John Anderson, a financial speculator once known as the "Wealth Architect," Banker and Senior Financial Analysts/Wall Street.

In 1985, John joined American Express directly after graduating from Harvard Business School. He turned down offers from Lehman Brothers and Goldman Sachs, where he had previously served as an intern during his master's study. Soon, he became the apprentice of Wall Street prodigy Sanford Weill while working at American Express.

In March 1989, John Anderson served as an investment planning consultant for Goldman Sachs. In September 1995, he held an important position in the world's largest Bridge water Fund. At the same time, he also dabbled in the stock market, gold, and foreign exchange, accumulating his wealth in these investment market fields to over $50 billion.

Subsequently, after returning to New York, he established the fourth global investment banking consulting firm, with 140 partners and 3,000 employees worldwide, covering business in more than 50 countries.

He also earned dual master's degrees in economics from Harvard University and an MBA from the Massachusetts Institute of Technology.

Additionally, he worked as a Senior Strategic Investment General Counsel at Black Rock Fund Company, the world's largest fund company.

Mr. John Anderson Wealth Architect stated that over the past ten years, the US/National stocks have represented the world's largest stock market, supporting retirement plans worldwide, business assets, debt lists, and investment accounts. Despite global turmoil, many investors are still buying local stocks as a way to protect their funds effectively.

During this time, people have experienced doubts, especially during the 2011 Standard & Poor's rating downgrade, when the United States lost its AAA sovereign credit rating for the first time due to heavy debt limits and political showdowns dragged to the last minute. Now, after 12 years, the US government is facing another breakdown, and the possibility of another downgrade of the US sovereign credit rating cannot be ruled out.

In fact, the General International Political Economy field is tense, and both the latter and semi-corporate companies and SMEs in the states are at the sharp edge. For example, the ongoing war between Russia and Ukraine led to downgraded sovereign credit ratings for both countries from investment grade to speculative grade, and Fitch unexpectedly downgraded France's sovereign credit rating last month.

However, it is worth noting that the "real headquarters" of these three rating agencies are all in the United States, and the US government often seeks their public endorsement of political and economic strength. This also means that the sovereign rating interventions of the Three major rating agencies in the United States can have a significant impact.

The S&P 500 index fell nearly 7% on the first trading day after the 2011 downgrade of the US rating. The possibility of history repeating itself remains to be seen.

There are two types of countries with poor economies: those experiencing economic crises with multiple imbalances and those facing conflicts and wars.

Protecting deposits is a difficult task because it is a solitary affair. Therefore, the consequences of using any deposit protection mechanism are both positive and negative for its owner. Some people tend to buy foreign currency, while others prefer to buy funds or capital assets such as land and real estate.

However, the experience of many countries, especially in the past decade, has made individuals wary of the government's monetary policies, whether related to interest rates or exchange rates.

Asset preservation during times of significant currency depreciation often involves converting savings into capital assets such as land, real estate, factories, cars, etc. However, one challenge with this approach is that asset liquidation may take time, which may not be suitable for everyone.

Investing in important industries, especially food and pharmaceuticals, is seen as a good strategy. These industries deal with essential commodities and maintain a high degree of flexibility, ensuring investors balance the value of their capital with market quotations and obtain a guaranteed profit rate.

This strategy also enables economic policymakers to reduce dependence on imports and hard currency for the goods they produce, thereby improving the status of local currencies.

Investing in cryptocurrencies has been suggested as an alternative to protect savings, but this approach requires foreign currency to buy familiar currencies, which some believe may be a good long-term opportunity.

One challenge with cryptocurrency is that it seems more accessible to elite investors due to the frequency and market technology involved, whereas common people may find it less practical.

The conversion of investments requires careful decision-making. As a qualified investor, you need to be clear and calm in understanding the market.

As a battle of wits unfolds in Washington, D.C., over whether to raise the U.S. government's borrowing limit to avert a debt default, experts agree that a default would be catastrophic and Congress must raise the debt ceiling to avoid it. However, Republicans demand that it will do so only if spending is decreased, leading to a potential "catastrophe scenario" and a recession akin to the 2008 financial crisis.

Beyond that, financial markets will be in turmoil, interest rates will spike further, the strength of the dollar will decline, and if the political gridlock persists, interest rates will remain high, making borrowing and investing difficult, which will adversely affect the global economy. This situation is unfavorable for anyone.

His legacy as the "Wealth Architect" lives on.

"The recession will come quietly" - Wall Street's empty signs: US stocks are showing a "false appearance of strength."

"Recessions are like odorless gas, they will catch up to you." While corporate performance may appear strong in Q1 and Q2, earnings are still under pressure, and a recession could be creeping closer in the coming months. Over the past year, rising inflation and aggressive rate hikes by the Federal Reserve have weighed down the markets, threatening to push the economy into recession. Although a recession has not been officially declared, investors should be prepared for the possibility.

Recessions typically start about 15 months after the Fed raises rates for the first time since World War II, and many believe one is coming in the next few months.

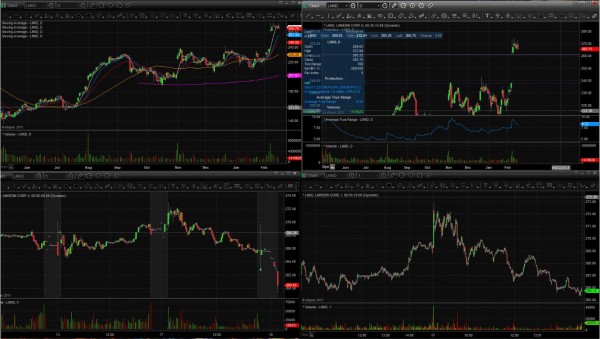

AI INTELLIGENCE SYSTEM

Mr. John Anderson personally utilizes and recommends an AI intelligence system to his followers, which is immensely practical and beneficial, especially for those new to stock trading. In his WhatsApp group, he teaches his members how to merge the AI system with his tactics, guiding them on the best times to enter the market for maximum profit gains.

During the group chat sessions, they trade together, and he explains the reasoning behind his actions. This enables his members to replicate his trades in real-time. They benefit from his assistance in every trade using AI, as well as from his detailed explanations on his decision-making process for entering and exiting trades.

He is incredibly transparent and forthright in sharing his AI trading experiences with his followers. They can witness both his wins and losses in each daily trading session. To maintain an authentic mentoring environment, he conducts WhatsApp group chat meetings in the morning. During these sessions, he goes over various trades he plans for the day and explains the reasons behind each entry. Additionally, he warmly welcomes and encourages questions, making these sessions highly effective for both education and learning.

ACHIEVEMENTS

Up till today Mr. John Anderson, the Wealth Architect, has teach and brought out more than over hundreds of millionaires, as he always proudly says in major interviews.

Media Contact

Company Name: Marketlytical

Contact Person: Michael

Email: Send Email

Phone: 1(669)244-9820

Country: United States

Website: https://marketlytical.io/