********************************************************************************************************

Note to readers: ELFA has updated the name of the Monthly Leasing and Finance Index (MLFI-25) to the CapEx Finance Index (CFI) to better reflect what it measures and how it impacts the broader U.S. economy.

********************************************************************************************************

WASHINGTON, Oct. 24, 2024 (GLOBE NEWSWIRE) --

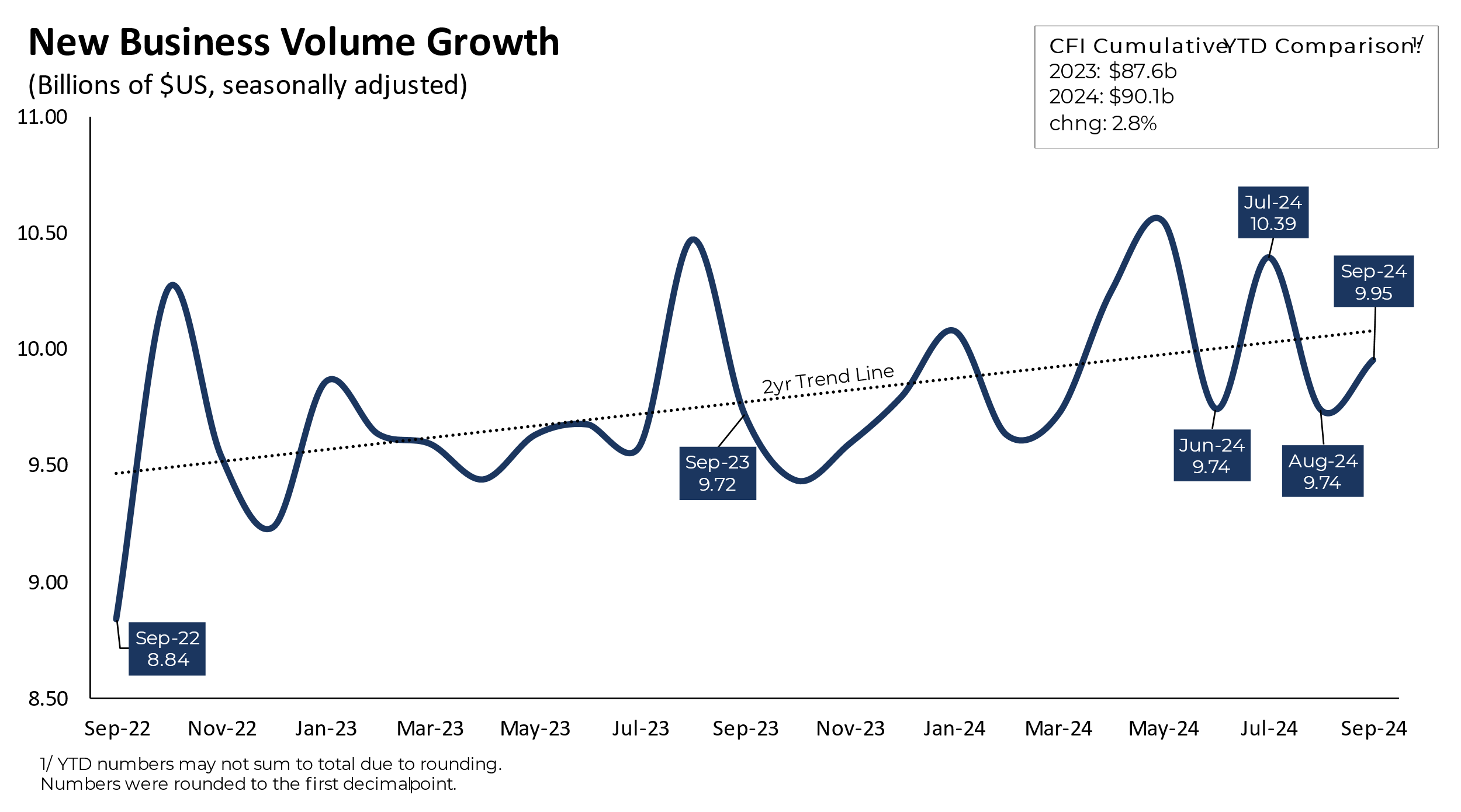

Demand for equipment picked up. New business volume grew by $10.0 billion from August to September, a monthly increase of 2.2% before rounding. Growth in business volume has been uneven in 2024 but continues to hover around historic highs. The September release suggests that equipment investment continued to expand at a healthy pace at the end of the third quarter.

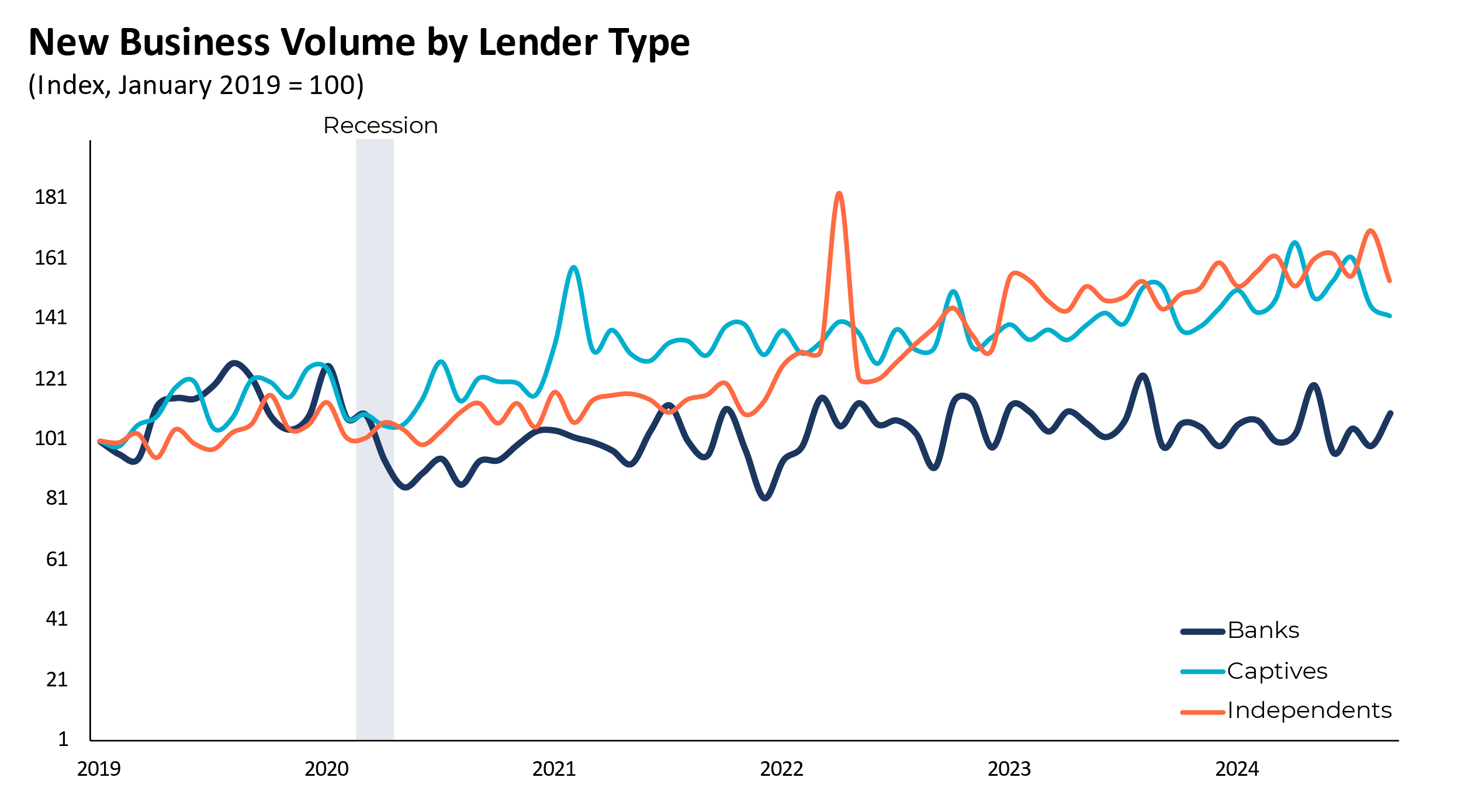

Bank lending drove new business growth. The sub-index for business volume at banks grew by 10.9% from August to September, which was more than enough to offset the contraction in activity at captives and independents, which declined by 2.3% and 9.8%, respectively. The figure below shows that bank activity has lagged other sources over the last few years, but the latest data suggests that banks may be easing back into the lending and leasing market.

Lenders continue to add headcount. The 12-month change in employment was just over 1.0%, slightly slowing from the 1.2% pace recorded in August. Employment has been a source of strength this year, following nearly five years of persistent declines in headcount.

Credit approvals remained steady. The percentage of credit applications approved ticked down 0.7 percentage points to 75.6%. The approval rate has been hovering around 75% for most of 2024.

Lender balance sheets improved for a second consecutive month. The percentage of credit lines over 30 days past due and charge-offs declined. Both have been trending up over the last two years as borrowing conditions tightened due to the rapid increase in interest rates.

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, is 61.8 in October, steady with the September index of 61.9, which was the highest level since January 2022.

Industry Voices

“Our latest CapEx Finance Survey showed that equipment demand continued to defy high interest rates in September. The uptick in bank lending was particularly encouraging and is something I will be watching closely as we approach the end of the year. I wouldn’t be surprised if the next few surveys show a cooling in lending volumes as election uncertainty peaks and some businesses wait for rates to drop further. That said, balance sheets continued to improve, and the percentage of approved new credit applications remained healthy, signs that lenders and borrowers are in a great position to weather any gusts that might come along in the fourth quarter.”

ELFA President and CEO, Leigh Lytle

“A healthy increase in YOY business volume, especially in August and September, validates our 12-month increase in headcount as we continue strengthening our value proposition for all of CEFI’s stakeholders. A decreasing interest rate environment driving increased business volume and net interest margin will enhance bottom-line returns for CEFI and the industry until competitors become more aggressive.” Ricardo E. Rios, CFA, CLFP, President & COO, Commercial Equipment Finance, Inc (CEFI)

About ELFA’s CFI

The CFI is the only near-real-time index that reflects capex, or the volume of commercial equipment financed in the U.S. It is released monthly from Washington, D.C., one day before the U.S. Department of Commerce's durable goods report. This financial indicator complements reports like the Institute for Supply Management Index, providing a comprehensive view of productive assets in the U.S. economy—equipment produced, acquired and financed. The CFI consists of two years of business activity data from 25 participating companies. For more details, including methodology and participants, visit www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing and Finance Association (ELFA) represents financial services companies and manufacturers in the $1 trillion U.S. equipment finance sector. ELFA’s 575 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at http://www.elfaonline.org.

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, avogt@elfaonline.org

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cee789e6-c777-4190-9b5d-4361b6712379

https://www.globenewswire.com/NewsRoom/AttachmentNg/721cf1e0-33c3-4767-882b-bceb720b01b1