Fast-food chain Arcos Dorados (NYSE:ARCO) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $1.13 billion. Its GAAP profit of $0.17 per share was 5.3% above analysts’ consensus estimates.

Is now the time to buy Arcos Dorados? Find out by accessing our full research report, it’s free.

Arcos Dorados (ARCO) Q3 CY2024 Highlights:

- Revenue: $1.13 billion vs analyst estimates of $1.13 billion (in line)

- EPS (GAAP): $0.17 vs analyst estimates of $0.16 (beat by $0.01)

- EBITDA: $125 million vs analyst estimates of $117 million (6.8% beat)

- Gross Margin (GAAP): 14.3%, in line with the same quarter last year

- Operating Margin: 7%, down from 8.1% in the same quarter last year

- EBITDA Margin: 11%, in line with the same quarter last year

- Locations: 2,410 at quarter end, up from 2,339 in the same quarter last year

- Same-Store Sales rose 32.1% year on year, in line with the same quarter last year

- Market Capitalization: $1.77 billion

Company Overview

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE:ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

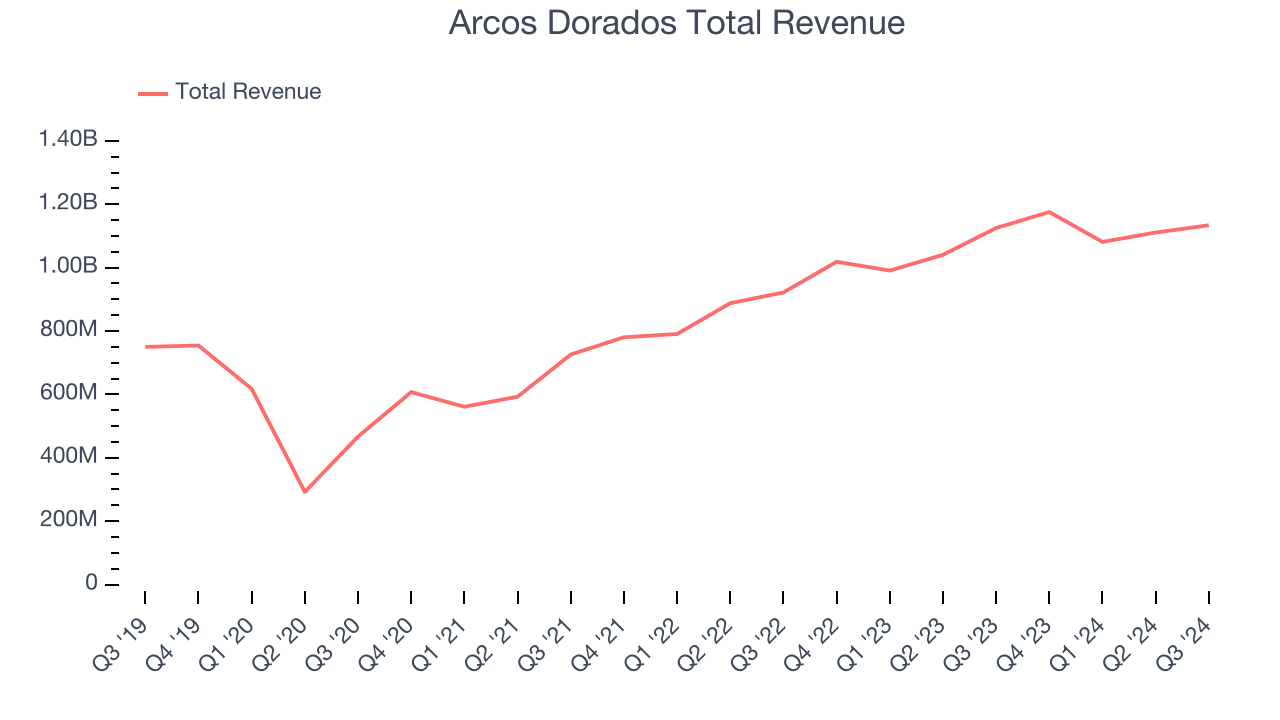

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Arcos Dorados is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions.

As you can see below, Arcos Dorados grew its sales at a decent 8.8% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Arcos Dorados’s $1.13 billion of revenue was flat year on year and in line with Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Restaurant Performance

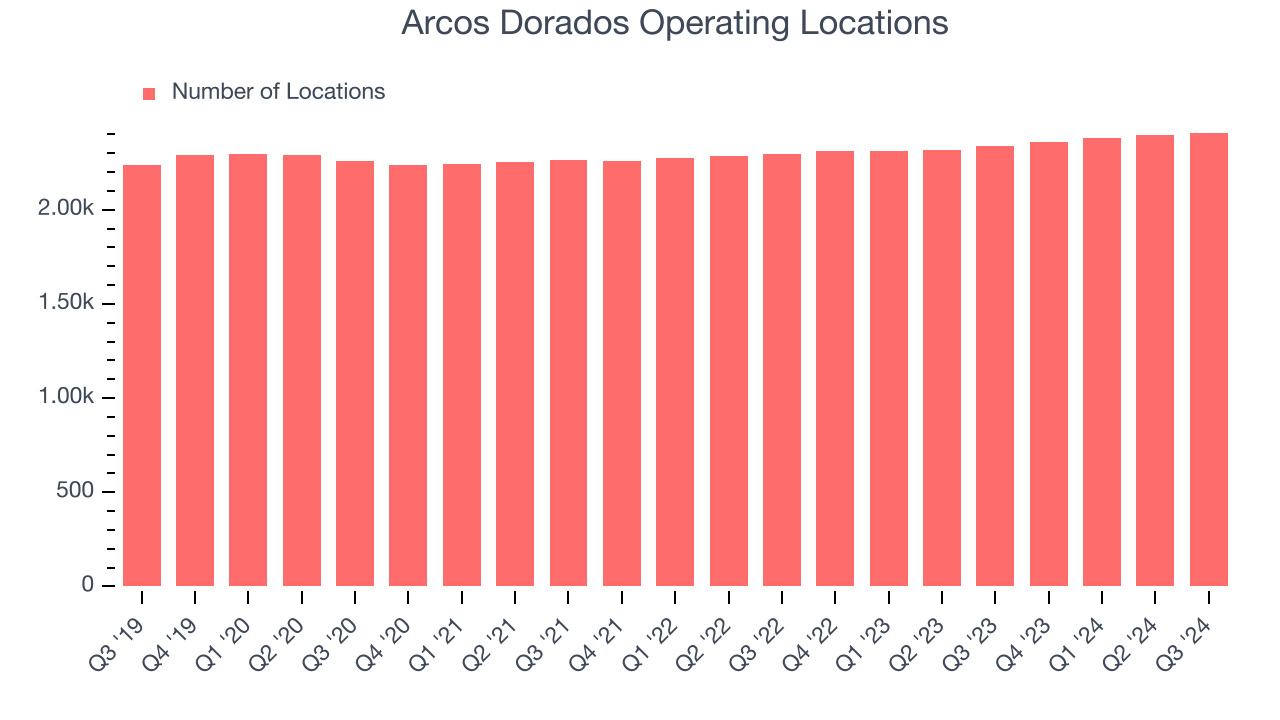

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Arcos Dorados operated 2,410 locations in the latest quarter. It has opened new restaurants quickly over the last two years and averaged 2.3% annual growth, faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

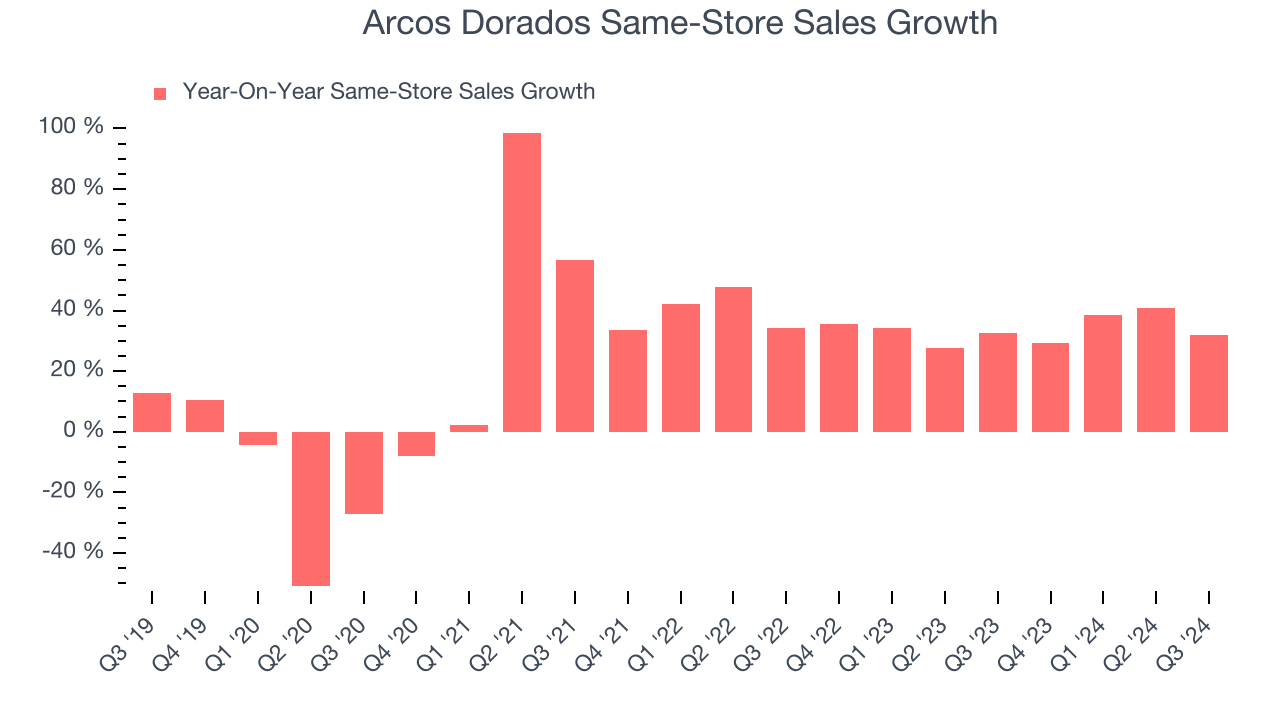

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for restaurants open for at least a year.

Arcos Dorados has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 33.9%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Arcos Dorados multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Arcos Dorados’s same-store sales rose 32.1% annually. This performance was more or less in line with the same quarter last year.

Key Takeaways from Arcos Dorados’s Q3 Results

We were impressed by how significantly Arcos Dorados blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 4% to $8.75 immediately following the results.

Arcos Dorados had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.