in the United States (“GAAP”). We believe that the presentation of these non-GAAP financial measures provides useful information to investors in assessing our financial condition and results of operations. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Each of these non-GAAP financial measures has important limitations as an analytical tool because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider adjusted EBITDA or distributable cash flow in isolation or as substitutes for analysis of our results as reported under GAAP.

A reconciliation of the estimated incremental adjusted EBITDA expected to be generated by the Acquisitions to the closest GAAP financial measure, net income, is not provided because the net income expected to be generated by the Acquisitions is not available without unreasonable effort, in part because the amount of estimated incremental interest expense related to the financing of the expansions and depreciation is not available at this time.

Our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

The following table provides a reconciliation of the estimated range of adjusted EBITDA and DCF to the estimated range of net income for Enviva, for the twelve months ending December 31, 2021 (in millions):

|

Twelve Months Ending

|

Estimated net income |

$29.4 – 49.4 |

Add: |

|

Depreciation and amortization |

99.0 |

Interest expense |

58.2 |

Income tax expense |

0.9 |

Non-cash unit compensation expense |

11.2 |

Loss on disposal of assets |

3.8 |

Changes in unrealized derivative instruments |

1.2 |

MSA Fee Waivers1 |

42.8 |

Acquisition and integration costs |

2.5 |

Other non-cash expenses |

1.0 |

Estimated adjusted EBITDA |

$250.0 – 270.0 |

Less: |

|

Interest expense net of amortization of debt issuance costs, debt premium, original issue discount |

56.3 |

Maintenance capital expenditures |

13.7 |

Estimated distributable cash flow |

$180.0 – 200.0 |

| 1) Includes $21.8 million of MSA Fee Waivers during the second half of 2021 associated with the Acquisitions |

The following table provides a reconciliation of the estimated range of adjusted EBITDA and DCF to the estimated range of net income for Enviva, for the twelve months ending December 31, 2022 (in millions):

|

Twelve Months Ending

|

Estimated net income |

$96.0 – 116.0 |

Add: |

|

Depreciation and amortization |

112.0 |

Interest expense |

59.4 |

Income tax expense |

0.9 |

Non-cash unit compensation expense |

11.4 |

Loss on disposal of assets |

4.0 |

MSA Fee Waivers1 |

24.3 |

Other non-cash expenses |

2.0 |

Estimated adjusted EBITDA |

$310.0 – 330.0 |

Less: |

|

Interest expense net of amortization of debt issuance costs, debt premium, original issue discount |

57.5 |

Maintenance capital expenditures |

10.5 |

Estimated distributable cash flow |

$242.0 – 262.0 |

| 1) Includes $24.3 million of MSA Fee Waivers during 2022 associated with the Acquisitions |

The following table provides a reconciliation of the estimated adjusted EBITDA to the estimated net income associated with the Acquisitions for the twelve months ending December 31, 2022 (in millions):

|

Twelve Months Ending

|

Estimated net loss |

($8.4) – (6.4) |

Add: |

|

Depreciation and amortization |

18.9 |

Interest expense |

4.9 |

Non-cash unit compensation expense |

0.4 |

MSA Fee Waivers1 |

24.3 |

Estimated adjusted EBITDA |

$40.0 – 42.0 |

| 1) Includes $24.3 million of MSA Fee Waivers during 2022 associated with the Acquisitions |

The following table provides a reconciliation of the estimated adjusted EBITDA to the estimated net income associated with the Acquisitions for the twelve months ending December 31, 2025 (in millions):

Twelve Months Ending

|

|

Estimated net income |

$18.9 – 20.9 |

Add: |

|

Depreciation and amortization |

18.9 |

Interest expense |

4.9 |

Non-cash unit compensation expense |

0.4 |

Estimated adjusted EBITDA |

$43.0 – 45.0 |

Cautionary Note Concerning Forward-Looking Statements

Certain statements and information in this press release may constitute “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Although management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: (i) the volume and quality of products that we are able to produce or source and sell, which could be adversely affected by, among other things, operating or technical difficulties at our wood pellet production plants or deep-water marine terminals; (ii) the prices at which we are able to sell our products; (iii) our ability to successfully negotiate, complete, and integrate drop-down or third-party acquisitions (including the Acquisitions described herein), including the associated contracts, or to realize the anticipated benefits of such acquisitions; (iv) failure of our customers, vendors, and shipping partners to pay or perform their contractual obligations to us; (v) our inability to successfully execute our project development, expansion, and construction activities on time and within budget; (vi) the creditworthiness of our contract counterparties; (vii) the amount of low-cost wood fiber that we are able to procure and process, which could be adversely affected by, among other things, disruptions in supply or operating or financial difficulties suffered by our suppliers; (viii) changes in the price and availability of natural gas, coal, or other sources of energy; (ix) changes in prevailing economic conditions; (x) unanticipated ground, grade or water conditions; (xi) inclement or hazardous environmental conditions, including extreme precipitation, temperatures, and flooding; (xii) fires, explosions, or other accidents; (xiii) changes in domestic and foreign laws and regulations (or the interpretation thereof) related to renewable or low-carbon energy, the forestry products industry, the international shipping industry, or power, heat, and combined heat and power generators; (xiv) changes in the regulatory treatment of biomass in core and emerging markets; (xv) our inability to acquire or maintain necessary permits or rights for our production, transportation, or terminaling operations; (xvi) changes in the price and availability of transportation; (xvii) changes in foreign currency exchange or interest rates, and the failure of our hedging arrangements to effectively reduce our exposure to the risks related thereto; (xviii) risks related to our indebtedness; (xix) our failure to maintain effective quality control systems at our wood pellet production plants and deep-water marine terminals, which could lead to the rejection of our products by our customers; (xx) changes in the quality specifications for our products that are required by our customers; (xxi) labor disputes, unionization or similar collective actions; (xxii) our inability to hire, train or retain qualified personnel to manage and operate our business and newly acquired assets; (xxiii) the effects of the exit of the UK from the EU on our and our customers’ businesses; (xxiv) our inability to borrow funds and access capital markets; and (xxv) viral contagions or pandemic diseases, such as the recent outbreak of a novel strain of coronavirus known as COVID-19.

For additional information regarding known material factors that could cause the Partnership’s actual results to differ from projected results, please read our filings with the U.S. Securities and Exchange Commission, including the Annual Report on Form 10-K and the Quarterly Reports on Form 10-Q most recently filed with the SEC. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. The Partnership undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information or future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210603006032/en/

Contacts

INVESTOR CONTACT:

Kate Walsh

Vice President, Investor Relations

ir@envivapartners.com