Online payroll and human resource software provider Dayforce (NYSE:DAY) announced better-than-expected revenue in Q3 CY2024, with sales up 16.6% year on year to $440 million. On the other hand, the company expects next quarter’s revenue to be around $454.5 million, slightly below analysts’ estimates. Its non-GAAP profit of $0.47 per share was also 11% above analysts’ consensus estimates.

Is now the time to buy Dayforce? Find out by accessing our full research report, it’s free.

Dayforce (DAY) Q3 CY2024 Highlights:

- Revenue: $440 million vs analyst estimates of $428.3 million (2.7% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.42 (11% beat)

- Revenue Guidance for Q4 CY2024 is $454.5 million at the midpoint, below analyst estimates of $458.1 million

- EBITDA guidance for the full year is $499.5 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 45.8%, down from 47% in the same quarter last year

- Operating Margin: 4.7%, down from 7% in the same quarter last year

- Free Cash Flow Margin: 20.9%, up from 17.2% in the previous quarter

- Billings: $435.1 million at quarter end, up 14% year on year

- Market Capitalization: $10.33 billion

“Our dedicated team achieved excellent results in the third quarter, positioning us to finish 2024 with strength,” said David Ossip, Chair and CEO of Dayforce.

Company Overview

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE:DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

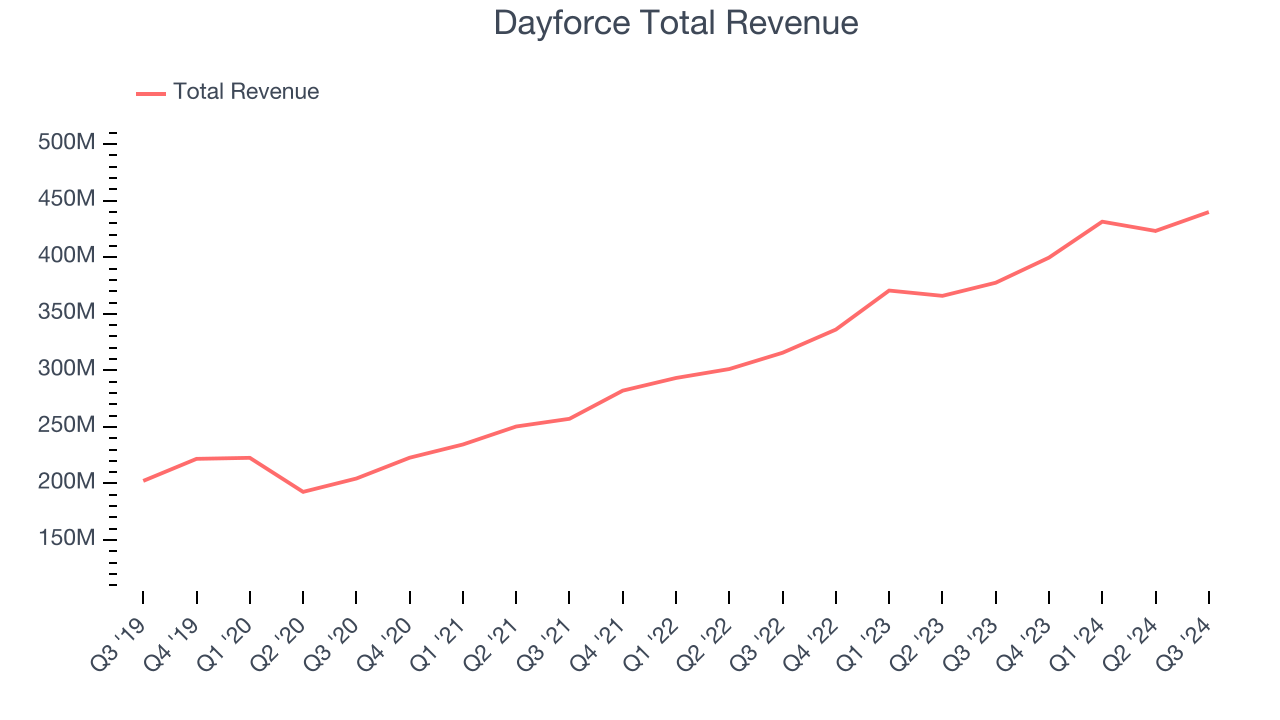

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Dayforce’s 20.6% annualized revenue growth over the last three years was decent. This is a useful starting point for our analysis.

This quarter, Dayforce reported year-on-year revenue growth of 16.6%, and its $440 million of revenue exceeded Wall Street’s estimates by 2.7%. Management is currently guiding for a 13.7% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.5% over the next 12 months. This projection is still above the sector average and indicates the market is baking in some success for its newer products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

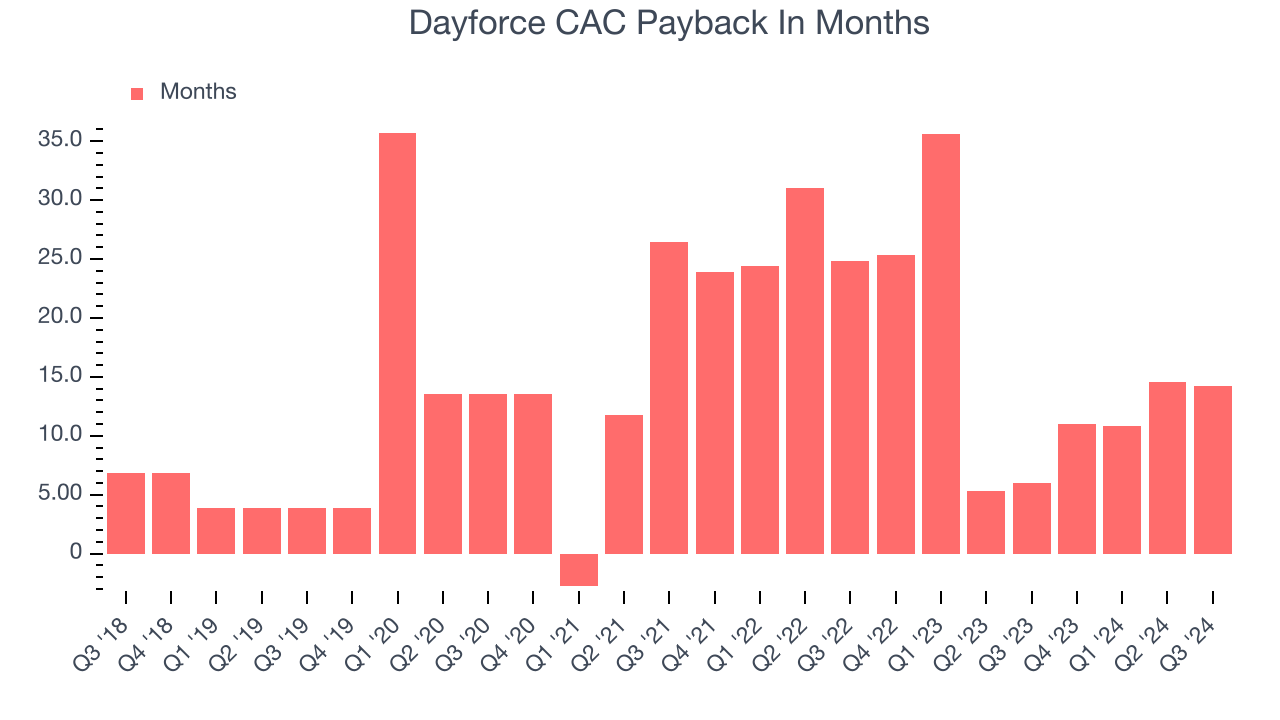

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Dayforce is extremely efficient at acquiring new customers, and its CAC payback period checked in at 14.3 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Dayforce’s Q3 Results

It was good to see Dayforce beat analysts’ revenue and billings expectations this quarter. On the other hand, its gross margin declined and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $65 immediately following the results.

Dayforce may have had a tough quarter, but does that actually create an opportunity to invest right now?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.