Household products company Spectrum Brands (NYSE:SPB) announced better-than-expected revenue in Q3 CY2024, with sales up 4.5% year on year to $773.7 million. Its non-GAAP profit of $0.97 per share was 9.2% below analysts’ consensus estimates.

Is now the time to buy Spectrum Brands? Find out by accessing our full research report, it’s free.

Spectrum Brands (SPB) Q3 CY2024 Highlights:

- Revenue: $773.7 million vs analyst estimates of $747.5 million (3.5% beat)

- Adjusted EPS: $0.97 vs analyst expectations of $1.07 (9.2% miss)

- Adjusted EBITDA: $68.9 million vs analyst estimates of $78.5 million (12.2% miss)

- Gross Margin (GAAP): 37.2%, up from 32.7% in the same quarter last year

- Operating Margin: 2.8%, in line with the same quarter last year

- EBITDA Margin: 8.9%, down from 15.4% in the same quarter last year

- Free Cash Flow was $67.7 million, up from -$528.7 million in the same quarter last year

- Organic Revenue rose 4.8% year on year (-2.7% in the same quarter last year)

- Market Capitalization: $2.63 billion

“The team and I are proud of our fourth quarter and fiscal 2024 results. We exceeded our annual operating plans on virtually every metric and all of our businesses returned to growth in the second half of the year, in spite of the challenging economic and geopolitical conditions that are impacting consumer demand. We achieved over 20% adjusted EBITDA growth for the year despite an incremental $62 million of investments into our brands, demonstrating the high quality of our earnings growth. We upgraded our capabilities in commercial operations, innovation, marketing and advertising. We restored operational momentum to our businesses with best-in class operational efficiency and fill rates in the mid 90% across each of our businesses. We have transformed from a difficult working capital position to a company with best-in-class working capital management capabilities and we have the strongest balance sheet in our peer group, ending fiscal 2024 with net leverage below 0.6 turns,” said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

Company Overview

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Spectrum Brands carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

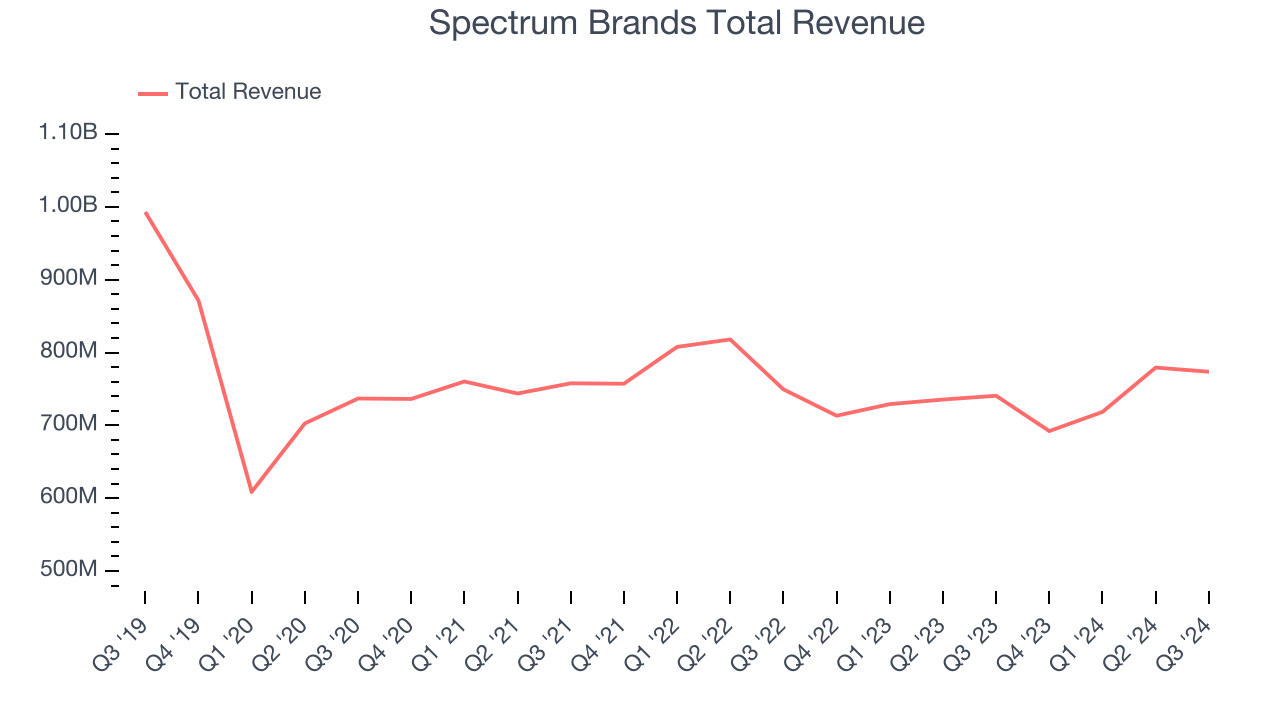

As you can see below, Spectrum Brands struggled to generate demand over the last three years. Its sales were flat, showing demand was soft. This is a poor baseline for our analysis.

This quarter, Spectrum Brands reported modest year-on-year revenue growth of 4.5% but beat Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last three years. While this projection indicates its newer products will catalyze better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

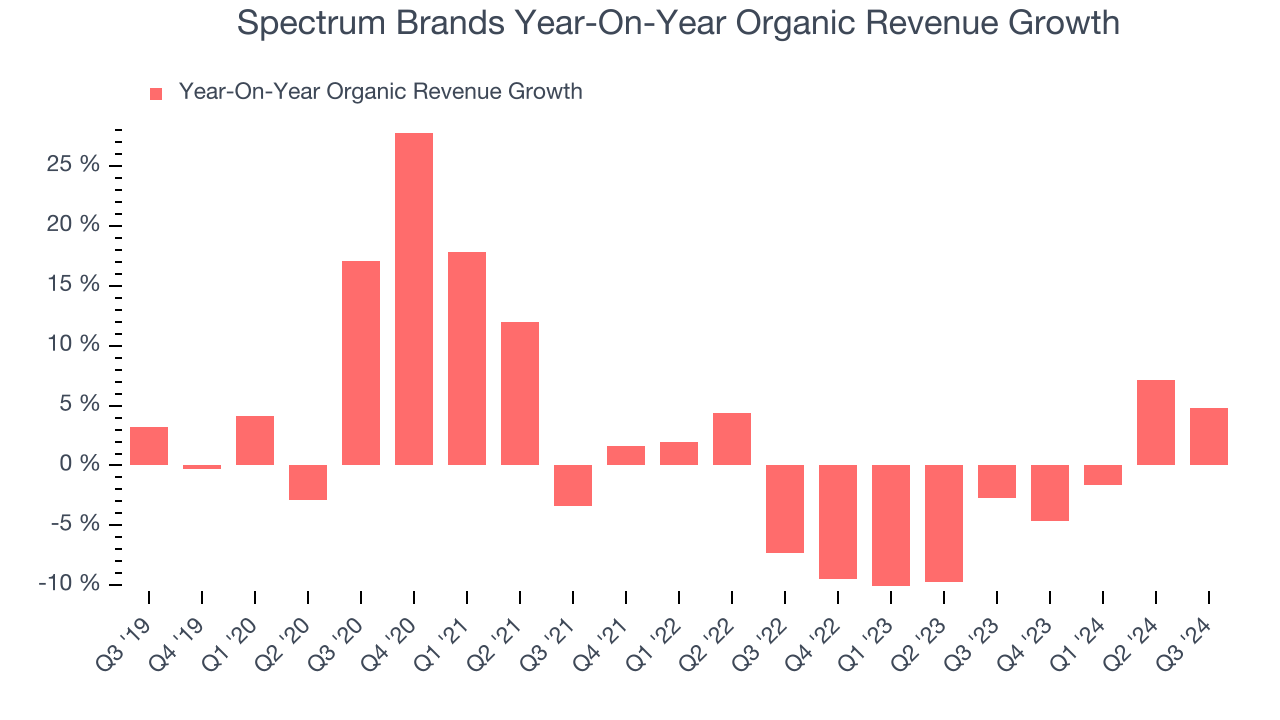

Spectrum Brands’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3.3% year on year.

In the latest quarter, Spectrum Brands’s organic sales rose by 4.8% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Spectrum Brands’s Q3 Results

We enjoyed seeing Spectrum Brands exceed analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $93.28 immediately following the results.

Is Spectrum Brands an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.