Personal care and home fragrance retailer Bath & Body Works (NYSE:BBWI) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 3.1% year on year to $1.61 billion. Next quarter’s revenue guidance of $2.75 billion was slightly above analysts’ estimates of $2.74 billion. Its GAAP profit of $0.49 per share was 6.6% above analysts’ consensus estimates.

Is now the time to buy Bath and Body Works? Find out by accessing our full research report, it’s free.

Bath and Body Works (BBWI) Q3 CY2024 Highlights:

- Revenue: $1.61 billion vs analyst estimates of $1.58 billion (3.1% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.49 vs analyst estimates of $0.46 (6.6% beat)

- Revenue Guidance for Q4 CY2024 is $2.75 billion at the midpoint, above analyst estimates of $2.74 billion

- EPS (GAAP) guidance for Q4 CY2024 is $2.01 at the midpoint, beating analyst estimates by 2.1%

- Operating Margin: 13.5%, in line with the same quarter last year

- Free Cash Flow was -$164 million compared to -$121 million in the same quarter last year

- Locations: 2,395 at quarter end, up from 2,301 in the same quarter last year

- Market Capitalization: $6.73 billion

Gina Boswell, CEO of Bath & Body Works, commented, “Our strong results exceeded the high end of our net sales and earnings per diluted share guidance. As a result, we are raising our full-year guidance to fully reflect this outperformance.”

Company Overview

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Bath and Body Works is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

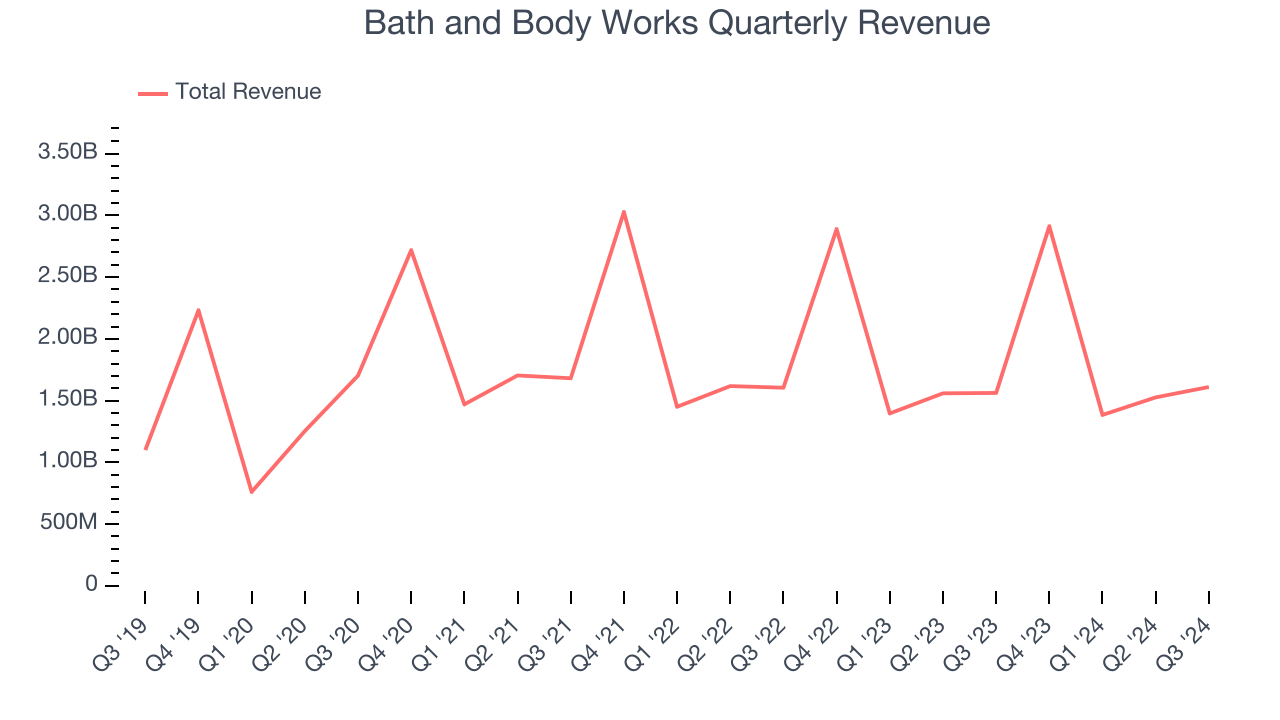

As you can see below, Bath and Body Works’s 7.5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid.

This quarter, Bath and Body Works reported modest year-on-year revenue growth of 3.1% but beat Wall Street’s estimates by 1.9%. Company management is currently guiding for a 49.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last five years. This projection is underwhelming and suggests its products will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

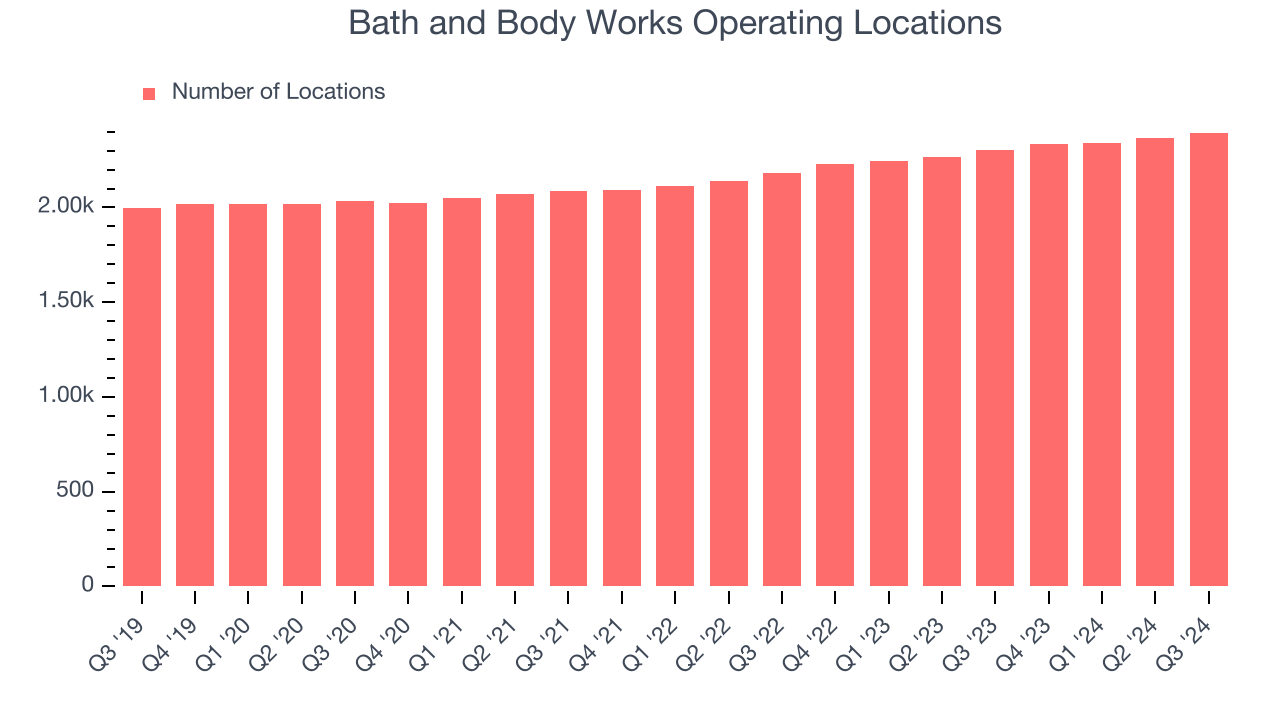

Bath and Body Works sported 2,395 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip and averaged 5.2% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

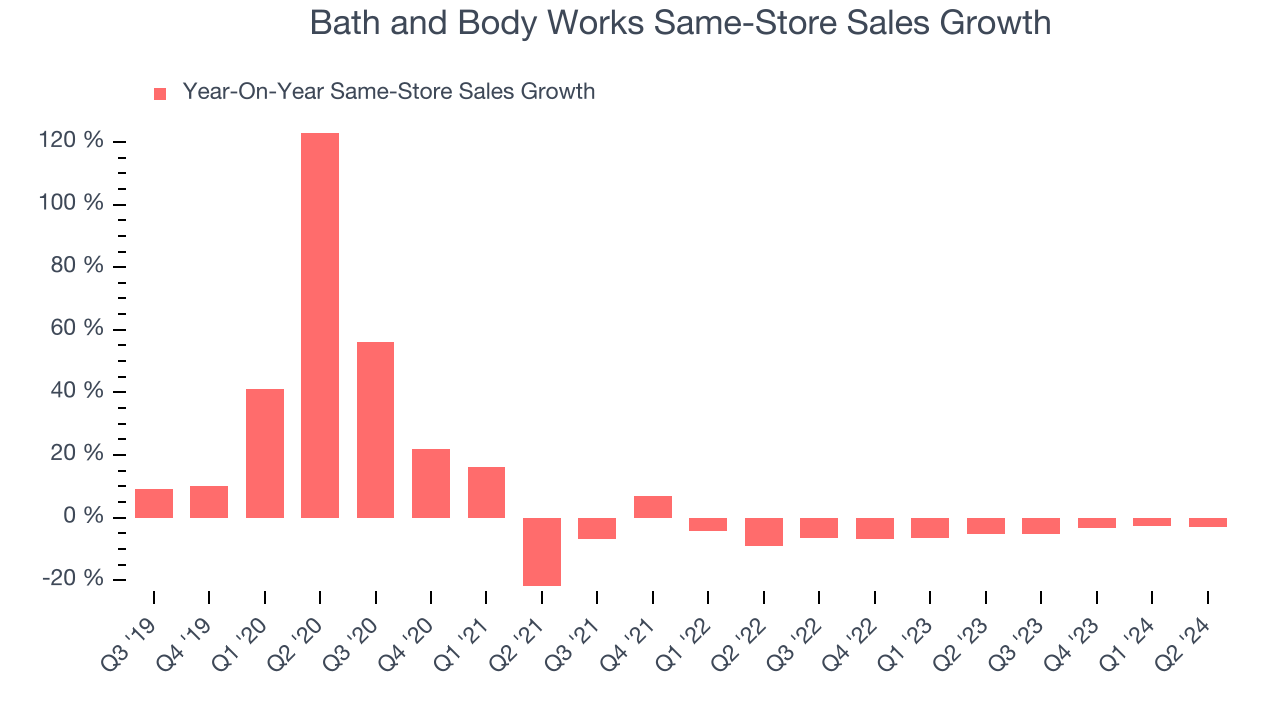

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Bath and Body Works’s demand has been shrinking over the last two years as its same-store sales have averaged 4.7% annual declines. This performance is concerning - it shows Bath and Body Works artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that Bath and Body Works reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Bath and Body Works’s Q3 Results

It was encouraging to see Bath and Body Works beat analysts’ revenue and EPS expectations this quarter. We were also glad it raised its Q4 revenue and EPS guidance. Overall, this was a solid "beat-and-raise" quarter. The stock traded up 10.7% to $34 immediately after reporting.

Big picture, is Bath and Body Works a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.