Let’s dig into the relative performance of WillScot Mobile Mini (NASDAQ:WSC) and its peers as we unravel the now-completed Q3 construction and maintenance services earnings season.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 12 construction and maintenance services stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 1.1%.

Luckily, construction and maintenance services stocks have performed well with share prices up 17.5% on average since the latest earnings results.

WillScot Mobile Mini (NASDAQ:WSC)

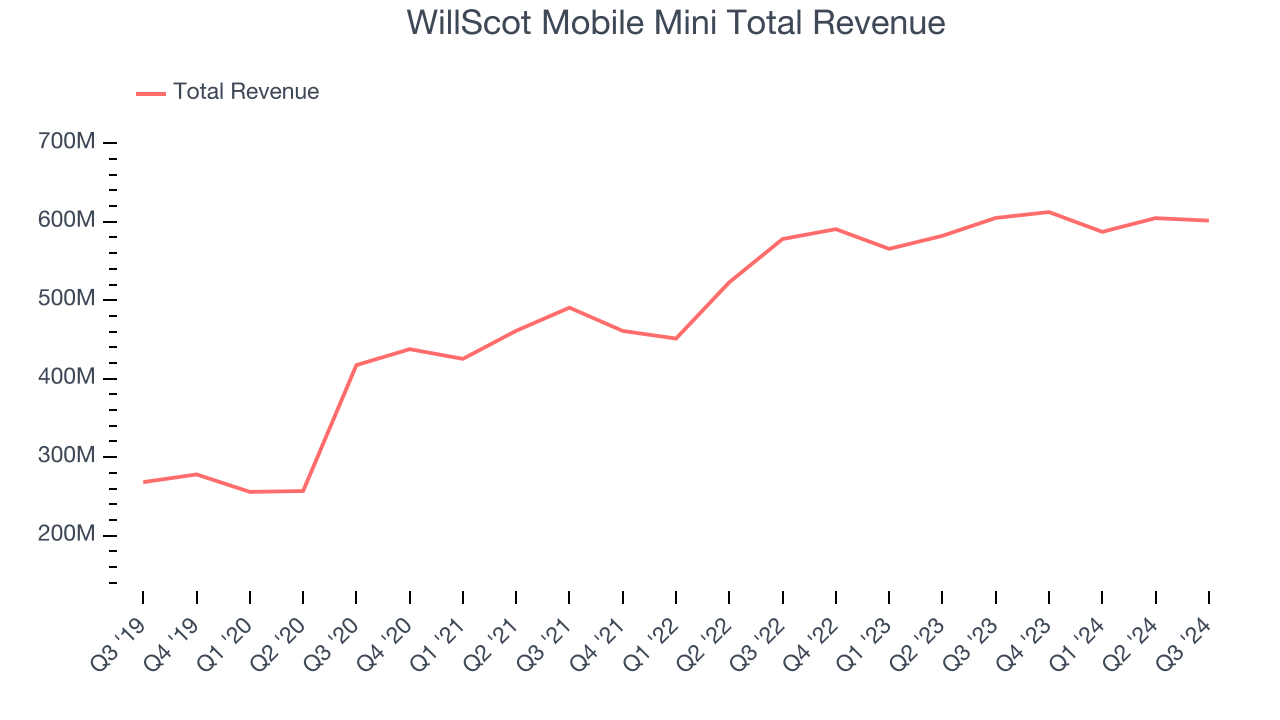

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ:WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

WillScot Mobile Mini reported revenues of $601.4 million, flat year on year. This print fell short of analysts’ expectations by 2.6%. Overall, it was a disappointing quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

Brad Soultz, Chief Executive Officer of WillScot, commented, “Our team continued to execute well in Q3, delivering record third quarter Adjusted EBITDA Margins, with Adjusted Free Cash Flow and Return on Invested Capital also near record levels."

WillScot Mobile Mini delivered the weakest full-year guidance update of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $38.52.

Is now the time to buy WillScot Mobile Mini? Access our full analysis of the earnings results here, it’s free.

Best Q3: Limbach (NASDAQ:LMB)

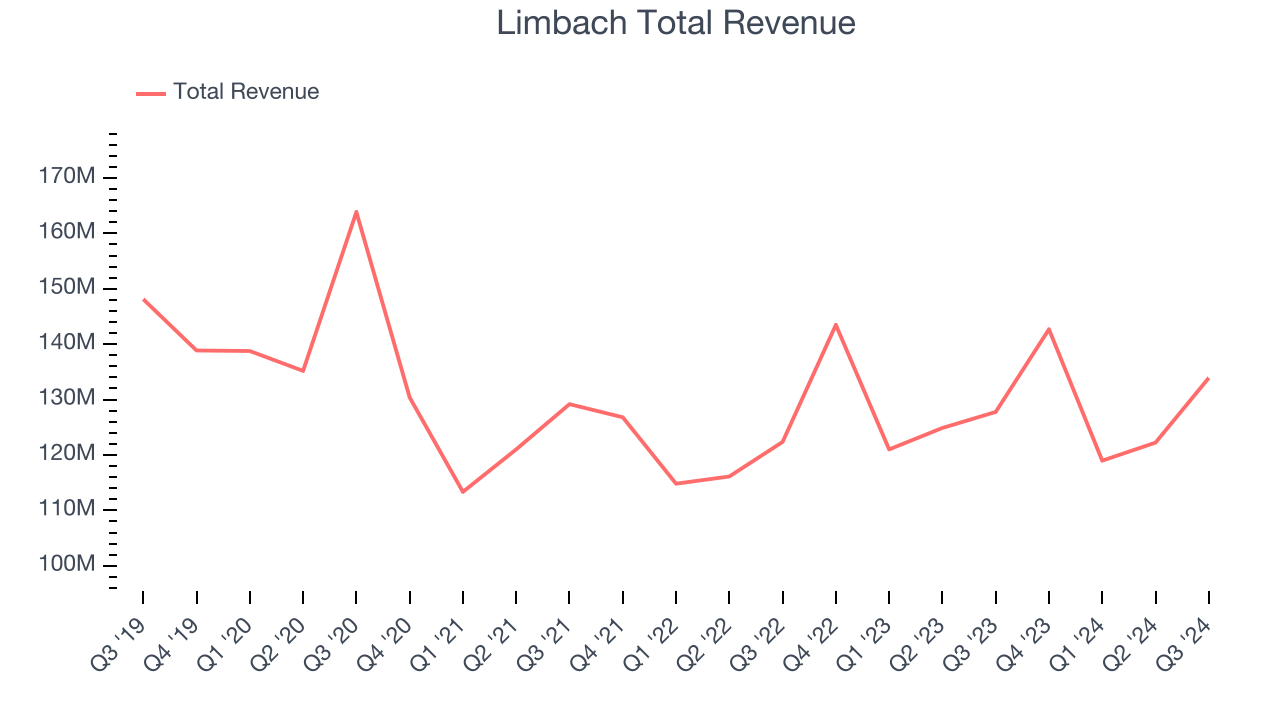

Established in 1901, Limbach (NASDAQ: LMB) provides integrated building systems solutions, including mechanical, electrical, and plumbing services.

Limbach reported revenues of $133.9 million, up 4.8% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with a solid beat of analysts’ EPS and EBITDA estimates.

Limbach achieved the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 31.9% since reporting. It currently trades at $102.88.

Is now the time to buy Limbach? Access our full analysis of the earnings results here, it’s free.

Tutor Perini (NYSE:TPC)

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

Tutor Perini reported revenues of $1.08 billion, up 2.1% year on year, falling short of analysts’ expectations by 7.2%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Tutor Perini delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.6% since the results and currently trades at $28.57.

Read our full analysis of Tutor Perini’s results here.

Granite Construction (NYSE:GVA)

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE:GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

Granite Construction reported revenues of $1.28 billion, up 14.2% year on year. This print came in 0.9% below analysts' expectations. It was a disappointing quarter as it also produced a significant miss of analysts’ adjusted operating income estimates.

The stock is up 20.8% since reporting and currently trades at $99.10.

Read our full, actionable report on Granite Construction here, it’s free.

Great Lakes Dredge & Dock (NASDAQ:GLDD)

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $191.2 million, up 63.1% year on year. This result topped analysts’ expectations by 3.5%. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ EBITDA and EPS estimates.

Great Lakes Dredge & Dock delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 7.8% since reporting and currently trades at $12.52.

Read our full, actionable report on Great Lakes Dredge & Dock here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.