Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Cal-Maine (NASDAQ:CALM) and its peers.

The consumer staples industry comprises companies engaged in the manufacturing, distribution, and sale of essential, everyday products. These products, also known as "staples," are fundamental to daily living and include packaged food, beverages and alcohol, personal care, and household products. Consumer staples stocks are considered defensive investments because consumers often purchase them regardless of economic conditions. To stand out, companies must have some combination of brand recognition, product quality, and price competitiveness.

The 17 consumer staples stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

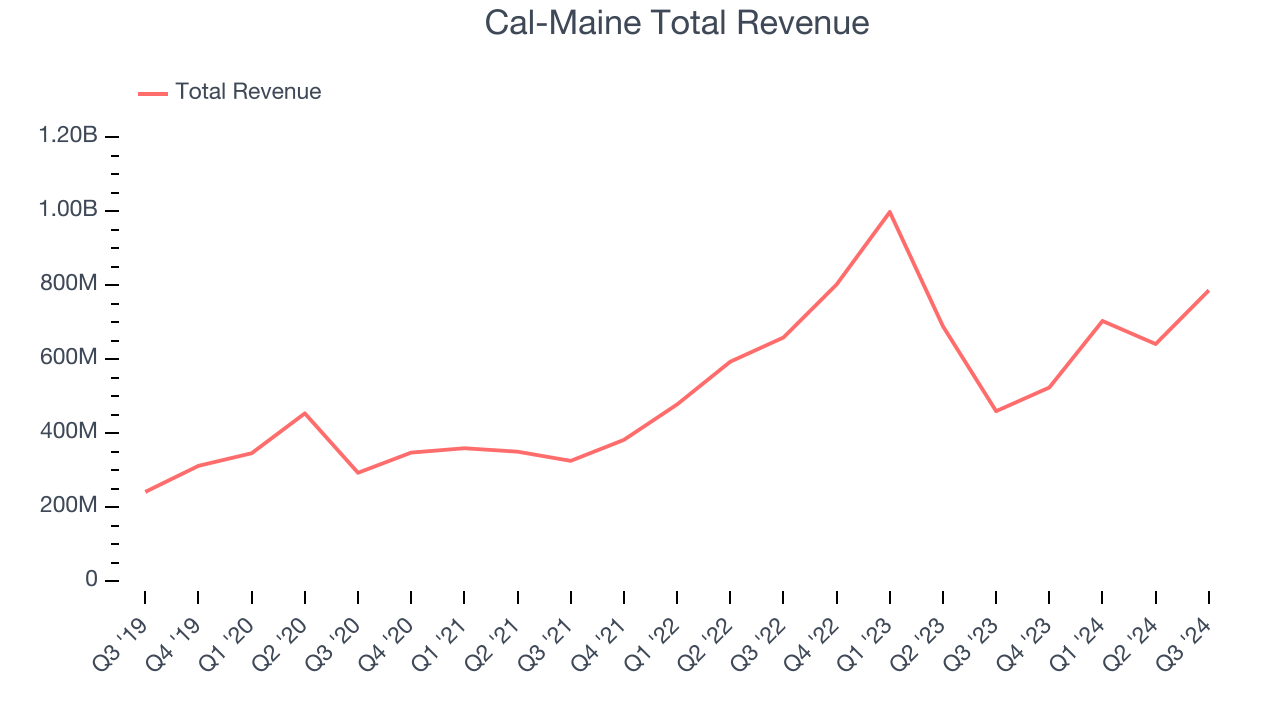

Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $785.9 million, up 71.1% year on year. This print exceeded analysts’ expectations by 11.5%. Despite the top-line beat, it was still a slower quarter for the company with a miss of analysts’ earnings estimates.Sherman Miller, president and chief executive officer of Cal-Maine Foods, stated, “Our financial and operating results for the first quarter mark a strong start to fiscal 2025 for Cal-Maine Foods. These results reflect favorable demand for shell eggs during most of the quarter and significantly higher market prices compared with the first quarter last year. At the same time, the national egg supply has declined due to the recent outbreaks of highly pathogenic avian influenza (“HPAI”).

Cal-Maine pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 16.3% since reporting and currently trades at $89.43.

Read our full report on Cal-Maine here, it’s free.

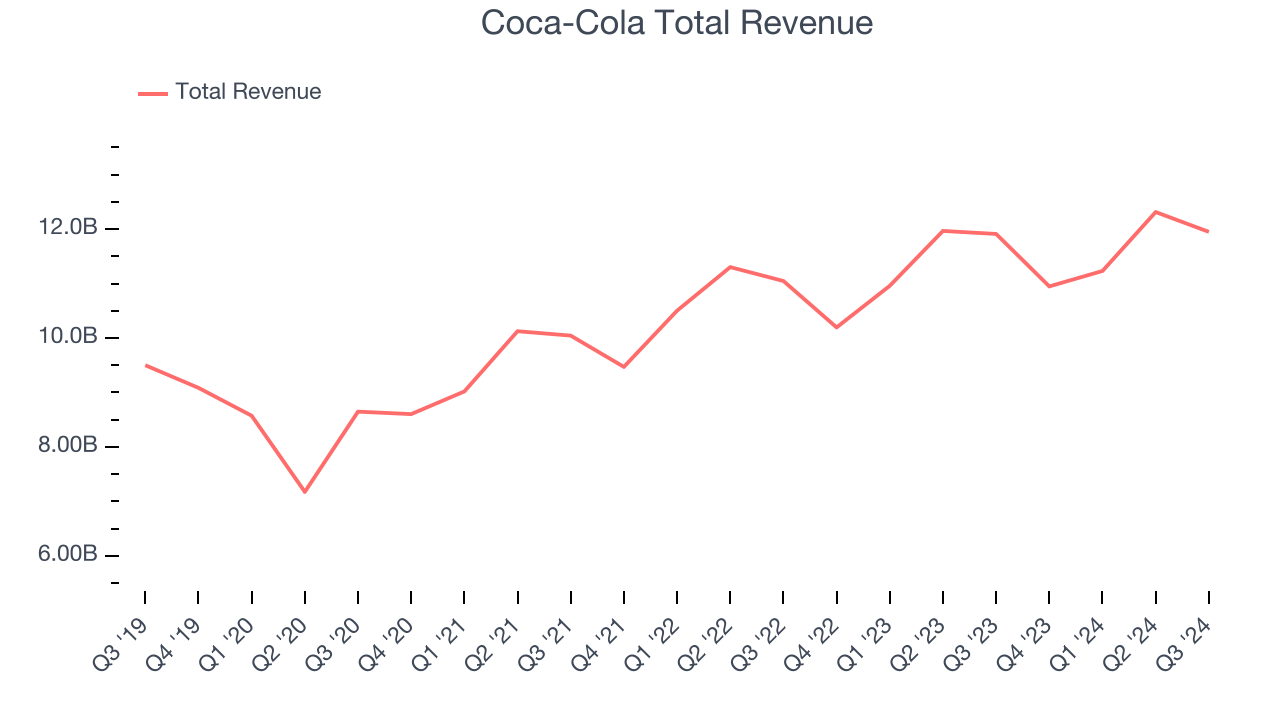

Best Q3: Coca-Cola (NYSE:KO)

A pioneer and behemoth in carbonated soft drinks, The Coca-Cola Company (NYSE:KO) is a storied beverage company best known for its flagship soda of the same name.

Coca-Cola reported revenues of $11.95 billion, flat year on year, outperforming analysts’ expectations by 2.9%. The business had a strong quarter with an impressive beat of analysts’ organic revenue growth estimates and a narrow beat of analysts’ earnings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.5% since reporting. It currently trades at $66.98.

Is now the time to buy Coca-Cola? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Conagra (NYSE:CAG)

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today (NYSE:CAG) boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.79 billion, down 3.8% year on year, falling short of analysts’ expectations by 1.6%. It was a softer quarter as it posted a miss of analysts’ organic revenue growth and EBITDA estimates.

As expected, the stock is down 10.6% since the results and currently trades at $29.25.

Read our full analysis of Conagra’s results here.

PepsiCo (NASDAQ:PEP)

With a history that goes back more than a century, PepsiCo (NASDAQ:PEP) is a household name in food and beverages today and best known for its flagship soda.

PepsiCo reported revenues of $23.32 billion, flat year on year. This number came in 1.9% below analysts' expectations. Overall, it was a slower quarter as it also recorded a miss of analysts’ organic revenue growth and EBITDA estimates.

The stock is up 2.8% since reporting and currently trades at $171.81.

Read our full, actionable report on PepsiCo here, it’s free.

Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $605.5 million, flat year on year. This result was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced a decent beat of analysts’ EBITDA estimates but underwhelming earnings guidance for the full year.

The stock is down 2% since reporting and currently trades at $295.96.

Read our full, actionable report on Boston Beer here, it’s free.

Market Update

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and them to your watchlist. These companies are posied for grow regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.