Small-cap stocks are finally staging a comeback after underperforming against medium to large-cap stocks this year.

This year's notable trend has been the significant outperformance of large-cap stocks, specifically those in the technology sector, versus small-cap stocks. However, with the iShares Russell 2000 ETF (NYSE: IWM) up 7% this month, could that trend shift to favor small-caps into the new year?

The rally in small-cap stocks began in November when the IWM found support near its 52-week lows and sharply bounced higher. Then, following lower-than-anticipated inflation figures, the IWM started a second push higher, reclaiming its 20-day and 50-day Simple Moving Averages (SMA).

With the small-cap-focused ETF consolidating just below its 200-day SMA, will the renewed strength in small-caps continue into the new year?

An overview of the iShares Russell 2000 ETF (IWM)

The iShares Russell 2000 ETF is an exchange-traded fund designed to mirror the performance of the Russell 2000 Index, which tracks the small-capitalization sector of the US equity market. This index comprises around 2,000 of the smallest issuers in the Russell 3000 Index and is a float-adjusted capitalization-weighted index. The fund offers a 1.57% dividend yield and has $55.43 billion in assets under management.

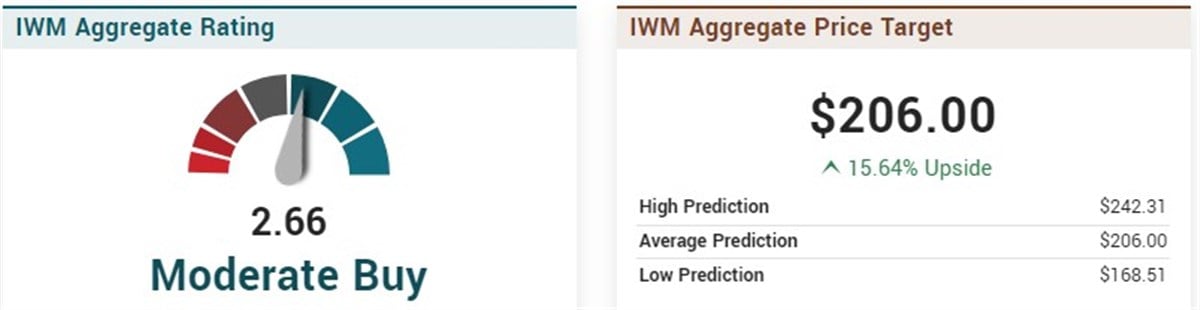

The IWM has geographic exposure mainly in the United States, with 93.1% of the fund exposed to the territory. Notably, holdings in the IWM currently have an aggregate rating of Moderate Buy, based on 305 analyst ratings covering 47 companies (11.2% of the portfolio).

Its holdings have an aggregate price target of $206, covering 47 companies, predicting almost 16% upside for the ETF.

Small caps break their downtrend

The IWM's current setup appears advantageous for bullish trends, with the ETF consolidating just below its steady 200-day SMA. Notably, after the latest inflation data, the ETF managed to regain its 50-day SMA, indicating a shift in momentum for the medium term.

Looking ahead, a successful breakthrough above its short-term resistance coupled with reclaiming the 200-day SMA could signify a substantial shift in the broader trend, potentially igniting increased investment, capital allocation, and further upside for both the ETF and the small-cap sector.

Could this trend continue?

Small-cap stocks, specifically the iShares Russell 2000 ETF (IWM), tend to shine when the economy is booming and smaller companies, which are part of the index, see a surge in demand for what they offer. Historically, it has also fared well during times of rising interest rates in a healthy economy, benefiting the smaller-cap stocks it represents.

How well it does will also depend on how individual companies perform, along with the general mood of the market and the confidence investors have. Following the latest inflation data, the market's undertone turned notably upbeat, hinting at a more risk-tolerant stance among investors as the year drew to a close. This shift in attitude likely favored small-cap stocks, mainly benefiting the IWM.

Moving ahead, the sustainability of this optimism until the year-end remains uncertain. However, from a technical analysis viewpoint, the IWM seems poised for a potential breakout.