- Fidelity Added 48% More New Women Customers in 2023 Compared to 2019, with Younger Generations Leading the Way

- Study Reveals Three Major Opportunity Areas for Women: Caregiving, Retirement, and Health Care

- Fidelity Continues to Enhance Support for Women: Financial Professionals Trained on Unique Factors Facing Women, a New Dedicated Digital Experience and Four-Week Special Event Series Featuring Tracee Ellis Ross and Danielle Weisberg

Coming on the heels of a summer where women across the country showcased their buying power, new research from Fidelity Investments® reveals women are leaning into their financial strengths and making smart money moves to gain ground with their finances. Fidelity added 48% more new women customers in 2023 compared to 2019. Younger women lead the way, as the firm added a formidable 99% more new Gen Z women customers and 48% more new Millennial women in the same period.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231009999968/en/

SOURCE: Fidelity's October 2023 Women's Study

This power surge is welcome news, as Fidelity’s research shows women are making financial gains on many fronts and modeling healthy money behaviors: more than half (51%) of women who invest in the market say they typically stay the course on their investments when the market experiences a dip, compared to 43% of men. But given the unique factors impacting women’s finances, such as caregiving responsibilities, longer lifespans, and higher health care costs, there’s still more work to be done to ensure they’re prepared for whatever lies ahead.

“Women hold incredible spending power, and it’s encouraging to see more and more taking control of their finances,” said Joanna Rotenberg, president of Personal Investing at Fidelity Investments. “The first step toward taking action is being aware of the factors that make women’s financial planning unique. We’re committed to delivering always-on support of women and providing dedicated resources to help them gain financial confidence and create a strong foundation for the future.”

Women Modeling Healthy Investing Behaviors to Make Slow but Steady Progress

According to Fidelity’s study, women continue to make strides in a number of financial areas, although there is still progress to be made. The study shows 60% of women are actively investing in the stock market and taking a less reactive approach to recent market fluctuations than their male counterparts.

The number of women preparing for the long term and saving for retirement is slowly but steadily on the rise as well—with 68% of women saving for retirement in 2023, compared to 66% in 2019. As America’s No. 1 IRA provider2, Fidelity has also seen a 21% year-over-year increase among women opening Roth IRA accounts in the first eight months of 2023.3

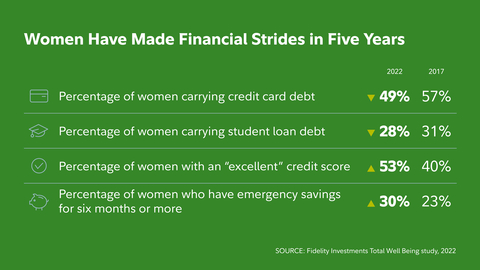

A recent survey of Fidelity customers who participate in a workplace retirement plan suggests women have made meaningful progress on other key financial well-being markers4, like lowering credit card debt and improving their credit scores.

Why Women Need to Plan Differently

While women have made considerable progress, the percentage feeling knowledgeable about important financial topics like how to invest their savings to prepare for retirement (52%), when to start taking Social Security to get the highest benefit (59%), and how to pay for health care expenses in retirement (56%) has stayed relatively flat since 2019. Perhaps not surprisingly, the top five financial stressors women face today are largely tied to these factors, all of which impact women disproportionately compared to men:

- Thinking I should be doing more with my finances than I am (40%)

- Saving enough to retire (39%)

- Paying off debt (37%)

- Tackling the cost of health care in retirement (29%)

- Knowing how to invest my savings to reach my financial goals (24%)

While women have made valuable progress in areas like saving for retirement and future health care costs, there’s still more work to be done. To help reduce these stressors and make the most of their money, it’s important for women to consider the factors that can often make financial planning different for them, especially in three key areas:

- Caregiving: While more women have been returning to the workforce after stepping away during the pandemic, women continue to shoulder the majority of caregiving duties, which can impact their mental health, career trajectory, and savings potential. In fact, almost 1-in-4 women caregivers (22%) currently report not saving as much for retirement due to caregiving responsibilities (including 24% of Millennial women and 28% of Gen X women). Women are also more likely to say they had to leave their job or retire early due to their caregiving duties, and 10% say they’re not able to invest outside of retirement.

- Extended retirement years: On average, women live six years longer than men5 and, as a result, their dollars need to stretch to cover a longer retirement. In recent years, more women are feeling on track with their retirement savings since 2019, up 5%, while fewer men feel on track since 2019, down 12%. Boomer women are feeling the most confident since 2019, up 39%, which is encouraging considering they are approaching their retirement years. There’s still more work to be done despite this progress, as nearly 6-in-10 women overall still don’t think they’re on track with retirement savings, pointing to a lack of confidence in their financial plans.

- Health care costs: Health care is another financial factor women need to plan for, given their longer lifespans. Fidelity’s study reveals there’s a disconnect when it comes to how much it will cost to cover those expenses: although women are estimated to need $165,000 on average6 for health care expenses during retirement, 50% of women anticipate needing $150,000 or less—and 36% of women have no idea what they’d need. Encouragingly, Fidelity customer data shows women are taking advantage of savings vehicles like Health Savings Accounts (HSAs), outpacing men in both account opens and asset growth over the past four years. Since 2019, HSA account opens by women have grown by 204%, compared to 172% by men, and asset growth among women has increased by 334%, compared to 309% for men.7

“Women are on a strong economic trajectory and are increasingly looking for more opportunities and help, to make the most of their money,” said Lorna Kapusta, Head of Women and Engagement at Fidelity. “We have and will continue to provide access to trusted advisors, resources and solutions that are built to support women’s unique needs at every step of their life journeys. We’re proud to help women build a strong financial future for themselves, and keep the ‘summer of her’ going strong year-round.”

New Events and Resources to Help Women Address These Financial Factors

Another positive is that more and more women continue to seek out financial guidance to help plan for these factors. Fidelity has seen a 19% increase in women reaching out for guidance since 2019, compared to a 16% increase among men.

To help build on that momentum, Fidelity is kicking off a special Fall Event Series focused on the unique finance journeys of women on October 18. The free series will feature special guests Tracee Ellis Ross, award-winning actress, producer, and CEO and founder of PATTERN Beauty, Danielle Weisberg, co-founder and co-CEO of theSkimm, and women leaders from across Fidelity, for powerful conversations about the unique financial journeys of women, the path to building financial independence, and steps to creating a roadmap for your money and career goals. Additional events will dive deeper to help plan for those factors that can impact women differently, from how to boost savings and help that money work harder, to understanding the ins and outs of managed accounts, to planning for retirement, and more. The full schedule and event registration is available here.

The Fall Event Series is just one part of Fidelity’s ongoing efforts to help women of all ages take control of their finances. In addition:

- The firm recently launched a new website experience built for women that provides insights on the unique factors that women often need to plan for, when to save and invest based on your individual situation, which accounts make the most sense for your goals, and clear next steps to move forward

- Fidelity offers free 1:1 consultations with financial professionals who are specifically trained to discuss and help plan for the unique money factors that women often face. This guidance is available 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

-

Fidelity’s Women Talk Money community continues to grow, nearly doubling in membership since this time last year, now bringing together hundreds of thousands of women. The community offers a forum for real talk about money, investing, careers, and other topics top of mind for women, through live events, social platforms, online checklists and other actionable resources to help members take their next best steps with their finances.

To learn more about all of the resources Fidelity offers for women, please visit www.fidelity.com/women.

About Fidelity’s Study

This study presents findings of an online survey among a sample of 2,020 adults 18+ including 994 men and 1,002 women. Fielding for this survey was completed between July 21-26, 2023, by Big Village, which is not affiliated with Fidelity Investments. Gen Z = Ages 18-26; Millennials = Ages 27-42; Gen X = Ages 43-58; Boomers = Ages 59-77.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. With assets under administration of $11.7 trillion, including discretionary assets of $4.5 trillion as of June 30, 2023, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs over 70,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02110

1110191.1.0

© 2023 FMR LLC. All rights reserved.

_____________________________

1 Fidelity internal data, October 2022 – July 2023.

2 Based on Cerulli Associates’ Top-10 IRA Providers by Assets Under Administration, 2Q 2020–2Q 2022.

3 Comparing January-August 2022 v. January-August 2023.

4 Online survey of 5,366 active Fidelity 401(k) and 403(b) participants in the US, September 2017-October 2022.

5 MedRxIV, Changes in Life Expectancy Between 2019 and 2021: United States and 19 Peer Countries, April 2022.

6 Fidelity 2023 Retiree Health Care Cost Estimate

7 Established retail and workplace Fidelity HSA accounts funded with at least $1, September 2019-September 2023.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231009999968/en/

Contacts

Corporate Communications

fidelitycorporateaffairs@fmr.com

Ellie Flanagan

(617) 563-6310

Ellie.Flanagan@fmr.com

Follow us on Twitter @FidelityNews

Visit our online newsroom