Over the past six months, Concrete Pumping’s shares (currently trading at $6.58) have posted a disappointing 11.3% loss, well below the S&P 500’s 14% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Concrete Pumping, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why you should be careful with BBCP and a stock we'd rather own.

Why Is Concrete Pumping Not Exciting?

Going public via SPAC in 2018, Concrete Pumping (NASDAQ:BBCP) is a provider of concrete pumping and waste management services in the United States and the United Kingdom.

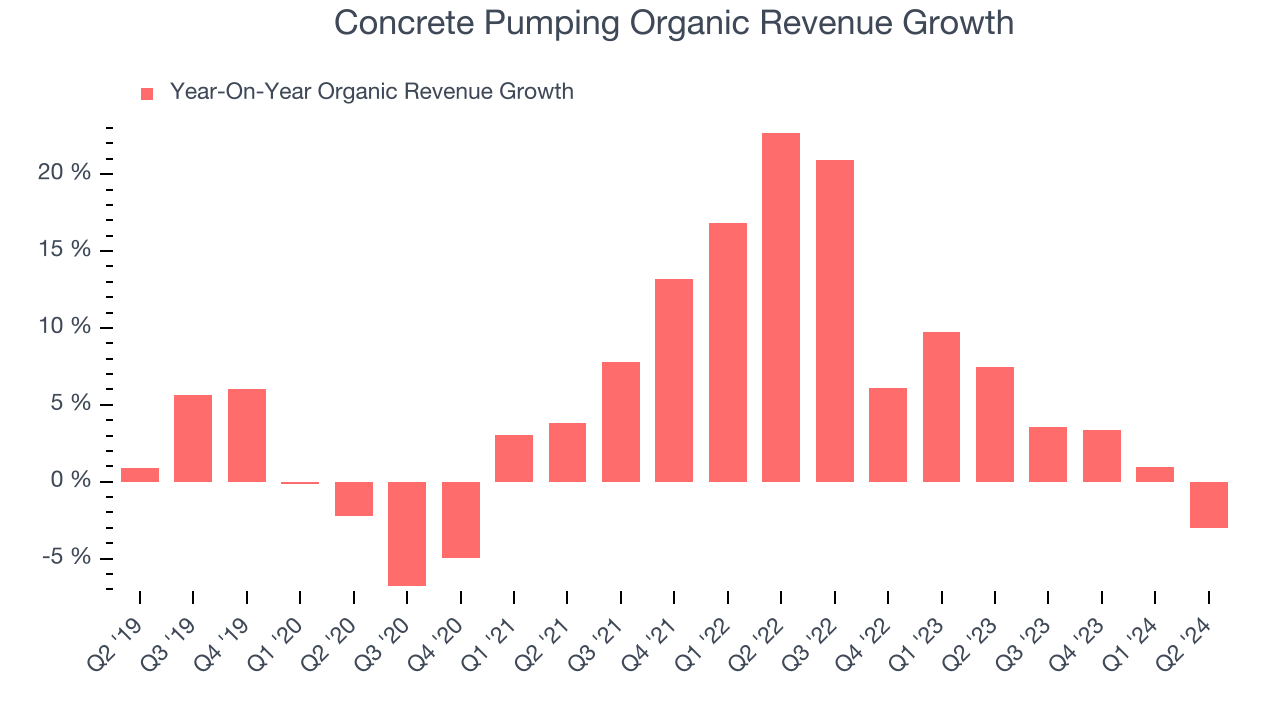

1. Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Construction and Maintenance Services companies by analyzing their organic revenue. This metric gives visibility into Concrete Pumping’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Concrete Pumping’s organic revenue averaged 6.1% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

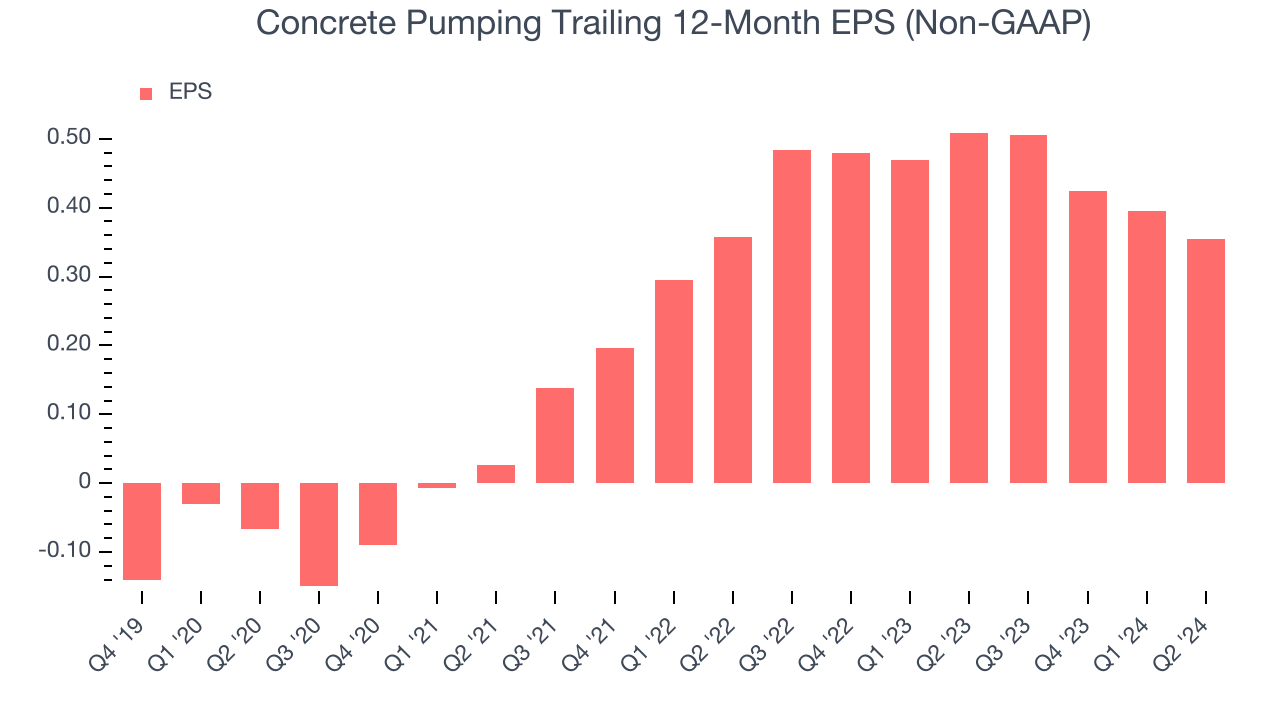

2. EPS Growth Has Stalled Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Concrete Pumping’s flat EPS over the last two years was worse than its 7.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

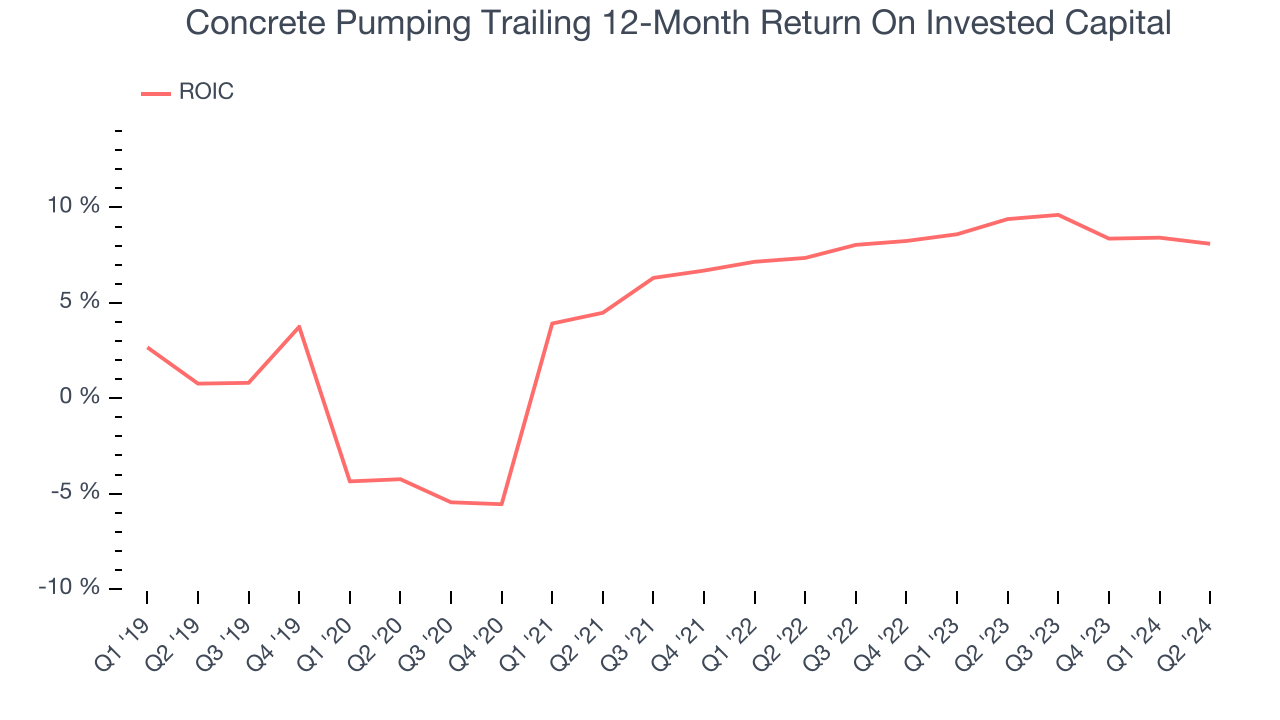

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Concrete Pumping’s five-year average ROIC was 5%, somewhat low compared to the best industrials companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job investing in profitable growth initiatives.

Final Judgment

Concrete Pumping isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 10.1x forward price-to-earnings (or $6.58 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d recommend looking at Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Like More Than Concrete Pumping

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.