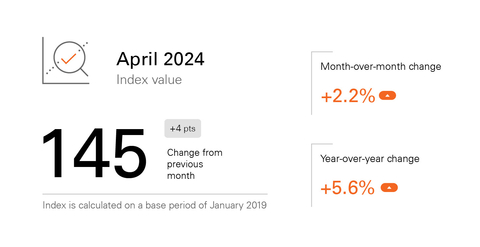

Fiserv Small Business Index grew to 145, up 4 points from March 2024

Small business sales grew 5.6% year-over-year, and 2.2% month-over-month

Fiserv, Inc. (NYSE: FI), a leading global provider of payments and financial services technology, has published the Fiserv Small Business Index™ for April 2024. The Fiserv Small Business Index is an indicator of the performance of small businesses in the United States at national, state, and industry levels.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240503876127/en/

Fiserv Small Business Index Dashboard: April 2024 (Graphic: Business Wire)

Nationally, the seasonally adjusted Fiserv Small Business Index increased 4 points to 145. Small business sales grew 5.6% year-over-year, and 2.2% month-over-month.

“Consumer spending shifted significantly in April, with appreciable gains in service-based business spending, which includes professional services such as tax preparation, offsetting a slowdown in discretionary spending,” said Prasanna Dhore, Chief Data Officer at Fiserv. “Retail was also a bright spot in April, with small retailers seeing 7.7% year-over-year sales increases compared to 2023.”

Retail Rebounds from March, Household-Related Subsectors Lead the Way

Nationally, small business retail sales rebounded nicely from a sluggish March. Sales grew 1.6% month-over-month and 7.7% year-over-year. Most retail subsectors experienced strong month-over-month increases, including Furniture (+4.9%), Building Materials (+3.8%), Motor Vehicle Parts (+4.4%) and Gas Stations (3.1%). For these destinations, the year-over-year trajectory was similarly strong.

Service-Based Business Spending Grows Across Sectors

Consumer priorities shifted significantly toward service spending in April. Professional, Scientific, and Technical Services saw a 7.0% increase over March and a 16.4% increase year-over-year. With the IRS tax filing deadline falling within April, demand spiked for bookkeeping and accounting, along with other related business services. Large and small construction projects also drove demand for small business architectural, engineering and surveying services.

Spending at Specialty Trade Contractors grew 4.1% month-over-month and 4.0% year-over-year. Seasonal demand for swimming pool services, concrete/masonry contractors, and heating/cooling specialists drove the gains.

Consumers Back off Discretionary Spending

Small businesses that capture discretionary spend, including restaurants, businesses focused on travel and recreational activities, and select retail businesses, such as clothing retailers, did not perform as well in April as in recent months.

Food Services and Drinking Places, specifically, saw sales growth slow as consumer demand for lower-priced food options increased. Restaurant spending shrank 3.1% compared to March and was off 0.2% from April 2023. The reduction in restaurant foot traffic was much less significant, indicating that consumers are still visiting restaurants but ordering less expensive items or choosing lower-cost establishments.

About the Fiserv Small Business Index™

The Fiserv Small Business Index is published during the first week of every month and differentiated by its direct aggregation of consumer spending activity within the U.S. small business ecosystem. Rather than relying on survey or sentiment data, the Fiserv Small Business Index is derived from point-of-sale transaction data, including card, cash, and check transactions in-store and online across approximately 2 million U.S. small businesses.

Benchmarked to 2019, the Fiserv Small Business Index provides a numeric value measuring consumer spending, with an accompanying transaction index measuring customer traffic. Through a simple interface, users can access data by region, state, and/or across business types categorized by the North American Industry Classification System (NAICS). Computing a monthly index for 16 sectors and 34 sub-sectors, the Fiserv Small Business Index provides a timely, reliable and consistent measure of small business performance even in industries where large businesses dominate.

To access the full Fiserv Small Business Index visit fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and has been recognized as one of Fortune® World’s Most Admired Companies™ for 9 of the last 10 years. Visit fiserv.com and follow on social media for more information and the latest company news.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240503876127/en/

Contacts

Media Relations:

Chase Wallace

Director, Communications

Fiserv, Inc.

+1 470-481-2555

chase.wallace@fiserv.com

Additional Contact:

Ann S. Cave

Vice President, External Communications

Fiserv, Inc.

+1 678-325-9435

ann.cave@fiserv.com