(Please enjoy this updated version of my weekly commentary published March 10th, 2022 from the POWR Stocks Under $10 newsletter).

First, let’s review the past week…

Over this past week, the S&P 500 is down by 2.4%. Two Thursdays ago, we had a powerful reversal following Russia’s invasion of Ukraine.

There was some hope that this could mark a bottom and that stocks would turn higher. Of course, the implicit part of this argument is that the news flow would be positive or at least not deteriorate further.

Not surprisingly, these hopes were dashed as we gradually leaked lower and gave up the bulk of these gains with many stocks making new lows. Not surprisingly, the news flow remains precarious.

Both sides are dug in and unlikely to compromise. The secondary effects of rising energy and food prices are a negative for stocks and the economy and also could create cascading, tertiary effects like an even more hawkish Fed, a decline in discretionary spending, or political instability in other parts of the world which does seem to follow inflationary spirals.

Then, there is the simple fact that the world is a much more dangerous place today than 3 months ago. This certainly weighs on risk appetites and dents demand for stocks.

Green Shoots

Now, that we’ve laid out the brutal and unpleasant reality of the current situation, let’s talk about the ‘green shoots’.

These are the small positives that I am seeing at the moment. We’ve been noting and accounting them on a weekly basis throughout this correction.

On their own, none of these developments are going to reverse the market’s bearish trend. But, cumulatively, they can start to matter.

And, I think we’re starting to see some impact. Despite the scary headlines and volatility, the market has actually been going more sideways than down. Yes, we’ve had some scary lurches lower under the 4,200 level on the S&P 500, but we’ve found support at these levels.

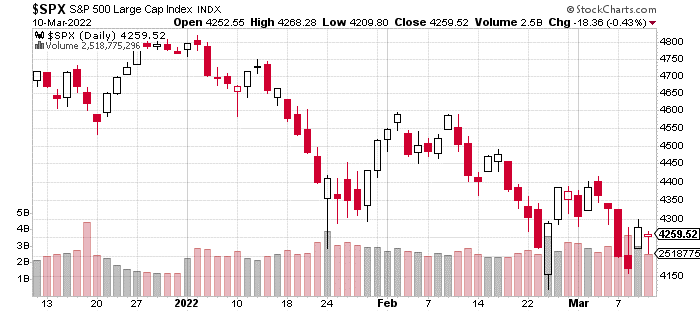

Take a look at the daily, 3-month chart of the S&P 500 below:

Since the initial drop in late January, there has been so much bad news in terms of geopolitical risk, the Fed tightening, inflation, and a fattening of tail risks.

The market has absorbed all of this bad news and is above January’s low. I, see this as a positive, in a way.

It’s like when a football team throws multiple interceptions, loses a fumble, and gives up a special teams TD but somehow going into halftime, is only down by 10 points.

There’s hope that if the team can play better, it can get back into the game. And, the team is likely to play better given how bad the first half was, while the other team may be due for some miscues of its own.

Some of the other positives that we have covered in previous commentaries: Q4 earnings season that was better than expected, coronavirus case counts continue to plunge, and the market is pricing in 7 rate hikes in 2022.

To sum it up, the stock market is a discounting machine. And, it’s discounted a lot of risk and negativity over the past couple of months.

I like the risk/reward of being aggressively long against the 4,200 level and being cautiously long against the Feb 24 low of 4,100.

Rebalancing Strategy

Yesterday’s trade was about what was discussed above. I see us getting closer to a more, normal trading environment, and I want the portfolio to reflect that.

Further, due to the gains in our portfolio and an overweight position, energy was getting close to a 35% weight. Now, we are at a 15% weight which is much healthier and allows us to peel off some profits.

Over the intermediate-term and longer-term, I think oil goes much higher. In the short-term, I have less conviction.

There’s also the fact that many high-quality stocks are down between 25 to 50% during this market correction, so we decreased our cash position from 24% to 19.5% in addition to plowing some of our energy profits into these opportunities.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low priced companies with explosive growth potential.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead.

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares were trading at $425.45 per share on Friday morning, down $0.03 (-0.01%). Year-to-date, SPY has declined -10.42%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Why Low-Priced Stocks Could Be Your Best Bet in Today’s Market appeared first on StockNews.com