Microsoft currently trades at $412.28 per share and has shown little upside over the past six months, posting a small loss of 3.1%. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Given the weaker price action, is now a good time to buy MSFT? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Is Microsoft a Good Business?

Short for microcomputer software, Microsoft (NASDAQ:MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

1. Skyrocketing Revenue Shows Strong Momentum

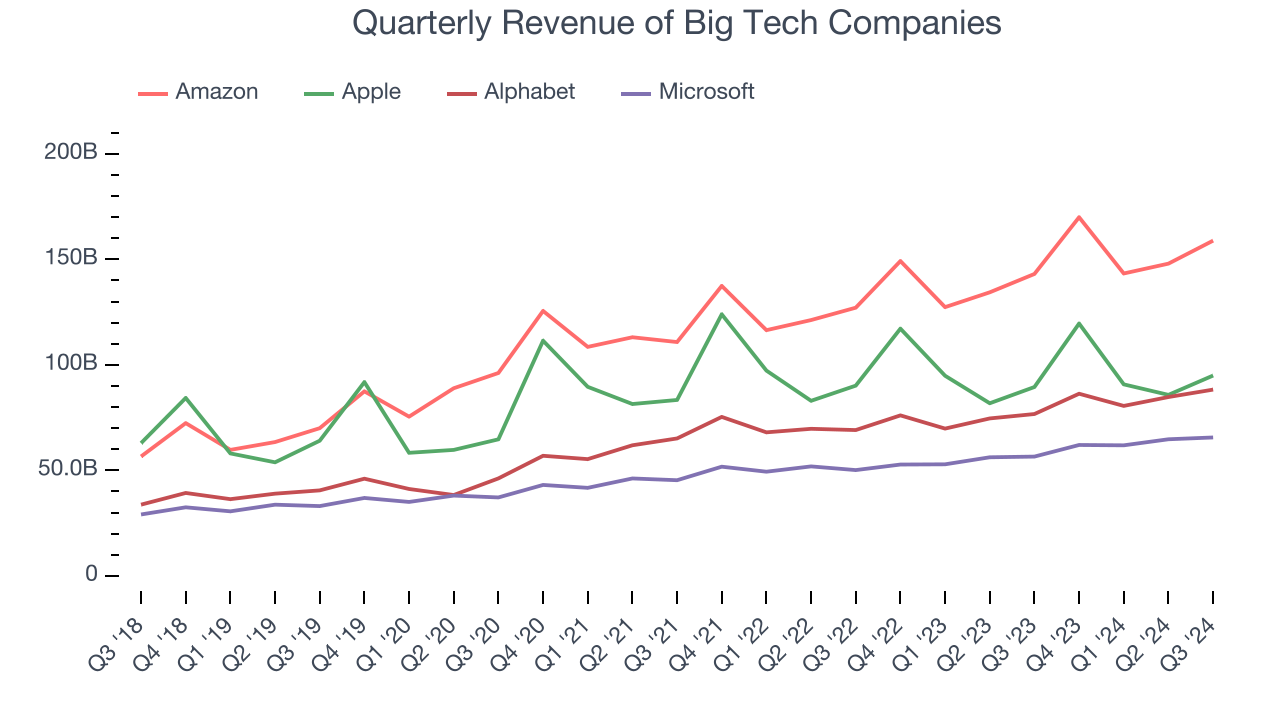

Microsoft shows that fast growth and massive scale can coexist despite the conventional wisdom about the law of large numbers. The company’s revenue base of $129.8 billion five years ago has nearly doubled to $254.2 billion in the last year, translating into an exceptional 14.4% annualized growth rate.

Over the same period, Amazon, Alphabet, and Apple put up revenue growth rates of 18.5%, 17%, and 8.5%, respectively.

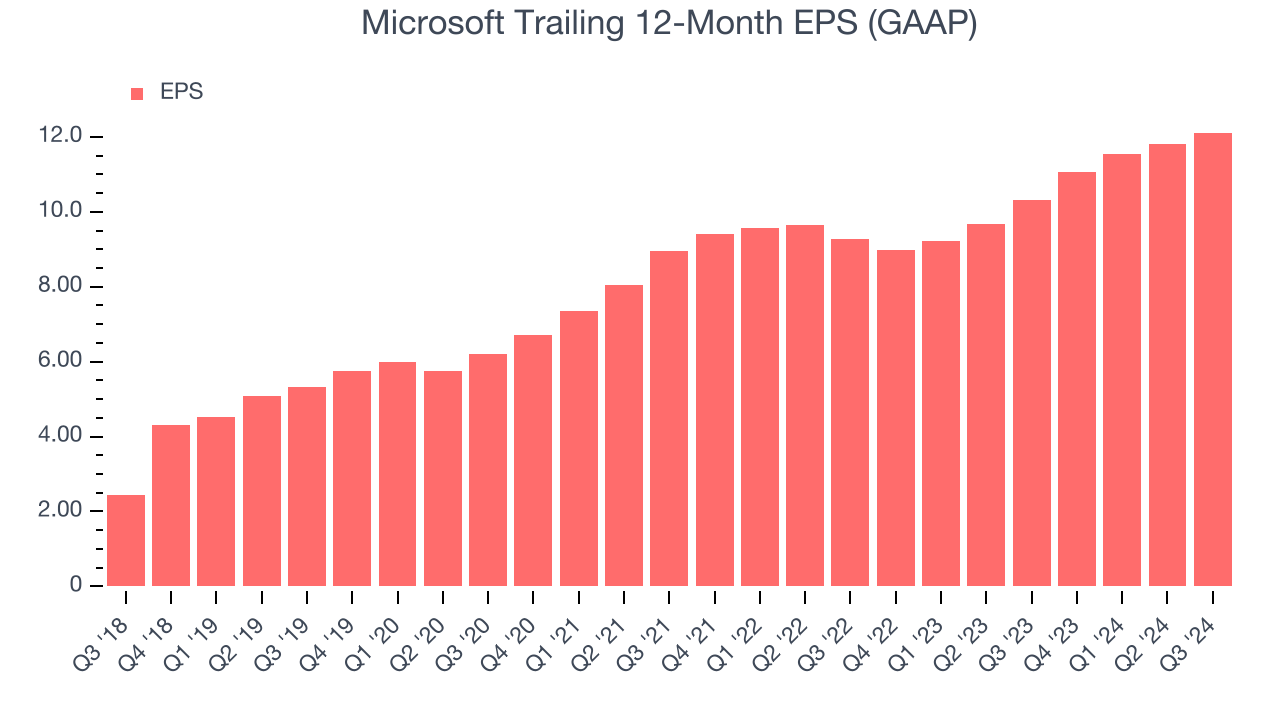

2. Long-Term EPS Growth Is Outstanding

We track the long-term change in earnings per share (EPS) because it shows whether a company’s growth is profitable. It also shows how taxes and interest expenses affect the bottom line.

Microsoft’s EPS grew at an astounding 17.9% compounded annual growth rate over the last five years, higher than its 14.4% annualized revenue growth. This tells us the company became more profitable as it expanded.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Microsoft’s five-year average ROIC was 76.2%, placing it among the best software companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we're bullish on Microsoft. With its shares underperforming the market lately, the stock trades at 30.7x forward price-to-earnings (or $412.28 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Microsoft

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.