Packaged snacks company Mondelez (NASDAQ:MDLZ) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 1.9% year on year to $9.20 billion. Its non-GAAP profit of $0.99 per share was 16.6% above analysts’ consensus estimates.

Is now the time to buy Mondelez? Find out by accessing our full research report, it’s free.

Mondelez (MDLZ) Q3 CY2024 Highlights:

- Revenue: $9.20 billion vs analyst estimates of $9.12 billion (in line)

- Adjusted EPS: $0.99 vs analyst estimates of $0.85 (16.6% beat)

- Gross Margin (GAAP): 32.6%, down from 38.7% in the same quarter last year

- Operating Margin: 12.5%, down from 15.3% in the same quarter last year

- Free Cash Flow was -$343 million, down from $892 million in the same quarter last year

- Organic Revenue rose 5.4% year on year (15.7% in the same quarter last year)

- Sales Volumes were flat year on year (3.8% in the same quarter last year)

- Market Capitalization: $92.89 billion

“We posted robust results for Q3, with accelerated top-line growth, strong earnings and attractive cash flow generation. These results were driven by our commitment to executing with excellence across our categories, markets and brands,” said Dirk Van de Put, Chair and Chief Executive Officer.

Company Overview

Founded as Nabisco in 1903, Mondelez (NASDAQ:MDLZ) is a packaged snacks powerhouse best known for its Oreo, Cadbury, Toblerone, Ritz, and Trident brands.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Mondelez is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have).

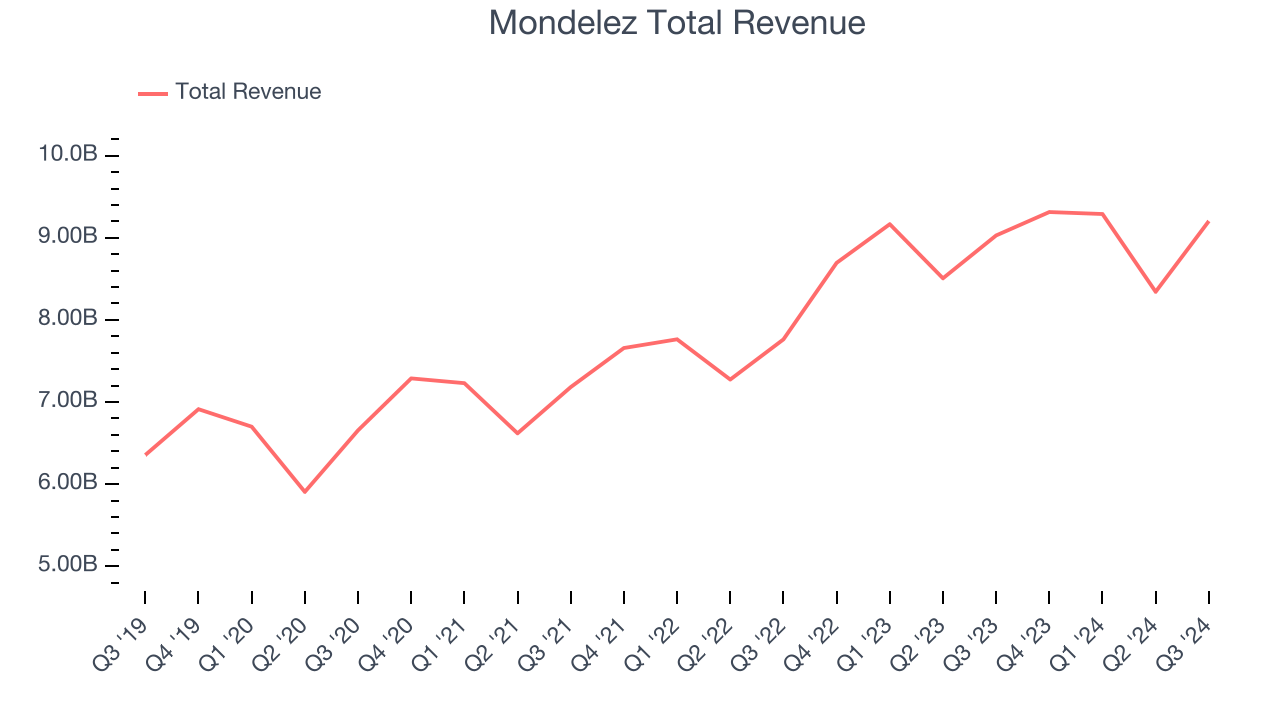

As you can see below, Mondelez’s sales grew at a decent 8.5% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Mondelez grew its revenue by 1.9% year on year, and its $9.20 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and shows the market thinks its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Mondelez generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

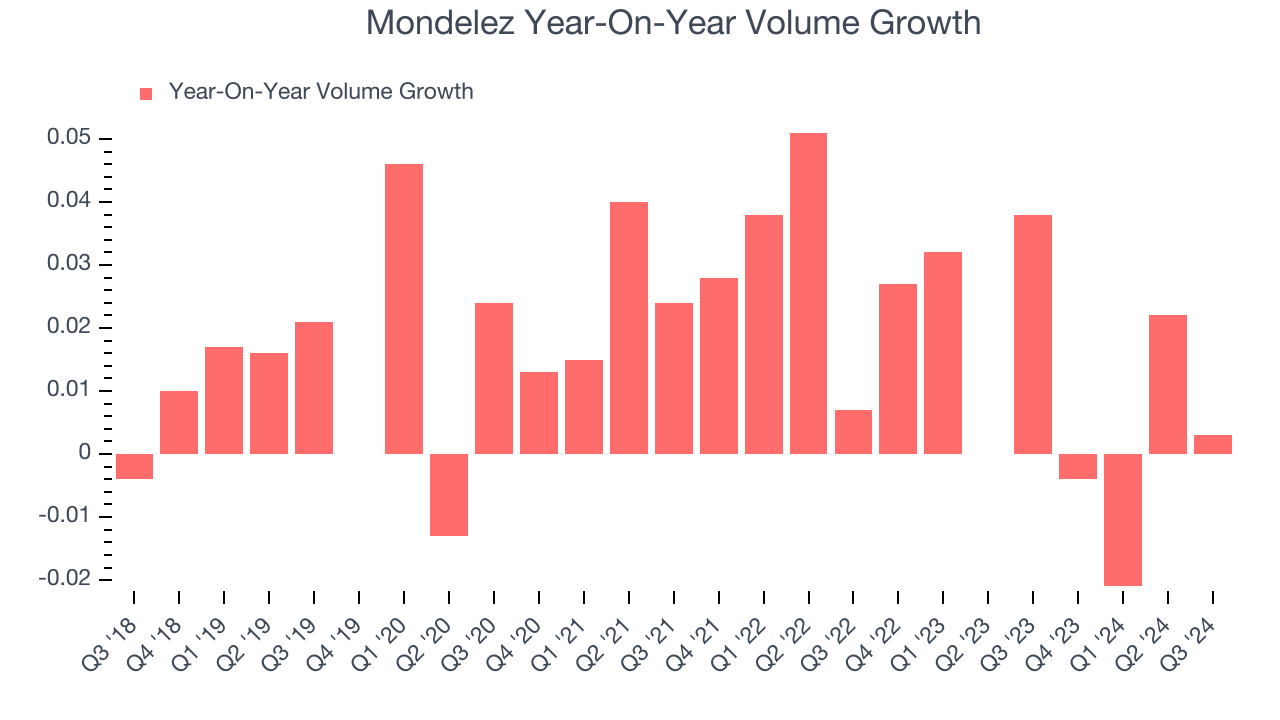

Over the last two years, Mondelez’s average quarterly volume growth was a healthy 1.2%. Even with this good performance, we can see that most of the company’s gains have come from price increases by looking at its 10.6% average organic revenue growth. The ability to sell more products while raising prices indicates that Mondelez enjoys some degree of inelastic demand.

In Mondelez’s Q3 2024, year on year sales volumes were flat. By the company’s standards, this result was a meaningful deceleration from the 3.8% year-on-year increase it posted 12 months ago. We’ll be watching Mondelez closely to see if it can reaccelerate demand for its products.

Key Takeaways from Mondelez’s Q3 Results

We were impressed that Mondelez beat analysts’ organic revenue growth expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin missed analysts’ expectations. Looking ahead, the company reiterated its previously-provided full year guidance for organic net sales and EPS growth, which shows that the company is on track. Overall, this quarter was solid. The stock remained flat at $68.62 immediately after reporting.

Is Mondelez an attractive investment opportunity right now?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.