Waste management company Casella (NASDAQ:CWST) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 16.7% year on year to $411.6 million. The company’s outlook for the full year was also close to analysts’ estimates with revenue guided to $1.54 billion at the midpoint. Its non-GAAP profit of $0.27 per share was 2.4% below analysts’ consensus estimates.

Is now the time to buy Casella Waste Systems? Find out by accessing our full research report, it’s free.

Casella Waste Systems (CWST) Q3 CY2024 Highlights:

- Revenue: $411.6 million vs analyst estimates of $413.6 million (in line)

- Adjusted EPS: $0.27 vs analyst expectations of $0.28 (2.4% miss)

- EBITDA: $102.9 million vs analyst estimates of $108.3 million (4.9% miss)

- The company reconfirmed its revenue guidance for the full year of $1.54 billion at the midpoint

- EBITDA guidance for the full year is $365 million at the midpoint, below analyst estimates of $366.9 million

- Gross Margin (GAAP): 35.1%, in line with the same quarter last year

- Operating Margin: 5.9%, down from 9.7% in the same quarter last year

- EBITDA Margin: 25%, in line with the same quarter last year

- Free Cash Flow Margin: 22.3%, up from 13.3% in the same quarter last year

- Market Capitalization: $6.48 billion

“We posted another solid quarter of execution against our growth strategies across our business," said John W. Casella, Chairman and CEO of Casella Waste Systems.

Company Overview

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ:CWST) offers waste management services for businesses, residents, and the government.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Sales Growth

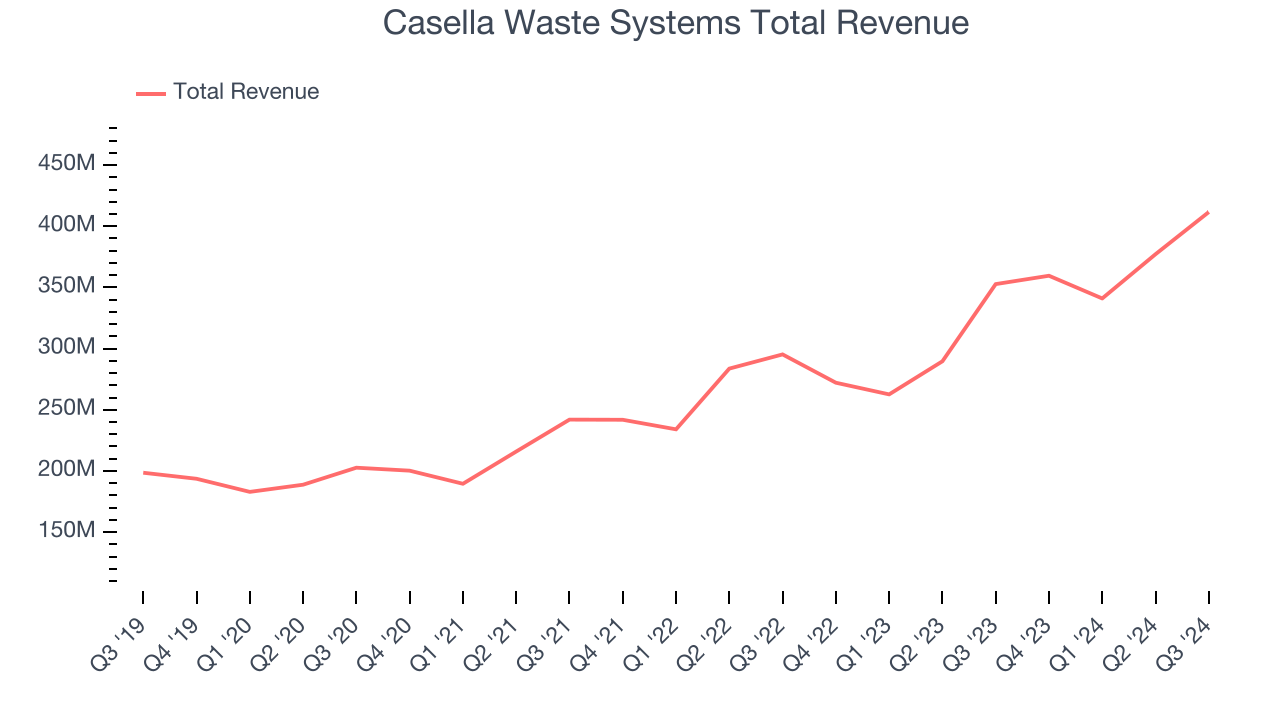

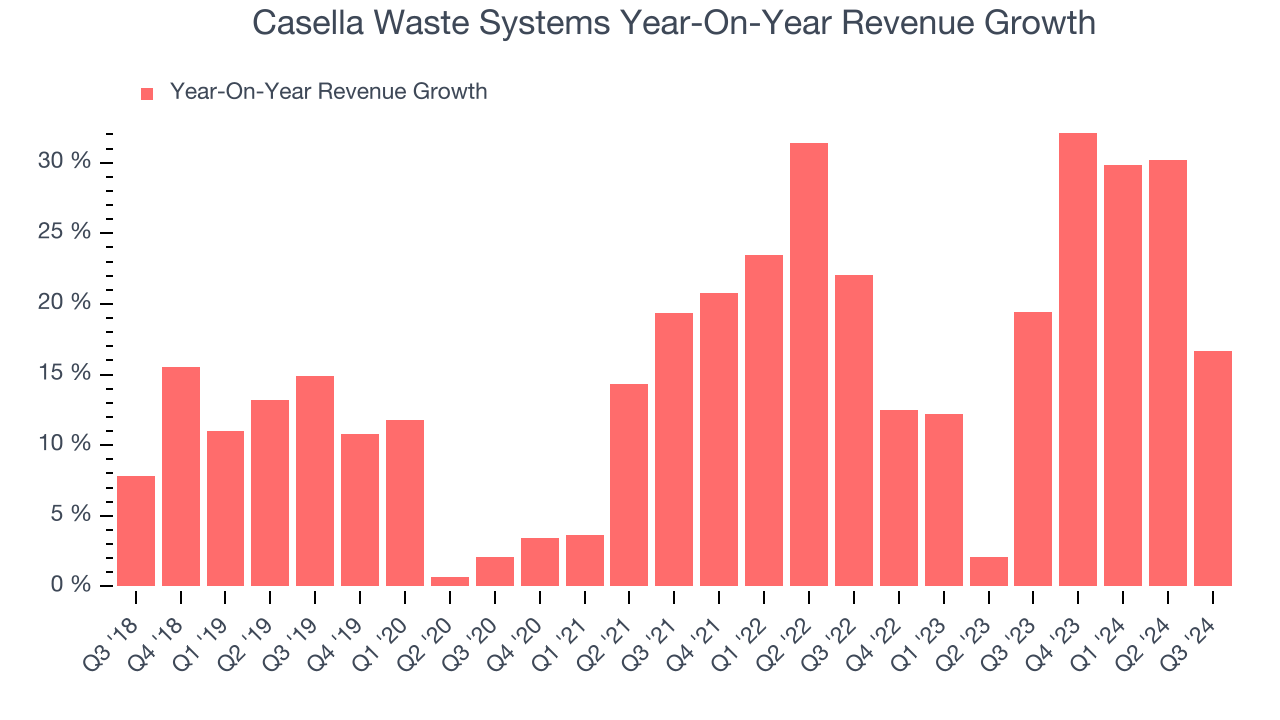

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Casella Waste Systems’s sales grew at an incredible 15.5% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Casella Waste Systems’s annualized revenue growth of 18.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Casella Waste Systems’s year-on-year revenue growth was 16.7%, and its $411.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, a deceleration versus the last two years. This projection is still healthy and shows the market is factoring in success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

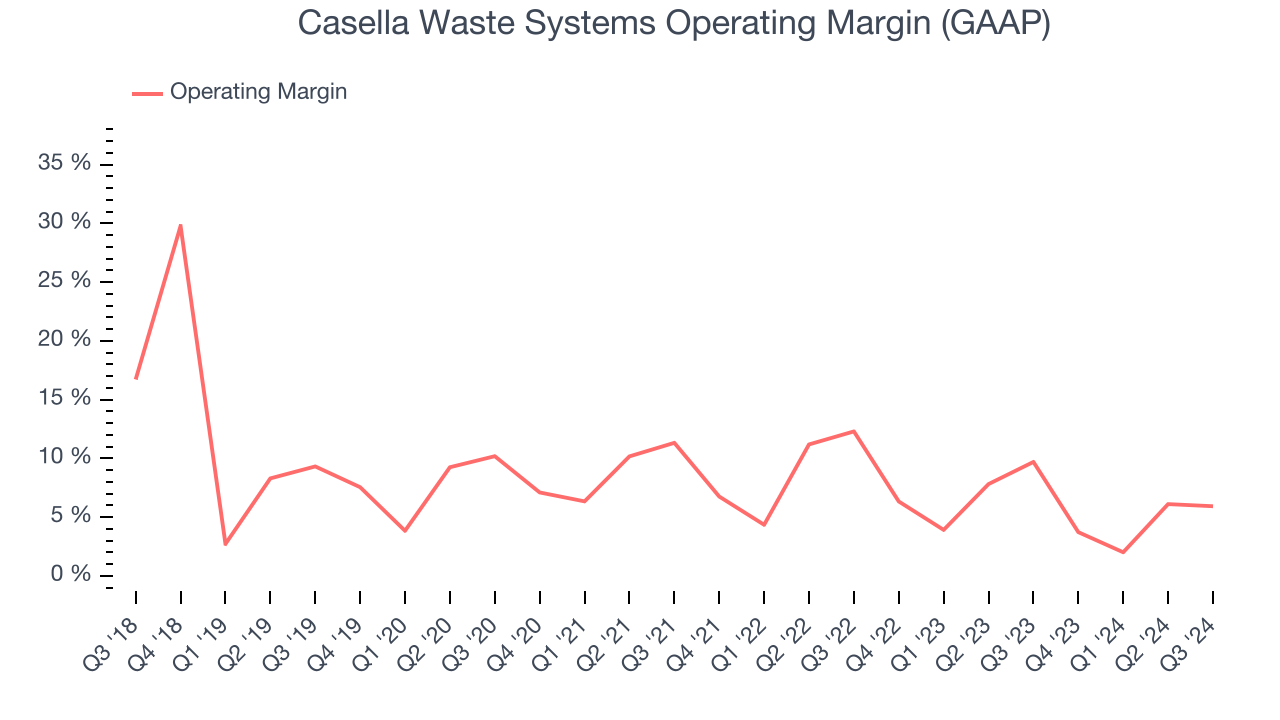

Casella Waste Systems was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.2% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

Looking at the trend in its profitability, Casella Waste Systems’s annual operating margin decreased by 3.2 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Casella Waste Systems generated an operating profit margin of 5.9%, down 3.8 percentage points year on year. Since Casella Waste Systems’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

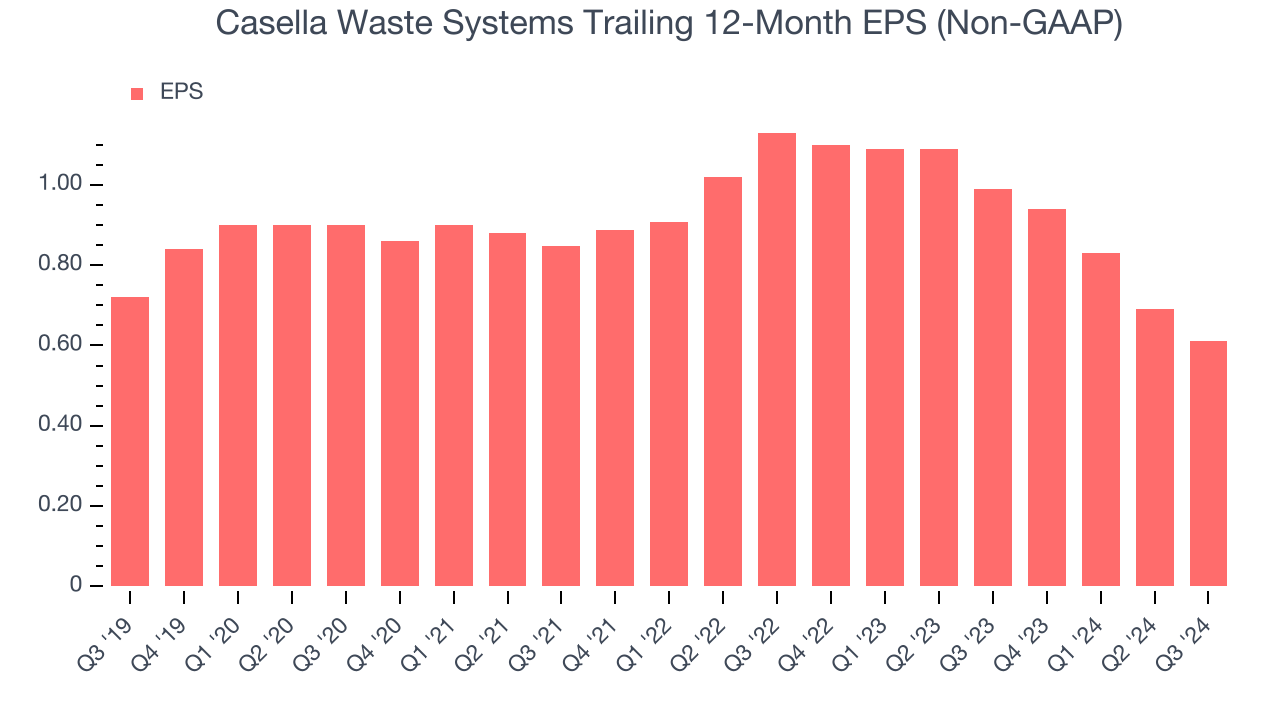

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Casella Waste Systems, its EPS declined by 3.3% annually over the last five years while its revenue grew by 15.5%. This tells us the company became less profitable on a per-share basis as it expanded.

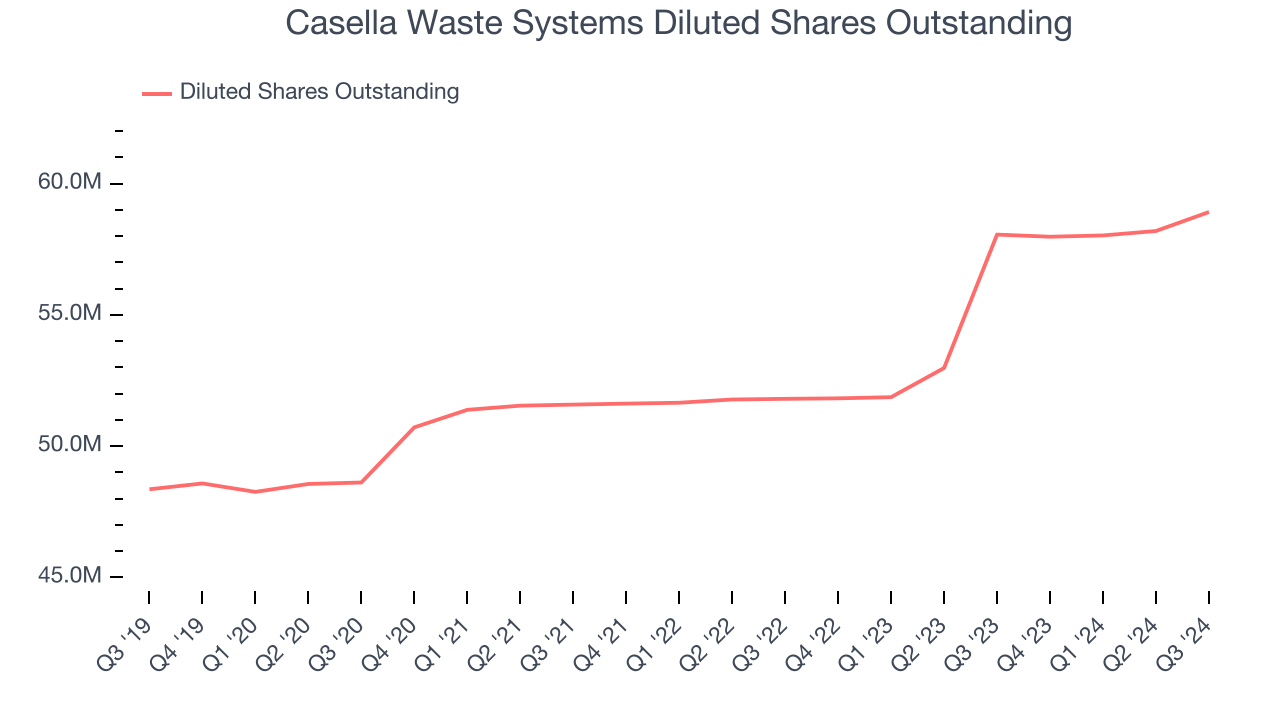

Diving into the nuances of Casella Waste Systems’s earnings can give us a better understanding of its performance. As we mentioned earlier, Casella Waste Systems’s operating margin declined by 3.2 percentage points over the last five years. Its share count also grew by 21.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Casella Waste Systems, its two-year annual EPS declines of 26.5% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Casella Waste Systems reported EPS at $0.27, down from $0.35 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Casella Waste Systems’s full-year EPS of $0.61 to grow by 34.7%.

Key Takeaways from Casella Waste Systems’s Q3 Results

We struggled to find many strong positives in these results as its EBITDA and EPS fell short of Wall Street’s estimates. The company's full-year EBITDA guidance was also below analysts' expectations. Overall, this quarter could have been better. The stock traded down 1.3% to $100 immediately following the results.

Casella Waste Systems’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.