As the overall market and various leading sectors, such as the technology and financial sectors, trade near their 52-week highs, optimism and speculation have seemingly returned to the markets.

Such optimism has been seen over the previous several weeks, judging by the number of breakouts occurring across several sectors. In particular, stocks with abnormally large short interest and beaten-down charts have benefited from the newfound optimism.

As far as beaten-down stocks with a heightened short interest go, one stock might meet that criteria better than any other. Shares of Beyond Meat (NASDAQ: BYND) are down over 28% year-to-date but have experienced a stellar four-week performance, rising over 26%.

The stock has experienced rising short interest and recently broke above a critical resistance level. Which now begs the question, could Beyond Meat be setting up for a short squeeze much higher?

A closer look at Beyond Meat

Beyond Meat specializes in developing, producing, and distributing plant-based meat alternatives globally. Their diverse portfolio includes plant-based beef, pork, and poultry substitutes, available in various retail channels such as grocery stores, mass merchandisers, and natural retailers.

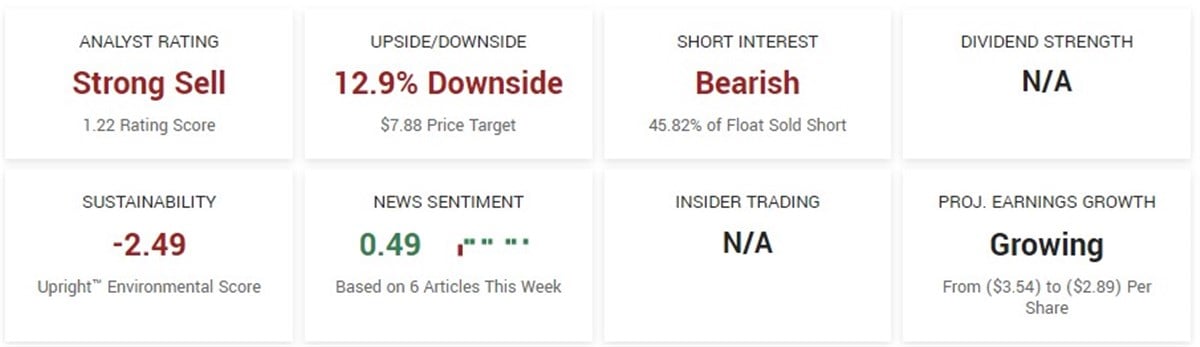

BYND stock is trading near the high end of its 50-day range but in the lower quartile of its 52-week range. The company has a $551 million market capitalization and trades 2.67 million shares on average. The stock possesses an overwhelming bearish sentiment, as analysts predict a downside with a Sell rating, and has a well above average short interest.

Based on nine analyst ratings, the stock has a consensus rating of Sell and a $7.88 price target, forecasting an almost 8% downside.

The bearish analyst sentiment has been a steady fixture for BYND. However, in recent months, it has gotten worse. Three months ago the stock had a Reduce rating and $12.78 price target. Since then, the price target has steadily lowered, and the rating has changed to Sell, with more analysts rating the stock as a Sell versus a Hold.

Short interest is on the rise

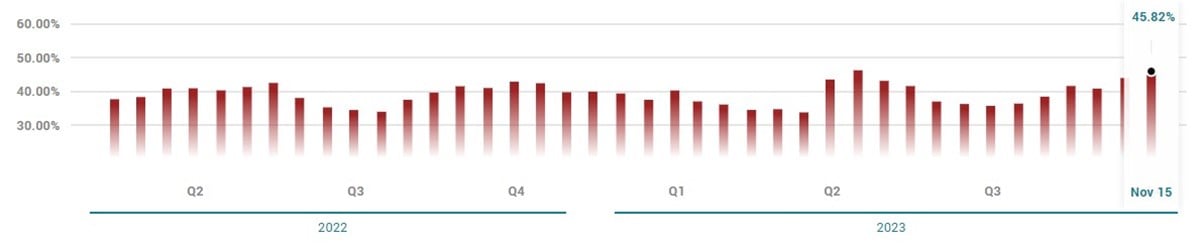

The short interest in BYND is at staggering heights, currently at 45.82%, meaning that almost half its float is sold short. A short interest of that magnitude firmly solidifies Beyond Meat as one of the most shorted stocks on the Nasdaq.

Notably, the short interest has been steadily climbing since October 15. The short interest has risen 4.74% vs. the previous month, and the total volume sold short currently stands at $201 million.

Will the recent momentum in BYND shares continue?

Shares of BYND recently experienced a notable shift in momentum as the stock broke its long-serving downtrend. Additionally, the stock has reclaimed its 50-day Simple Moving Average (SMA) and experienced a noteworthy uptick in trading volume. This signals that buyers have stepped up, and the supply has dwindled in the short term.

So, going forward, if the stock can base above the previous resistance and the 50-day SMA, with sustained volume and interest, its chances of progressing further to the upside will increase dramatically. Add to that the large and growing short interest, and the ingredients for a short squeeze appear present. As mentioned, though, if that is to happen, the stock needs to continue to base above the previous resistance, near $8.