As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at waste management stocks, starting with Republic Services (NYSE:RSG).

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 8 waste management stocks we track reported a softer Q3. As a group, revenues missed analysts’ consensus estimates by 2.1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.4% since the latest earnings results.

Republic Services (NYSE:RSG)

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

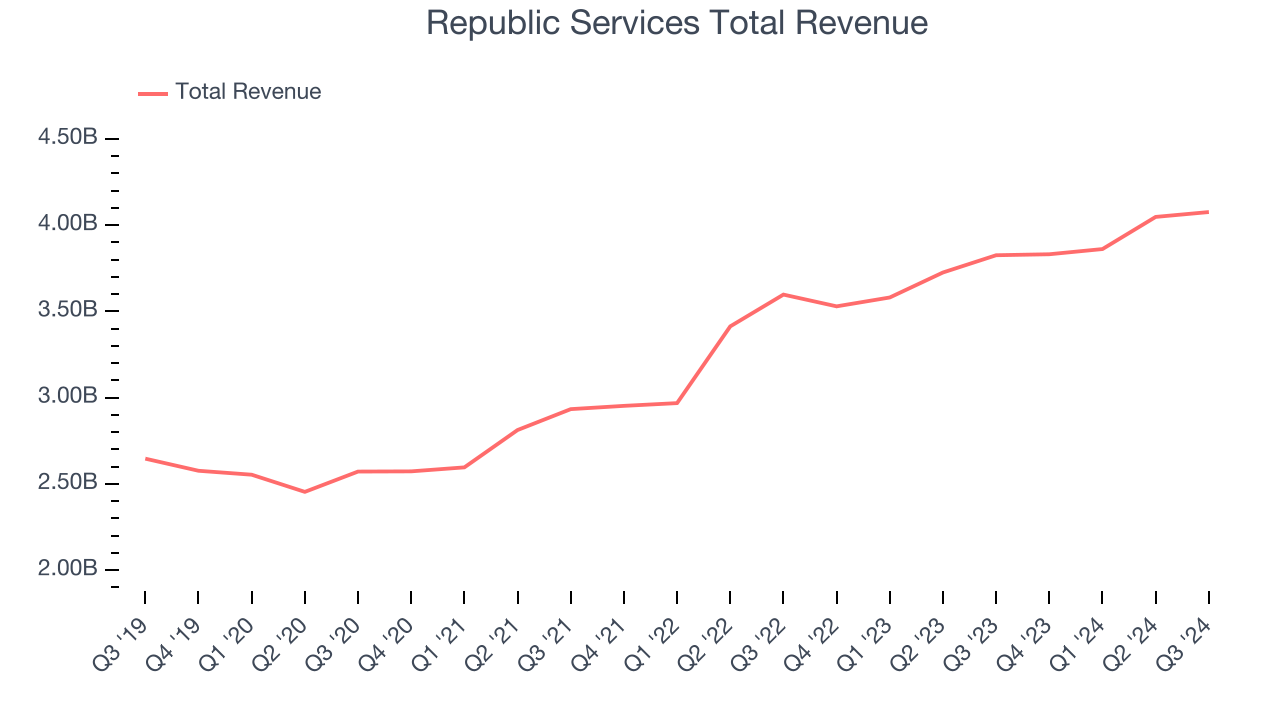

Republic Services reported revenues of $4.08 billion, up 6.5% year on year. This print fell short of analysts’ expectations by 1%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ sales volume estimates.

"Our strong performance during the third quarter is a direct result of executing our strategic priorities," said Jon Vander Ark, president and chief executive officer.

Interestingly, the stock is up 2.9% since reporting and currently trades at $210.19.

Is now the time to buy Republic Services? Access our full analysis of the earnings results here, it’s free.

Best Q3: Waste Management (NYSE:WM)

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $5.61 billion, up 7.9% year on year, outperforming analysts’ expectations by 1.7%. The business had a strong quarter with a decent beat of analysts’ adjusted operating income estimates.

Waste Management scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.1% since reporting. It currently trades at $219.

Is now the time to buy Waste Management? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Quest Resource (NASDAQ:QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $72.77 million, up 3.3% year on year, falling short of analysts’ expectations by 5.6%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 15.7% since the results and currently trades at $6.94.

Read our full analysis of Quest Resource’s results here.

Perma-Fix (NASDAQ:PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $16.81 million, down 23.2% year on year. This result came in 2.3% below analysts' expectations. Overall, it was a disappointing quarter as it also logged a significant miss of analysts’ EBITDA estimates.

Perma-Fix had the slowest revenue growth among its peers. The stock is up 1.1% since reporting and currently trades at $14.84.

Read our full, actionable report on Perma-Fix here, it’s free.

Enviri (NYSE:NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE:NVRI) offers steel and waste handling services.

Enviri reported revenues of $573.6 million, up 9.3% year on year. This result lagged analysts' expectations by 6.5%. It was a disappointing quarter as it also recorded a significant miss of analysts’ EPS estimates.

Enviri had the weakest performance against analyst estimates among its peers. The stock is down 28.1% since reporting and currently trades at $7.22.

Read our full, actionable report on Enviri here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.