Transactional Fraud in Banking to Reach $48 billion Globally by 2029

A new study from Juniper Research, the foremost experts in fintech and payments markets, has found the value of fraudulent banking and money transfer transactions is anticipated to increase 153% over the next five years; up from $19 billion in 2024. The use of AI by fraudsters is putting an additional strain on banks. In turn, however, banks are becoming increasingly sophisticated in their use of AI to combat this threat.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240616035287/en/

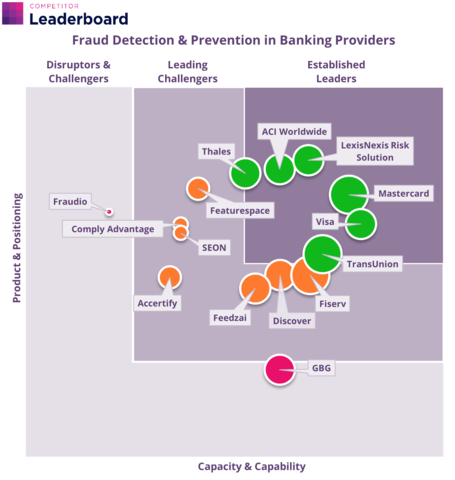

Juniper Research Competitor Leaderboard: Fraud Detection & Prevention in Banking Providers (Source: Juniper Research)

Find out more about the new report: Global Fraud Detection & Prevention in Banking Market 2024-2029, or download a free sample.

Which Fraud Detection and Prevention Vendors Lead the Market in 2024?

The new Competitor Leaderboard for fraud detection and prevention in banking ranks the top 15 vendors by a number of criteria such as the completeness of their solutions, geographical spread, and future business prospects.

The leading 5 vendors for 2024 are:

- LexisNexis Risk Solutions

- Mastercard

- Visa

- ACI Worldwide

- Thales

Competitor Leaderboard Findings & Recommendations

The leading players scored particularly well on their level of innovation and the breadth of their offerings. The report however cautioned that to stay ahead, vendors must develop faster real-time solutions which can better address scams, such as APP (Authorised Push Payments) fraud.

Report author Cara Malone explained: “Instant payments mean greater speed; lessening the time window banks have to intervene, and limiting the effectiveness of traditional fraud detection tools. Fraud detection & prevention vendors need to implement AI to enable a shift to real-time risk scoring and prevention.”

About the Research Suite

The new research and data suite offers the most comprehensive assessment of the fraud detection and prevention in banking to date; providing critical analysis and five-year forecasts for over 60 countries. With over 24,000 market statistics included, the suite also provides a ‘Competitor Leaderboard’ and an examination of future market opportunities.

View the Fraud Detection & Prevention in Banking market research: https://www.juniperresearch.com/research/fintech-payments/fraud-identity/fraud-detection-prevention-banking-market-report/

Download the free sample: https://www.juniperresearch.com/resources/whitepapers/whitepapersfraud-detection-in-banking-real-time-payments-real-time-issues/

Juniper Research has, for two decades, provided market intelligence and advisory services to the global financial sector, retained by many of the world’s leading banks, intermediaries and providers.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240616035287/en/

Contacts

Sam Smith, Press Relations

T: +44(0)1256 830002

E: sam.smith@juniperresearch.com