3D measurement and imaging company FARO (NASDAQ:FARO) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell 4.9% year on year to $82.56 million. The company expects next quarter’s revenue to be around $92 million, close to analysts’ estimates. Its GAAP loss of $0.02 per share was also 93% above analysts’ consensus estimates.

Is now the time to buy FARO? Find out by accessing our full research report, it’s free.

FARO (FARO) Q3 CY2024 Highlights:

- Revenue: $82.56 million vs analyst estimates of $78.97 million (4.5% beat)

- EPS: -$0.02 vs analyst estimates of -$0.29 ($0.26 beat)

- EBITDA: $8.85 million vs analyst estimates of $4.82 million (83.6% beat)

- Revenue Guidance for Q4 CY2024 is $92 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 55.7%, up from 48% in the same quarter last year

- Operating Margin: 2.6%, up from -5.2% in the same quarter last year

- EBITDA Margin: 10.7%, up from 3.5% in the same quarter last year

- Free Cash Flow was $697,000, up from -$5.08 million in the same quarter last year

- Market Capitalization: $354.3 million

"I am proud of our ongoing progress in profitability, achieving 55.7% gross margins, GAAP net loss of $0.3 million and $8.9 million of adjusted EBITDA, or 10.7% of revenue, all exceeding our expectations for the third quarter. This marks a significant transformation in our operations over the past year, as its the first time that we have delivered back-to-back double-digit quarterly adjusted EBITDA margins in almost a decade," said Peter Lau, President & Chief Executive Officer.

Company Overview

Launched by two PhD students in a garage, FARO (NASDAQ:FARO) provides 3D measurement and imaging systems for the manufacturing, construction, engineering, and public safety industries.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

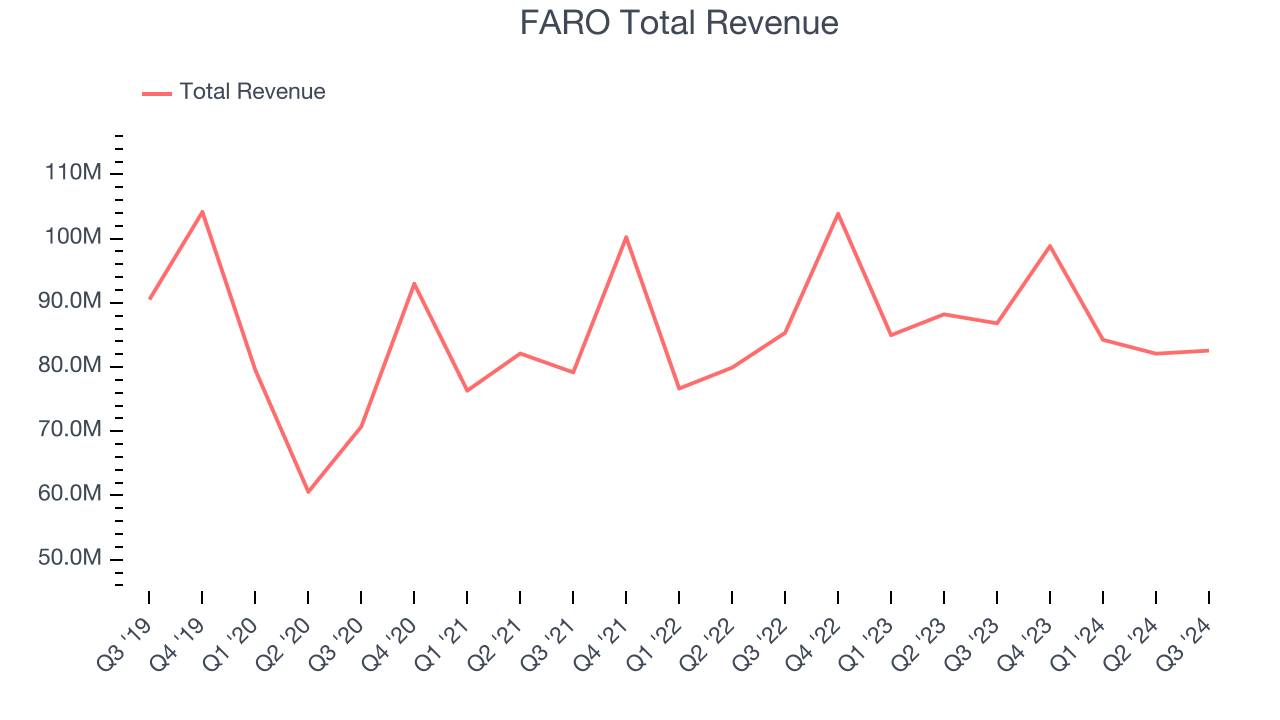

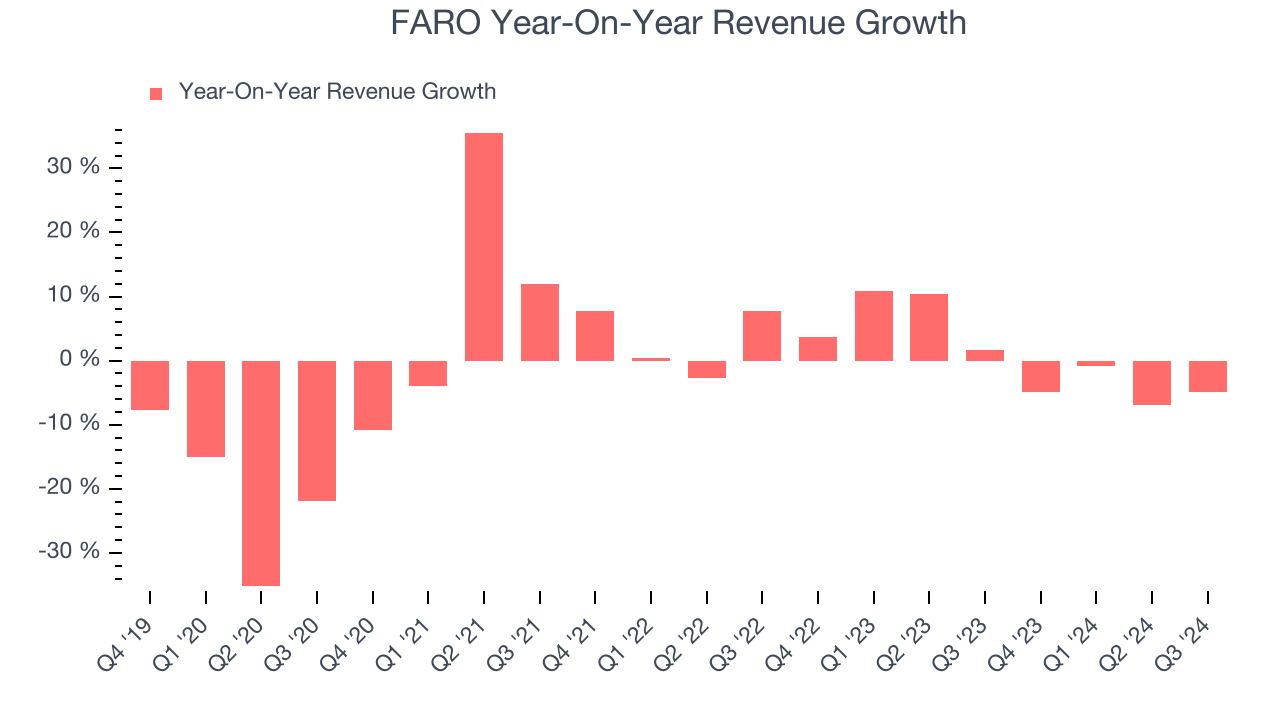

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. FARO struggled to generate demand over the last five years as its sales dropped by 2.3% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. FARO’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop in sales.

This quarter, FARO’s revenue fell 4.9% year on year to $82.56 million but beat Wall Street’s estimates by 4.5%. Management is currently guiding for a 6.9% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and shows the market believes its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

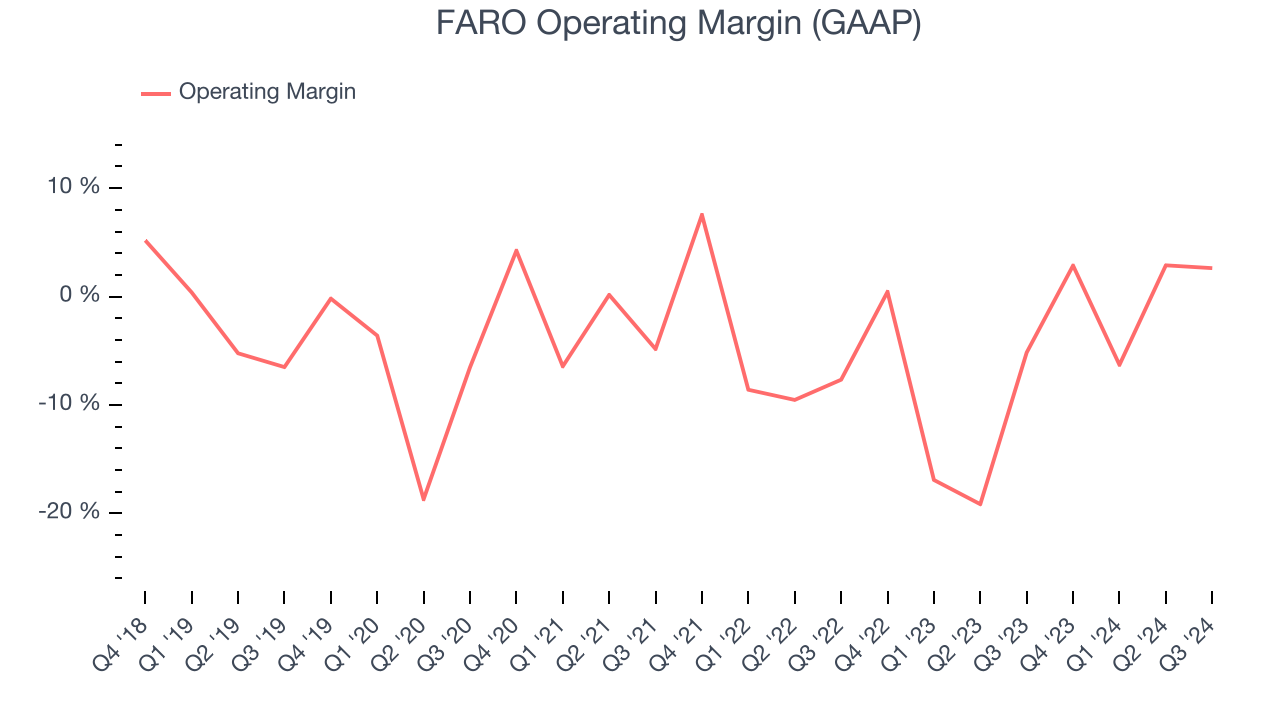

Operating Margin

Although FARO was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 4.1% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, FARO’s annual operating margin rose by 6.6 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

This quarter, FARO generated an operating profit margin of 2.6%, up 7.8 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

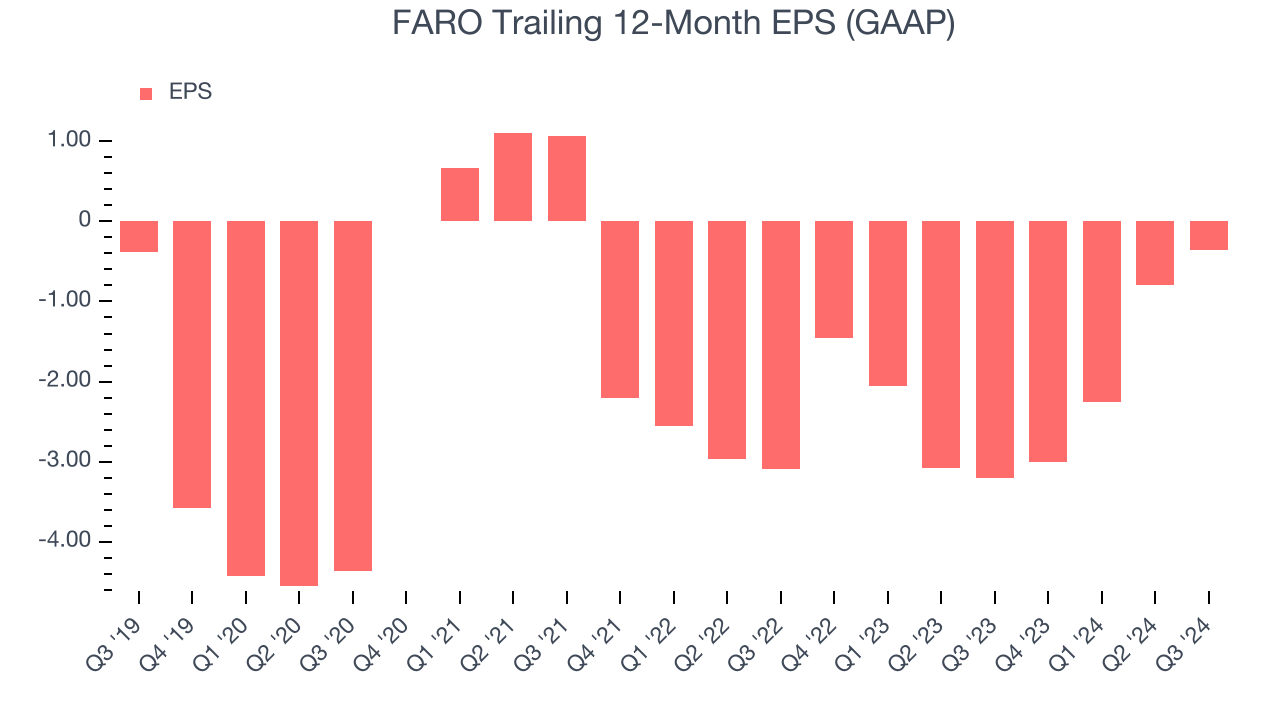

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although FARO’s full-year earnings are still negative, it reduced its losses and improved its EPS by 1.8% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For FARO, its two-year annual EPS growth of 66.2% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, FARO reported EPS at negative $0.02, up from negative $0.46 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FARO to perform poorly. Analysts forecast its full-year EPS of negative $0.35 will tumble to negative $0.52.

Key Takeaways from FARO’s Q3 Results

We were impressed by how significantly FARO blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $18.83 immediately following the results.

FARO put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.