Business analytics software company MicroStrategy (NASDAQ:MSTR) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 10.3% year on year to $116.1 million. Its non-GAAP loss of $1.56 per share was also 9,355% below analysts’ consensus estimates.

Is now the time to buy MicroStrategy? Find out by accessing our full research report, it’s free.

MicroStrategy (MSTR) Q3 CY2024 Highlights:

- Revenue: $116.1 million vs analyst estimates of $121.5 million (4.4% miss)

- Adjusted EPS: -$1.56 vs analyst estimates of -$0.02

- Gross Margin (GAAP): 70.4%, down from 79.4% in the same quarter last year

- Operating Margin: -373%, down from -19.5% in the same quarter last year

- Bitcoin Holdings: 252,220 BTC tokens with a market value of $18.2 billion (marked at $9.9 billion, the "at cost" value, on its balance sheet)

- Market Capitalization: $52.33 billion

“Our focus remains to increase value generated to our shareholders by leveraging the digital transformation of capital. Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan," said Phong Le, President and Chief Executive Officer, MicroStrategy.

Company Overview

Founded in 1989 with an initial contract with DuPoint, MicroStrategy (NASDAQ:MSTR) started as a data mining and business intelligence software platform, but in 2020, the company made waves by investing heavily in Bitcoin.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

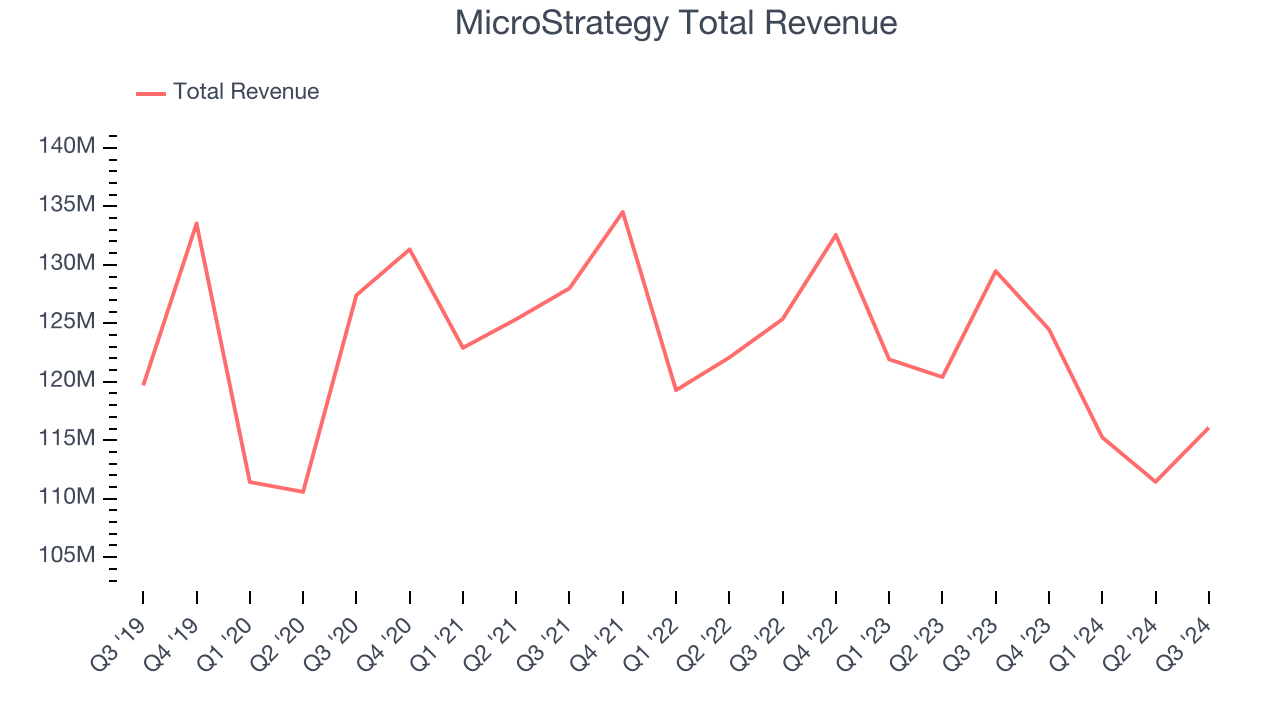

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, MicroStrategy’s revenue declined by 2.7% per year. This shows demand was weak, a rough starting point for our analysis.

This quarter, MicroStrategy missed Wall Street’s estimates and reported a rather uninspiring 10.3% year-on-year revenue decline, generating $116.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, an acceleration versus the last three years. Although this projection illustrates the market thinks its newer products and services will fuel better performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

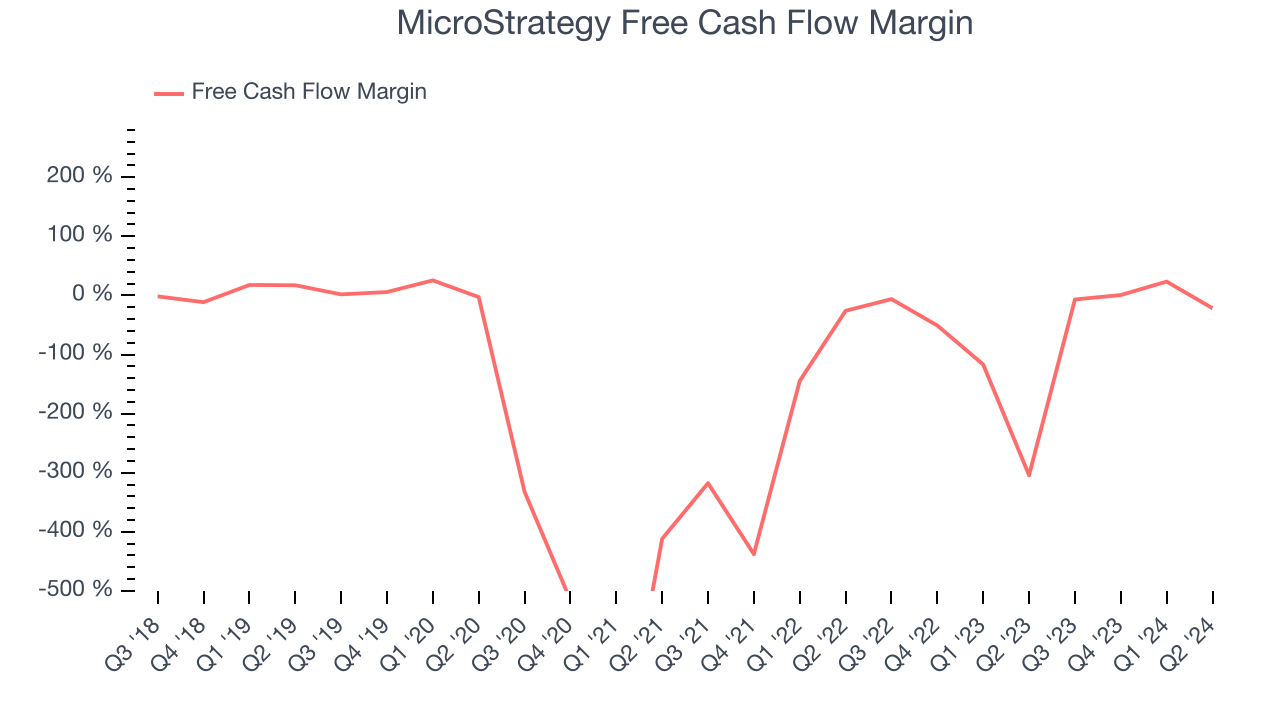

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

MicroStrategy has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, subpar for a software business.

The company’s cash burn increased from $8.85 million of lost cash in the same quarter last year . These numbers deviate from its longer-term margin, raising some eyebrows.

Key Takeaways from MicroStrategy’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EPS missed Wall Street's estimates. However, that doesn't matter much for MicroStrategy as the market is laser-focused on its Bitcoin holdings, which clocked in at 252,220 tokens this quarter. Assuming a BTC price of $72,276, this translates into a market value of $18.2 billion, or ~27% of its market capitalization when accounting for its ~$4.3 billion of debt. BTC is currently marked at its $9.9 billion cost basis on the company's balance sheet. The stock traded down 4.3% to $236.49 immediately following the results.

MicroStrategy may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.