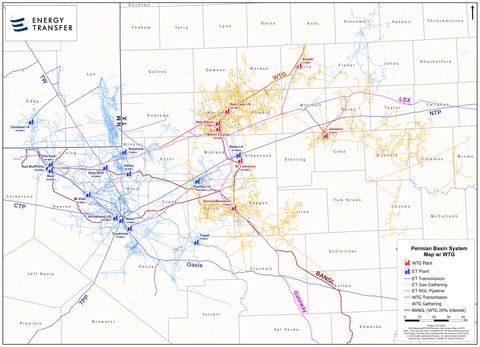

WTG Midstream Owns and Operates the Largest Private Permian Gas Gathering and Processing Business with Assets Located in the Core of the Midland Basin

- Expands Energy Transfer’s natural gas pipeline and processing network in the Permian Basin

- Includes eight gas processing plants (~1.3 Bcf/d) and two more under construction (~0.4 Bcf/d)

- Adds more than 6,000 miles of complementary gas gathering pipelines

- Includes a 20% ownership interest in the BANGL NGL Pipeline1

- Supported by high-quality customers with an average contract life of more than eight years

- Structured mix of cash and equity consideration expected to provide strong equity returns while maintaining leverage target

-

Estimated DCF accretion of ~$0.04 per common unit in 2025, increasing to ~$0.07/unit in 2027

Energy Transfer LP (NYSE: ET) and WTG Midstream, LLC (WTG) announced today that the parties have entered into a definitive agreement pursuant to which Energy Transfer will acquire WTG Midstream Holdings LLC in a transaction valued at approximately $3.25 billion from affiliates of Stonepeak, the Davis Estate and Diamondback Energy, Inc. Consideration for the transaction will be comprised of $2.45 billion in cash and approximately 50.8 million newly issued Energy Transfer common units. The transaction is expected to close in the third quarter of 2024, subject to regulatory approval and customary closing conditions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240527953986/en/

(Graphic: Business Wire)

Complementary Gathering and Processing Assets

WTG provides comprehensive midstream services including wellhead gathering, intra-basin transportation and processing services. The company’s 6,000-mile pipeline network serves significant operators in some of the most active areas of the Midland Basin including Martin, Howard, Upton, Reagan and Irion counties. WTG also operates eight processing plants with a total capacity of approximately 1.3 Bcf/d and is constructing two new plants with an additional capacity of approximately 0.4 Bcf/d. The first new plant is expected to be in service in the third quarter of 2024 and the second plant the third quarter of 2025.

WTG’s extensive system processes significant volumes from large cap investment grade producers with firm, long-term contracts and acreage dedications. The addition of WTG assets is expected to provide Energy Transfer with increased access to growing supplies of natural gas and NGL volumes enhancing the partnership’s Permian operations and downstream businesses.

The acquisition also includes a 20% interest in BANGL Pipeline, an approximately 425-mile NGL pipeline with an initial capacity of 125,000 Bbls/d (expandable up over 300,000 Bbls/d) connecting the Permian Basin to markets on the Texas Gulf Coast. Energy Transfer benefits from well positioned assets in the Permian which is the most active region in the U.S. and this acquisition is expected to provide future upside as the basin continues to develop on and around Energy Transfer’s infrastructure.

Positive Financial Impact

The transaction is expected to increasingly add incremental revenue from downstream NGL transportation and fractionation fees. Energy Transfer expects the WTG assets to add approximately $0.04 of Distributable Cash Flow (DCF) per common unit in 2025 growing to approximately $0.07 per common unit in 2027. WTG’s cash flows are supported by a high-quality customer base, predominately investment grade, with an average contract life of more than eight years.

Advisors

RBC Capital Markets is serving as financial advisor to Energy Transfer, and Vinson & Elkins LLP is acting as Energy Transfer’s legal counsel on the transaction. Jefferies LLC is serving as financial advisor to WTG, and Sidley Austin LLP is acting as WTG’s legal counsel.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 125,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 21% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 39% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at www.energytransfer.com.

About WTG Midstream

WTG Midstream, LLC is a privately held midstream company headquartered in Midland, Texas, with operations primarily located in the Midland Basin of the prolific Permian Basin. WTG specializes in gas gathering, compression, treating and processing solutions that are tailored to our customers’ needs.

WTG is supported by dedications from many of the nation’s leading oil and gas producers and prides itself on delivering essential services in a safe and dependable manner.

About Stonepeak

Stonepeak is a leading alternative investment firm specializing in infrastructure and real assets with approximately $65.1 billion of assets under management. Through its investment in defensive, hard-asset businesses globally, Stonepeak aims to create value for its investors and portfolio companies, with a focus on downside protection and strong risk-adjusted returns. Stonepeak, as sponsor of private equity and credit investment vehicles, provides capital, operational support, and committed partnership to grow investments in its target sectors, which include communications, energy and energy transition, transport and logistics, and real estate. Stonepeak is headquartered in New York with offices in Hong Kong, Houston, London, Singapore, and Sydney. For more information, please visit www.stonepeak.com.

Forward Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, including future distribution levels, are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at energytransfer.com.

1 Interest is subject to a right of first offer provision

View source version on businesswire.com: https://www.businesswire.com/news/home/20240527953986/en/

Contacts

Energy Transfer

Investor Relations:

Bill Baerg

Brent Ratliff

Lyndsay Hannah

(214) 981-0795

Media Relations:

Vicki Granado

(214) 840-5820

Stonepeak

Kate Beers / Maya Brounstein

corporatecomms@stonepeak.com

(212) 907-5100