Let’s dig into the relative performance of Air Transport Services (NASDAQ:ATSG) and its peers as we unravel the now-completed Q3 air freight and logistics earnings season.

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 7 air freight and logistics stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 19.3% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Air Transport Services (NASDAQ:ATSG)

Founded in 1980, Air Transport Services Group (NASDAQ:ATSG) provides air cargo transportation and logistics solutions.

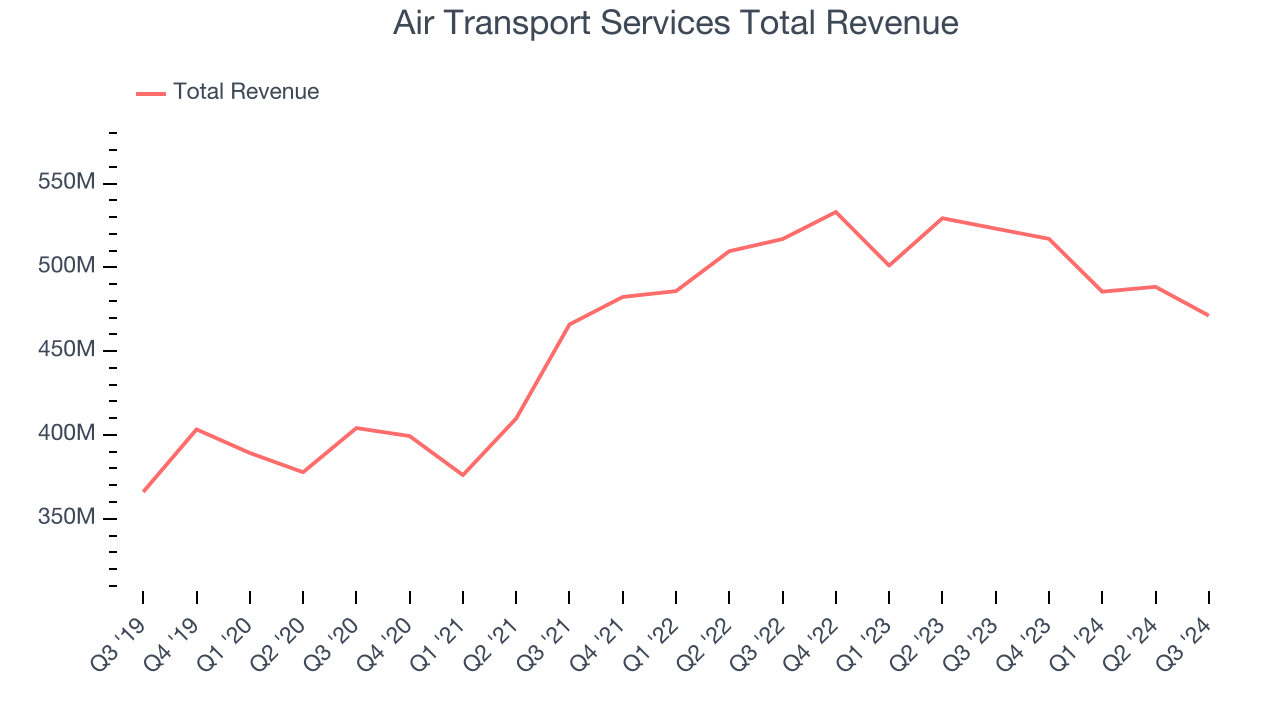

Air Transport Services reported revenues of $471.3 million, down 9.9% year on year. This print fell short of analysts’ expectations by 7.1%. Overall, it was a disappointing quarter for the company with a miss of analysts’ earnings estimates.

Mike Berger, chief executive officer of ATSG, said, "First off, we are excited about our future with Stonepeak. Our leasing business continued to benefit from strong demand for our freighter aircraft, as we added four Boeing 767-300 freighter leases during the third quarter."

Air Transport Services delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $21.93.

Read our full report on Air Transport Services here, it’s free.

Best Q3: Expeditors (NYSE:EXPD)

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

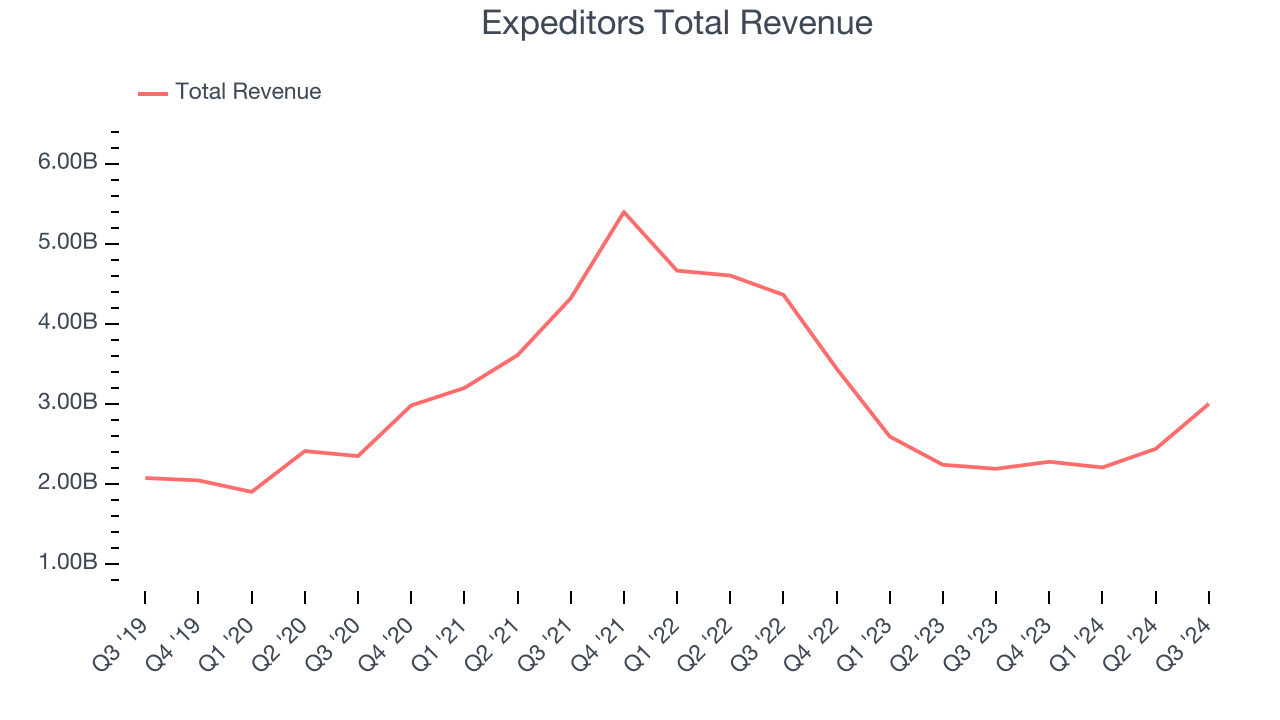

Expeditors reported revenues of $3 billion, up 37% year on year, outperforming analysts’ expectations by 21.3%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA estimates.

Expeditors achieved the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.8% since reporting. It currently trades at $117.01.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: FedEx (NYSE:FDX)

Infamously taking its last $5,000 to a Las Vegas blackjack table to keep the company afloat, FedEx (NYSE:FDX) is a provider of parcel and cargo delivery services

FedEx reported revenues of $21.58 billion, flat year on year, falling short of analysts’ expectations by 1.5%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA estimates.

As expected, the stock is down 4.7% since the results and currently trades at $286.38.

Read our full analysis of FedEx’s results here.

C.H. Robinson Worldwide (NASDAQ:CHRW)

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ:CHRW) offers freight transportation and logistics services.

C.H. Robinson Worldwide reported revenues of $4.64 billion, up 7% year on year. This print surpassed analysts’ expectations by 2.4%. It was an exceptional quarter as it also produced an impressive beat of analysts’ sales and EBITDA estimates.

The stock is flat since reporting and currently trades at $110.49.

Read our full, actionable report on C.H. Robinson Worldwide here, it’s free.

United Parcel Service (NYSE:UPS)

Trademarking its recognizable UPS Brown color, UPS (NYSE:UPS) offers package delivery, supply chain management, and freight forwarding services.

United Parcel Service reported revenues of $22.25 billion, up 5.6% year on year. This result met analysts’ expectations. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

United Parcel Service pulled off the highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $130.16.

Read our full, actionable report on United Parcel Service here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.