As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the aerospace industry, including Astronics (NASDAQ:ATRO) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 14 aerospace stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 2% above.

In light of this news, share prices of the companies have held steady as they are up 3.5% on average since the latest earnings results.

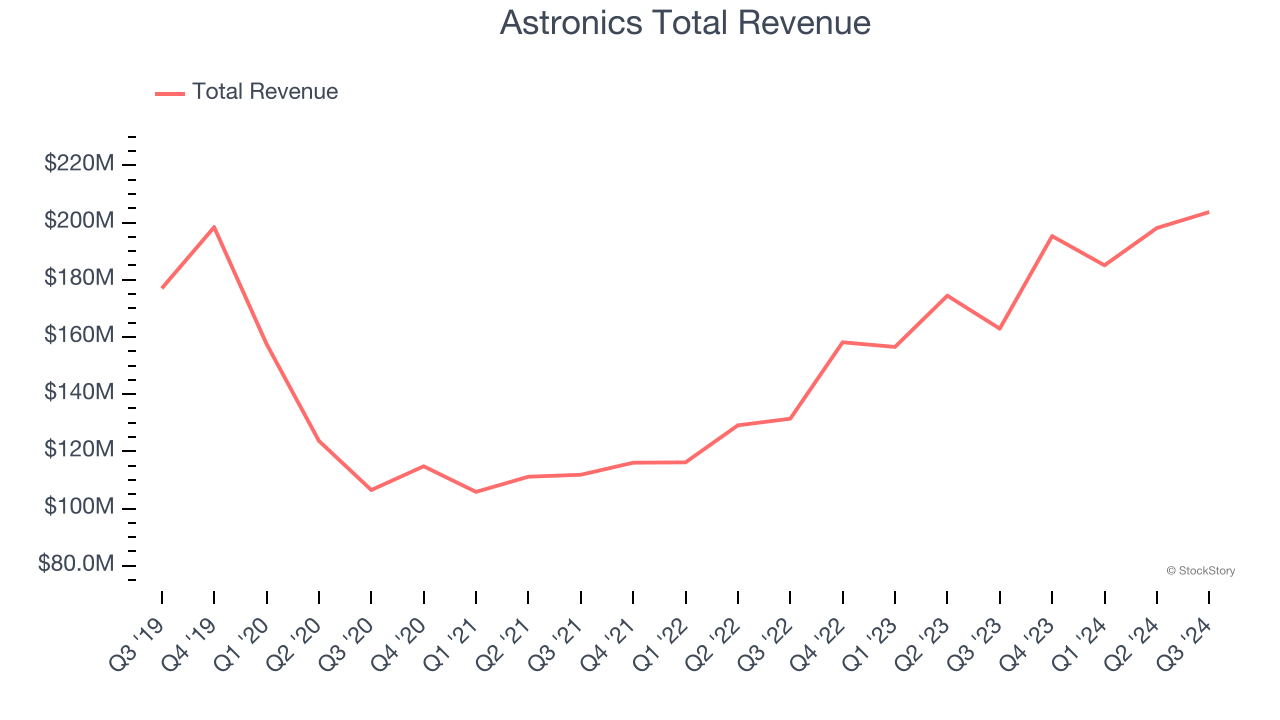

Astronics (NASDAQ:ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $203.7 million, up 25% year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Peter J. Gundermann, Chairman, President and Chief Executive Officer, commented, “We delivered a solid third quarter operationally. Revenue was at the high end of our range, up 25% over the comparator quarter. Adjusted EBITDA was $27.1 million for the quarter and $91 million for the trailing twelve months. Operating margins improved from both volume and the initiatives we have executed to drive profitability. Our Aerospace segment adjusted operating margin was 14.2%. We are clearly making progress towards our operational goals, though our results include the impact of expenses related to our July refinancing, a customer bankruptcy and a warranty reserve. All in all, we feel it was another quarter of progress as we continue to recover from the disruption of the past few years.”

Unsurprisingly, the stock is down 19.1% since reporting and currently trades at $16.65.

Is now the time to buy Astronics? Access our full analysis of the earnings results here, it’s free.

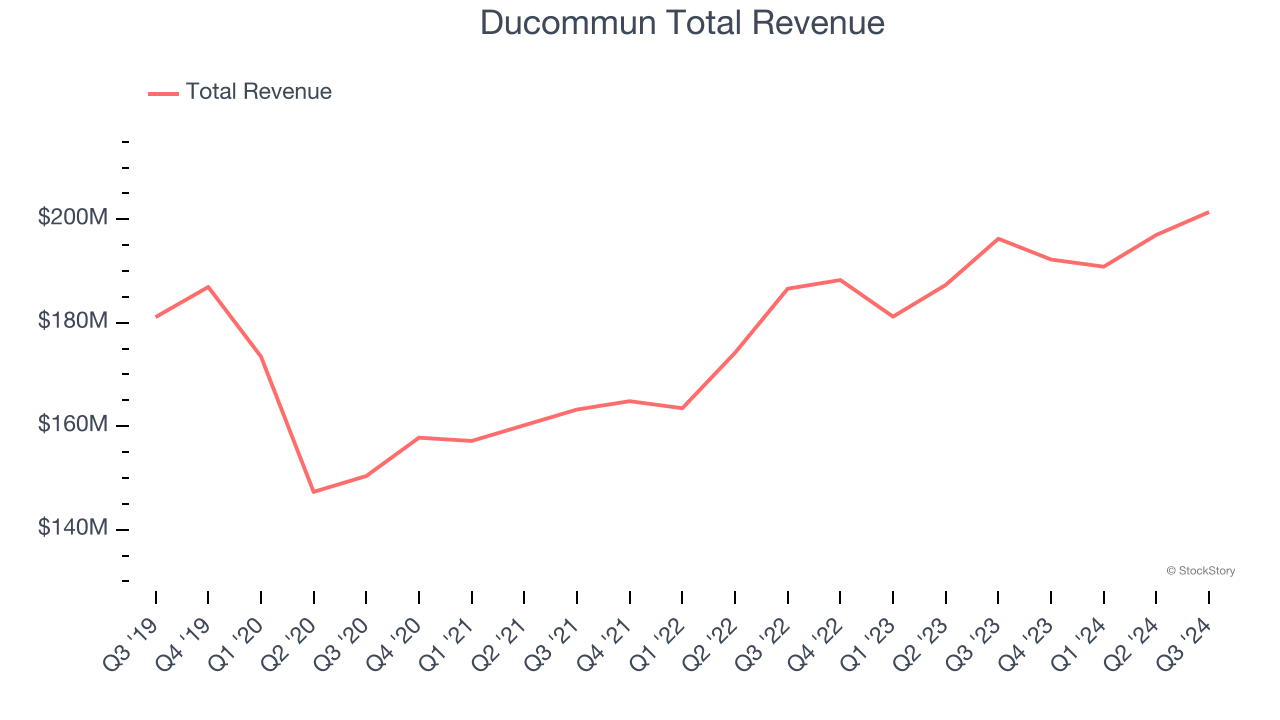

Best Q3: Ducommun (NYSE:DCO)

California’s oldest company, Ducommun (NYSE:DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

Ducommun reported revenues of $201.4 million, up 2.6% year on year, outperforming analysts’ expectations by 3.8%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.3% since reporting. It currently trades at $61.22.

Is now the time to buy Ducommun? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.43 billion, up 2.5% year on year, falling short of analysts’ expectations by 2.7%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 11.4% since the results and currently trades at $76.96.

Read our full analysis of Textron’s results here.

Hexcel (NYSE:HXL)

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE:HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

Hexcel reported revenues of $456.5 million, up 8.8% year on year. This number missed analysts’ expectations by 1%. Overall, it was a slower quarter as it also produced a significant miss of analysts’ adjusted operating income estimates.

Hexcel achieved the highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $63.60.

Read our full, actionable report on Hexcel here, it’s free.

AerSale (NASDAQ:ASLE)

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ:ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale reported revenues of $82.68 million, down 10.6% year on year. This result lagged analysts' expectations by 11.1%. It was a softer quarter as it also produced a significant miss of analysts’ adjusted operating income and EPS estimates.

AerSale had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 4.2% since reporting and currently trades at $6.15.

Read our full, actionable report on AerSale here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.