Domain registrar and web services company GoDaddy (NYSE:GDDY) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 7.3% year on year to $1.15 billion. The company expects next quarter’s revenue to be around $1.18 billion, close to analysts’ estimates. Its GAAP profit of $1.32 per share was 6.4% above analysts’ consensus estimates.

Is now the time to buy GoDaddy? Find out by accessing our full research report, it’s free.

GoDaddy (GDDY) Q3 CY2024 Highlights:

- Revenue: $1.15 billion vs analyst estimates of $1.14 billion (in line)

- EPS: $1.32 vs analyst estimates of $1.24 (6.4% beat)

- EBITDA: $366.5 million vs analyst estimates of $332.5 million (10.2% beat)

- Revenue Guidance for Q4 CY2024 is $1.18 billion at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 64.5%, up from 62.9% in the same quarter last year

- Operating Margin: 22.1%, up from 15.6% in the same quarter last year

- EBITDA Margin: 31.9%, up from 27.7% in the same quarter last year

- Free Cash Flow Margin: 34.8%, up from 28.8% in the previous quarter

- Billings: $1.18 billion at quarter end, up 8.7% year on year (slight beat vs expectations of $1.17 billion)

- Market Capitalization: $22.75 billion

Company Overview

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

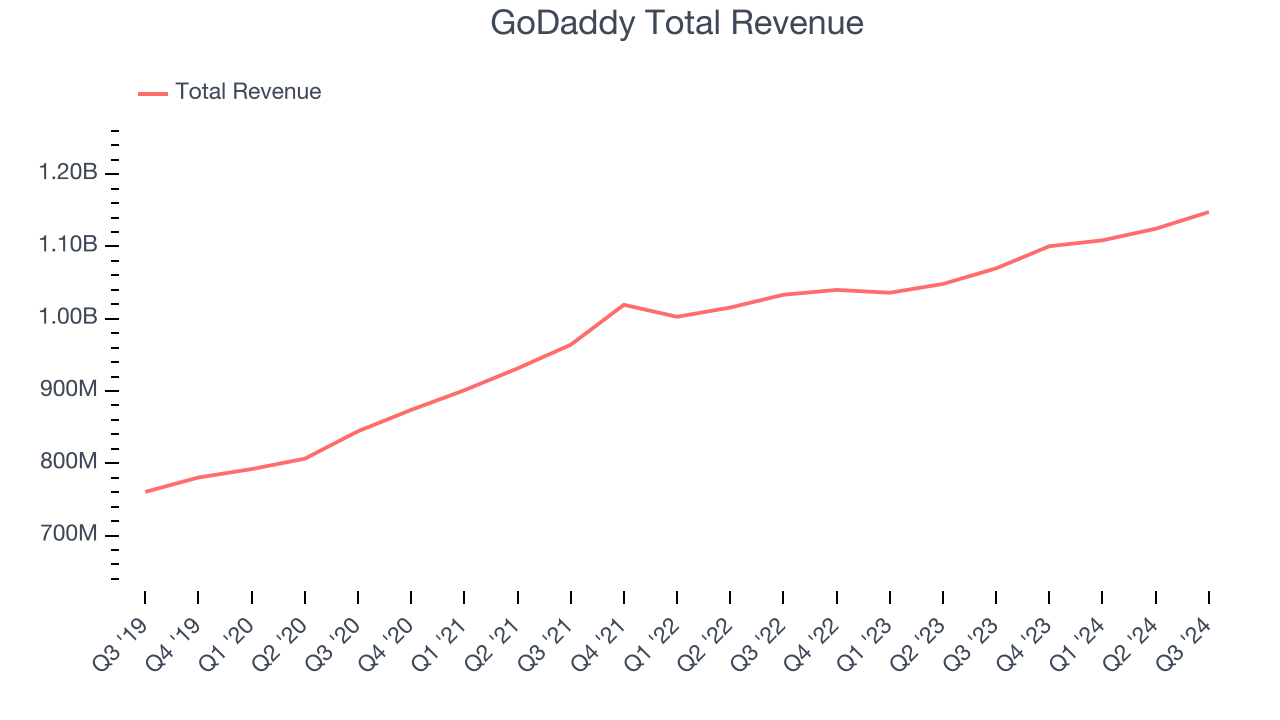

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, GoDaddy’s 6.9% annualized revenue growth over the last three years was weak. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, GoDaddy grew its revenue by 7.3% year on year, and its $1.15 billion of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 6.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates the market thinks its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

GoDaddy does a decent job acquiring new customers, and its CAC payback period checked in at 49.9 months this quarter. The company’s performance indicates relatively solid competitive positioning, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from GoDaddy’s Q3 Results

We were impressed by how significantly GoDaddy blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin improved. Overall, this quarter had some key positives. Revenue guidance for next quarter was roughly in line with expectations. The stock remained flat at $162.16 immediately following the results.

GoDaddy had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.