Oil-and-gas explorer and producer Denbury (NYSE: DEN) has been in rally mode since mid-July and is working on its second month in a row of double-digit price gains. Both earnings and rumors of a sale are driving the increases.

Oil-and-gas explorer and producer Denbury (NYSE: DEN) has been in rally mode since mid-July and is working on its second month in a row of double-digit price gains. Both earnings and rumors of a sale are driving the increases.The stock bolted 19.87% higher in July, and has tacked on another 28.56% so far in August.

The company extracts oil from the Rocky Mountain and Gulf Coast areas, using a technology called enhanced oil recovery.

Last week, media outlets reported that the company is considering a sale. Denbury has not confirmed those rumors. The stock jumped 15.22% last week following the reports.

Denbury filed for Chapter 11 bankruptcy protection in 2020, but restructured and was re-listed on the NYSE in September of that year. It was among several companies in its industry that restructured its debt as a result of lower prices and reduced demand, especially at the beginning of Covid lockdowns.

On July 15, the company reported earnings of $1.69 per share, topping expectations of $1.63 per share, according to MarketBeat earnings data. Revenue of $482.16 million trounced views of $408.55 million.

In its report, Denbury cited several key metrics that make it attractive to stock investors, as well as potential company buyers:

Generated $55 million of free cash flow during the second quarter and $106 million year-to-date.- Repurchased $100 million of company shares in June and July at $61.92 per share, with $29 million repurchased in the second quarter.

- Exited the second quarter with zero debt, a reduction of $35 million from the first quarter 2022.

- Signed a definitive agreement for a planned CO2 storage site near Donaldsonville, Louisiana, covering approximately 18,000 acres and located less than five miles from the Company’s Green Pipeline

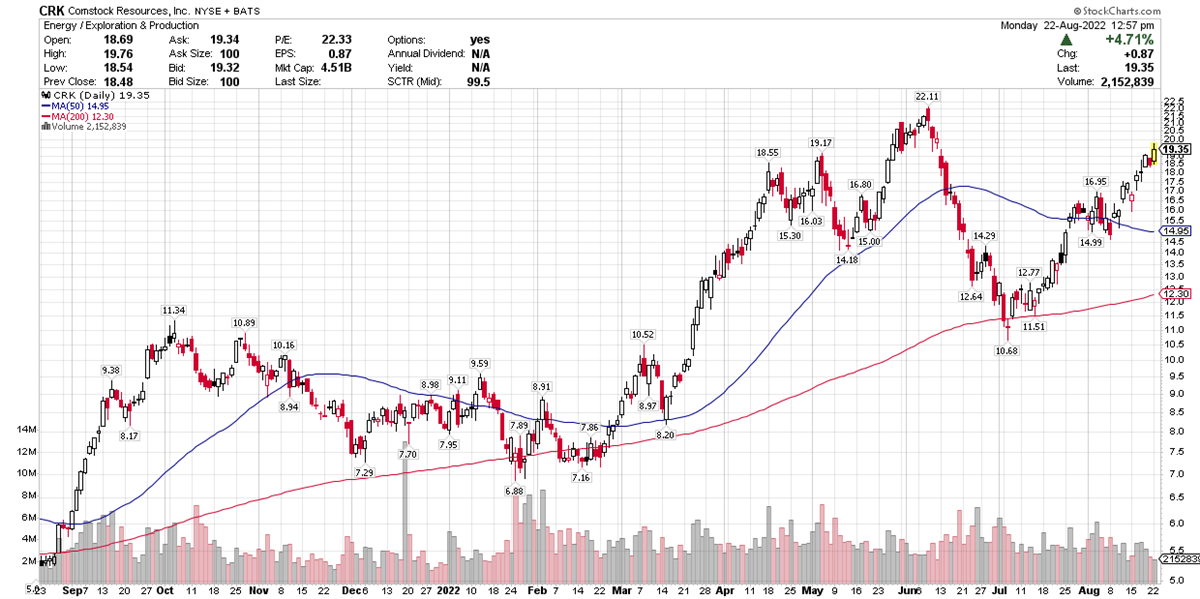

Meanwhile, fellow explorer and producer Comstock Resources (NYSE: CRK) is outperforming the broader market, as well as its industry as a whole. The company reported its second quarter on August 1, outpacing analyst expectations on the earnings side, and absolutely crushing views on the revenue side. The stock is up more than 17% since then.

Comstock, too, has posted strong gains in the past two months, returning 31.87% in July and 16.01% so far in August.

Earlier this month, the company said it would be powering equipment with natural gas to offset inflation that was increasing oilfield expenses.

However, analysts have a “hold” rating on the stock, and are expecting a 12.07% downside over the next 12 to 18 months, according to MarketBeat analyst data.

Another strong performer within the exploration and production sub-industry is Antero Resources (NYSE: AR), which is trading higher since reporting earnings in late July. The company missed earnings views but beat expectations on the top line. Nonetheless, Antero still grew year-over-year earnings by a whopping 1,192%.

So how do these companies stack up against their industry peers?

All three are components of the SPDR S&P Oil & Gas Exploration & Production ETF (NYSEARCA: XOP). This ETF tracks the index of the same name, comprised of the oil and gas exploration and production segment of the S&P total market index. Unlike the S&P 500 large-cap index, the total market index includes large-, mid-, small-, and micro-cap stocks.

Within the SPDR S&P Oil & Gas Exploration & Production Index, Denbury is the second most heavily weighted component, after Occidental Petroleum (NYSE: OXY). Antero is also among the top 10 most heavily weighted.

When it comes to performance, the index is up 46.27% year-to-date. Compare that to the stocks’ returns:

- Denbury: 20.71%

- Comstock: 128.43%

- Antero: 139.26%

Not that you should invest solely based on past returns; we all understand the caveats around that. But when choosing an investment to represent a specific sector or industry, it’s crucial to understand how your stock compares to others that are similar. Don’t choose one that seems destined to be a laggard, given its business model, management team and future prospects.