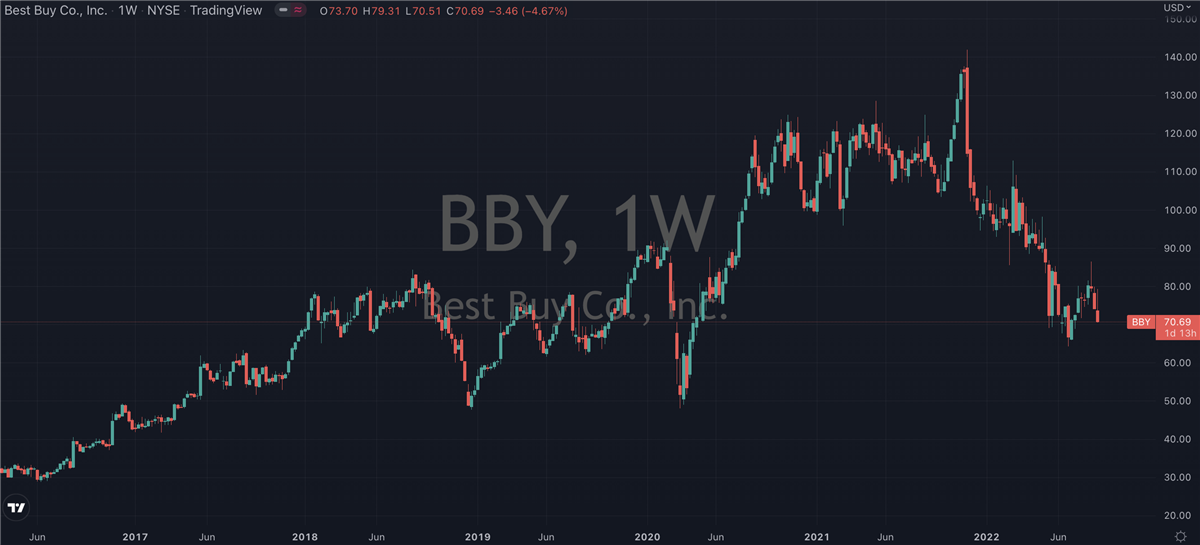

Consumer retail names have had a tough 2022 so far, with soaring inflation and falling household spending combining to create the perfect storm, and Best Buy (NYSE: BBY) has been no exception. The well-known consumer electronics store has had to watch its shares fall 50% from the dizzying heights they reached last year.

Consumer retail names have had a tough 2022 so far, with soaring inflation and falling household spending combining to create the perfect storm, and Best Buy (NYSE: BBY) has been no exception. The well-known consumer electronics store has had to watch its shares fall 50% from the dizzying heights they reached last year. And in that context, it might not feel like the best time in the world to consider getting involved in them. But it’s not all doom and gloom, and with global inflation forecasted to peak in the early months of next year those of us with a long enough time horizon might do well to consider the longer-term potential here.

Let’s start by taking a look at the company’s Q2 earnings which were released earlier this week. Both topline revenue and bottomline EPS came in ahead of analyst expectations, a welcome surprise for investors no doubt. The former was still down close to 13% on the year, while the latter showed a healthy black print.

Bullish Outlook

Corie Barry, Best Buy’s CEO, struck a bullish tone that sought to reassure investors and coax in new ones. She said with the release that “I am incredibly proud of our teams as they continue to rise to the challenges of the past few years and I remain impressed with their ability to lead through the rapidly shifting business environment. Our comparable sales were down 12.1% as we lapped strong comparable sales growth last year of 19.6%. Our online sales penetration, at 31% of our total Domestic sales, is almost twice as high as pre-pandemic Q2 FY20 while our diluted EPS grew over 40% versus Q2 FY20.”

She also spoke to the challenging macroeconomic environment, and how that has contributed to an “uneven sales” trajectory. However, she made a point of saying that she and her team were very much “focused on balancing our near-term response to difficult conditions, managing well what is in our control, while also delivering on our strategic initiatives and what will be important for our long-term growth.” Crucially for those thinking about getting involved, Best Buy’s core strategy, and management’s confidence in it, remains solid. As Barry summed up, “we have exciting opportunities ahead of us in a world that is more reliant on technology than ever. We are a financially strong company with a resilient, world class team that will successfully navigate the current environment.”

So while a lot of the key metrics moved in the wrong direction, it could be said that this wasn’t much of a surprise and indeed was more than likely already baked into the share price. After all, investors have been dealing with red hot inflation prints since the start of the year and retailers like Best Buy are on the front line when it comes to the effect on business. In addition, management is taking a proactive stance to ensure they’re as well prepared as possible to bounce back once these headwinds abate. As part of this week’s update, it was reported that due to the ongoing changes in business trends, Best Buy’s management said it “commenced during Q2 an enterprise-wide restructuring initiative to better align its spending with critical strategies and operations, as well as to optimize its cost structure.”

Getting Involved

Shares of Best Buy jumped in the aftermath of the release, suggesting Wall Street was a fan of both the analyst beat and the restructuring plans. While they’ve since cooled, in line with the rest of the equity market, this was still a good bellwether.

There’s no doubt that many months of turbulent business activity remain ahead of them, but Best Buy is doing all they can for now to minimize the damage and ensure they’re set up for success when the macro economic environment shifts. Management has been upfront with investors, even going so far as to issue a surprise forward guidance cut in July. In doing so they’ve frontloaded the negative sentiment and made a strong case for the worst case scenario already being baked into the share price. Any surprise news to the upside, be it company or economy specific, in the coming months would go a long way to undoing the 50% haircut that shares have had to endure so far this year.