The stock market is one of the greatest known tools used to build wealth.

But not if you’re following bad stock advice.

Choosing the right investments can be hard. In addition to needing the expertise to understand the market, it can be time-consuming to peel through earnings reports and financial statements.

That’s where the best stock-picking services come in.

Like investing in stocks, investing in a high-quality newsletter or platform is critical to building wealth.

So how can you find the best stock recommendation service? Who has the best stock picking record? Ask yourself these questions before paying for a subscription:

- How trustworthy is it?

- Do they have a proven track record?

- How affordable is it?

Using these 3 criteria as a guide, let’s talk about some of the best stock picking services in 2024.

But before we get started, a quick note…

Many stock-picking services have both a free and paid membership option. Often, the paid portion takes a deeper dive into analyst research and recommendations. While many free services offer solid advice and recommendations, this list primarily focuses on premium options (considering annual costs).

Now, let’s take a look at our list of best stock picking services.

What’s the Best Stock Picking Service?Looking for the best stock recommendation service? There’s something for everyone out there. Here are 5 of the best stock picking services in 2024:

1. StockNews

Source: StockNews

StockNews has a simple goal: “To help investors enjoy more investment success.” The service works toward this goal in two primary ways that (in our biased opinion) warrant a spot on this best stock picking service list:

- A proprietary ratings system. The POWR ratings system is StockNews’ own system, which analyzes stocks based on 118 different points, then issues a grade from A to F. An “A” stock is a Strong Buy, based on having enjoyed an average annual return of 30.72% or more since 1999.

- Commentary from an expert trader. Steve Reitmeister has over 40 years of investing experience — notably including about 20 years leading Zacks.com (which is also on this list of the best stock picking services). He’s a master of whittling down commentary to the essentials so that you can easily understand.

Reitmeister shares his commentary and hand-selected stock picks via one of StockNews’ services, Reitmeister Total Return portfolio.

That’s just one of StockNews’ many offerings — the site currently offers several different stock picking and stock recommendation services, including POWR Stocks Under $10, which focuses on small-cap stocks, POWR Value, which focuses on value stocks, and POWR Income Insider, which focuses on growth and income investing.

If you’re not sure where to start, you can begin by subscribing to StockNews’ free newsletter.

Is it trustworthy? YES. With an experienced investor with 4 decades of market experience at the helm of StockNews, you’ll gain a lot of invaluable market insight from this service.

Track Record: Various services have different track records. For instance, the POWR Stocks Under $10 service boasts an average annual returns of 57.82% for its picks.

Cost: Most of the plans cost $66.42 per month with the 1-year plan. However, you can also opt for a 30-day trial for just $1.

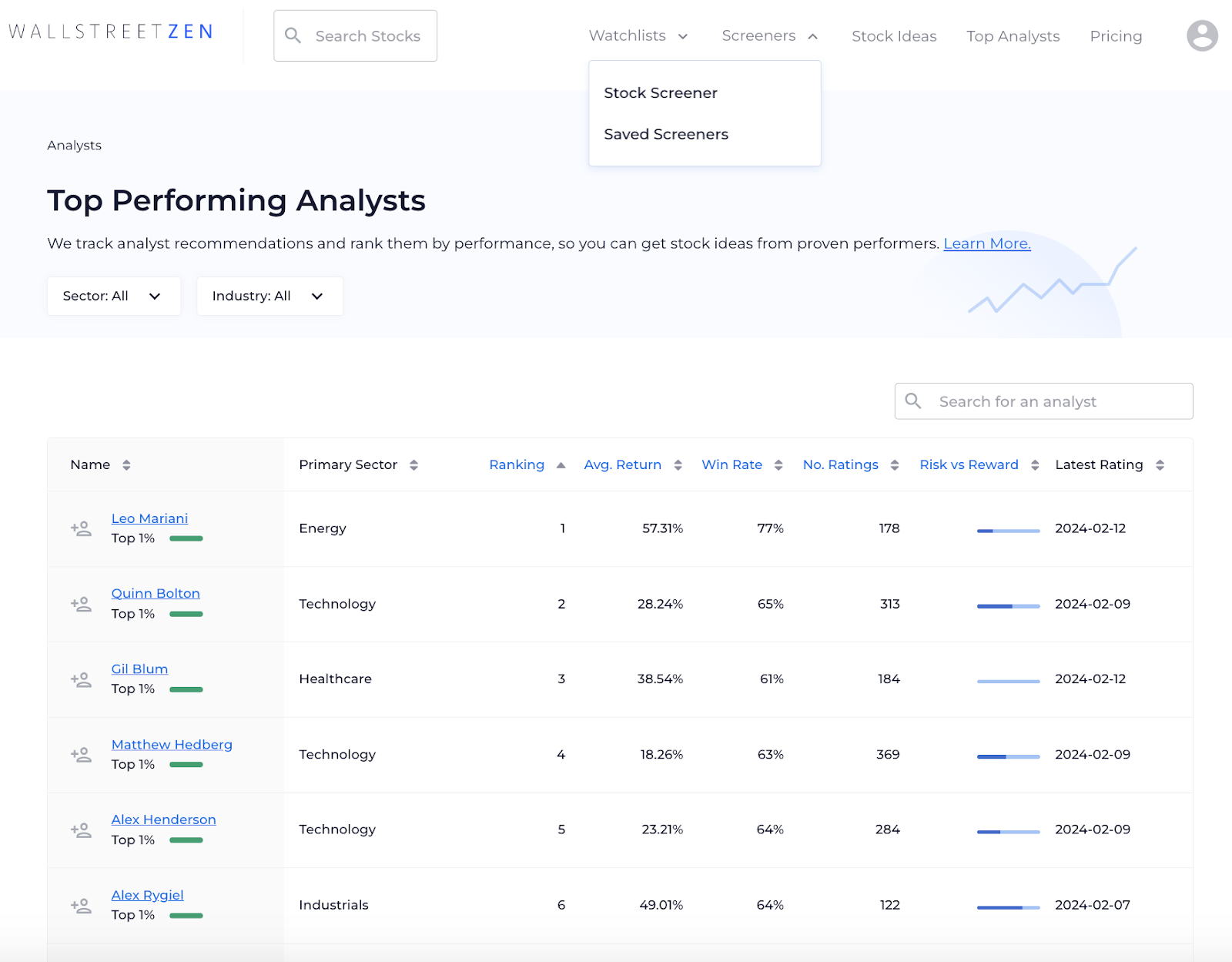

What makes WallStreetZen one of the best stock picking service providers?

Let’s start with the site’s most popular page — WallStreetZen’s Top Analysts. Here’s why it’s so popular:

(Source: WallStreetZen)

WallStreetZen compiles data from over 4,000 Wall Street analysts. They backtest their performance over several years. They use this information to rank analysts based on number of ratings, average return and win rate. That means you can rest assured you’re following proven winners.

The bottom line is, the best person to follow for stock advice is the one who is consistently picking winners.

Plus, this analyst research is found throughout the site:

- On the Top Analysts page…

- On the Forecast page for individual stocks…

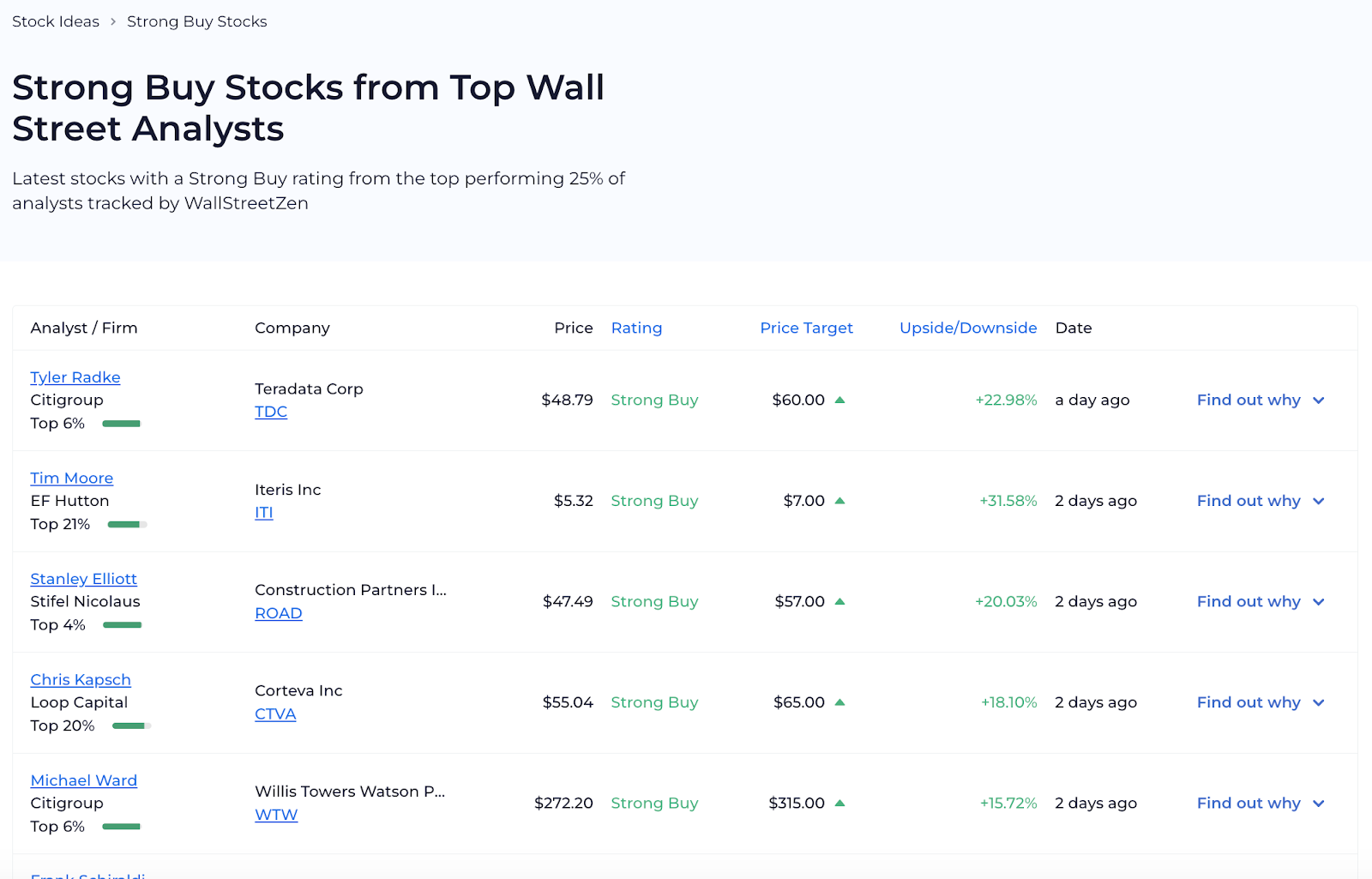

- And on a constantly-updated list of “Strong Buy” stock picks from the Top 25% Analysts:

Source: WallStreetZen

Plus, it’s incorporated into their screener and within a curated library of pre-built Stock Ideas.

If you’re interested in a stock, you can simply type the ticker into the search bar and see who’s weighing in on it with the best stock-picking record. Or, you can look at the recommendations of the Top 1% Analysts.

If you like what you see with Top Analysts, you’ll want to check out Zen Score and the Stock Screener as well. The transparent, data-driven, and visually compelling information is integrated throughout the entire site.

Is it trustworthy? YES. Unlike the other stock picking services, WallStreetZen is a platform that enables you to locate great investments by showing you the most recent recommendations from the best-performing analysts. Its incentives are aligned with yours.

Track Record: Each analyst is ranked based on their historical performance and consistency, so you can be sure that the top analysts are demonstrating real stock-picking skills.

Check out what Top Analysts are recommending today

Cost: After a 14-day trial you may want to unlock Premium, with a 30-day, money-back guarantee.

It costs $19.50/month ($234 billed annually) or $59/month billed monthly — you can save 60% by going annual.

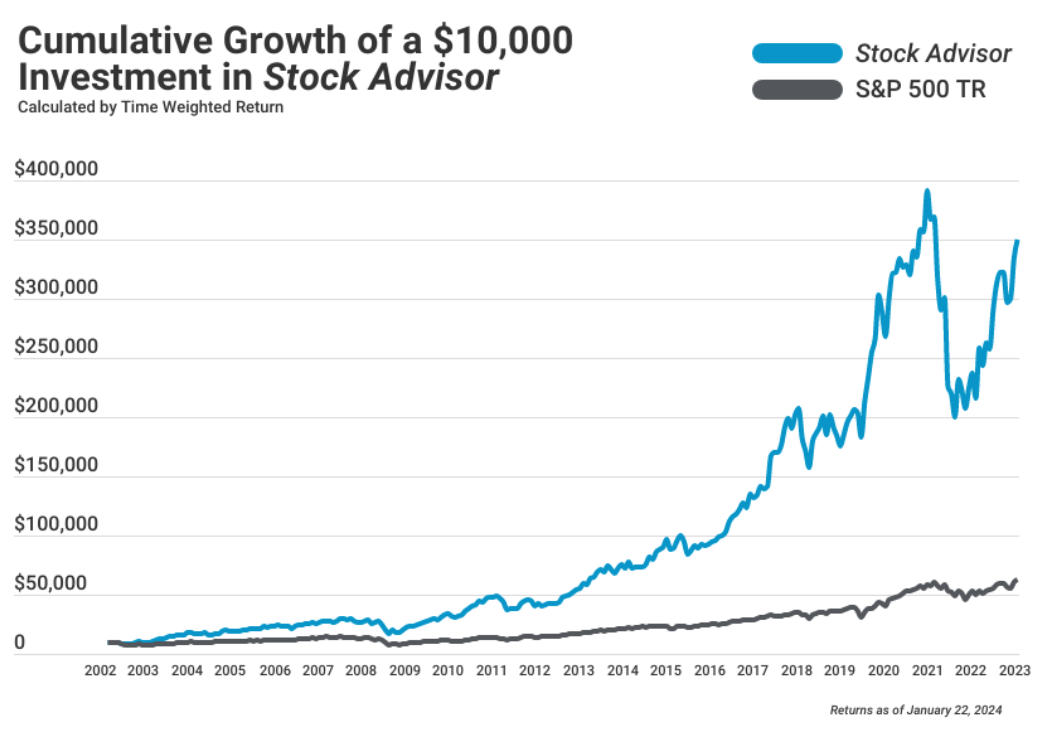

3. The Motley Fool - Stock AdvisorYou might be tempted to call it one of the best stock prediction websites given its track record. Since its inception in 2002, The Motley Fool Stock Advisor has beaten the S&P 500 by more than 450%.

But it’s not predicting, per se. It’s making calls based on research and data.

Brothers Tom and David Gardner founded The Motley Fool in 1993 and have grown it into one of the largest and best stock picking services in the world.

Their flagship product is Stock Advisor, an investment newsletter that makes direct stock recommendations.

If you’re looking to take the guesswork out of investing, this is the best option for you. Stock Advisor delivers a few stock picks per month to add to your portfolio and a report on why you should buy each of them.

Upon sign-up, members receive two new stock recommendations along with two new stock picks each month. Each recommendation comes with an in-depth analysis of the risks and potential upside of each investment.

Stock Advisor also comes with Best Buys Now, a list of what they believe to be the 10 best recommendations to invest in at that time. For new investors, they also publish an additional Starter Stocks list they recommend for beginners.

A Motley Fool premium subscription also comes with performance tracking, a stock screener, exclusive special reports, educational materials, community discussion boards, and video interviews with team members.

Is it trustworthy? YES. With over half a million newsletter subscribers, this service on our list of best prediction websites does not lack credibility or authority - there are plenty of reviews online for each one of its services.

Although not user-friendly as WallStreetZen, the Fool website is feature-rich and fairly intuitive.

Track Record: Since Stock Advisor’s inception in 2002, it has vastly outperformed the S&P 500 index:

Source: Motley Fool Stock Advisor

With over 20 years of proven success helping individuals navigate the complex investing world - The Motley Fool is one of the most trusted names in the financial industry.

Cost: You can get a promotional price of $89 for your first year, which will then renew at the regular price of $199 per year. Considering all you get, it’s well worth it.

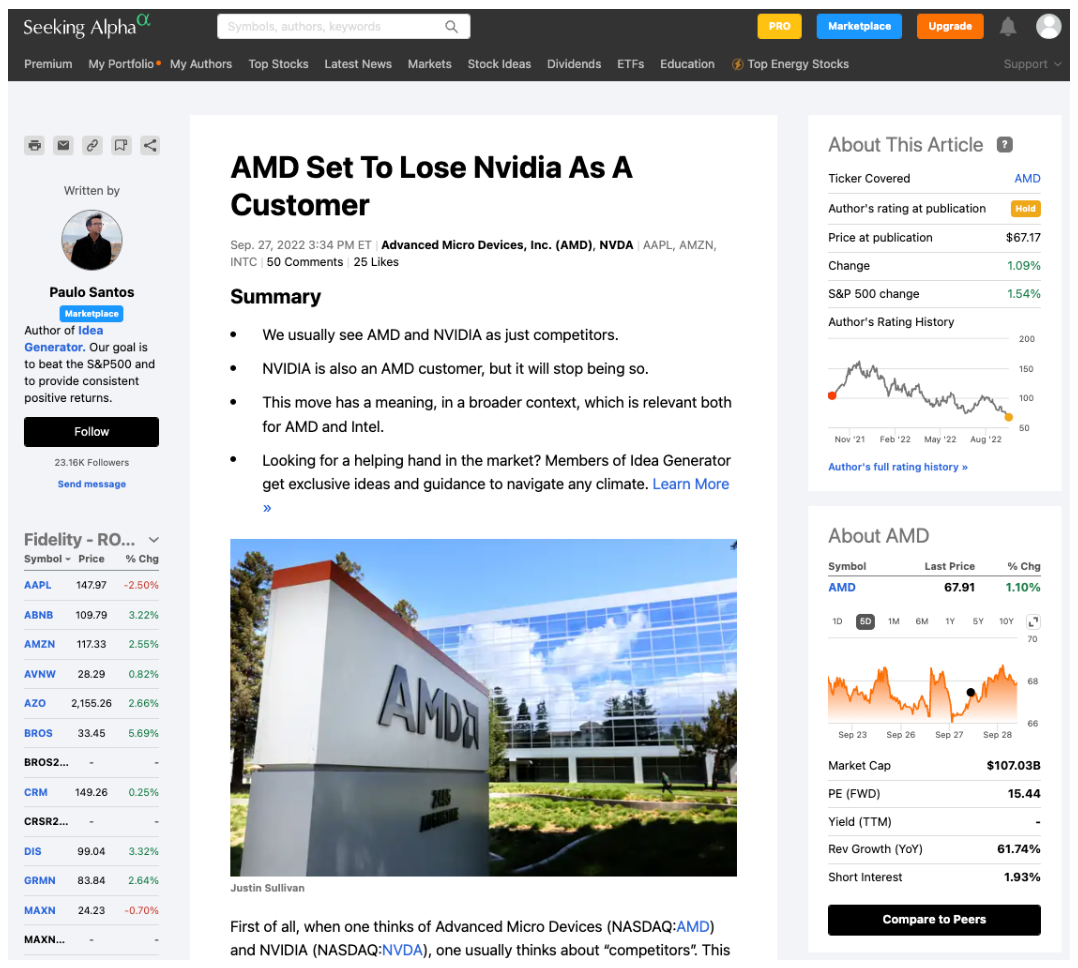

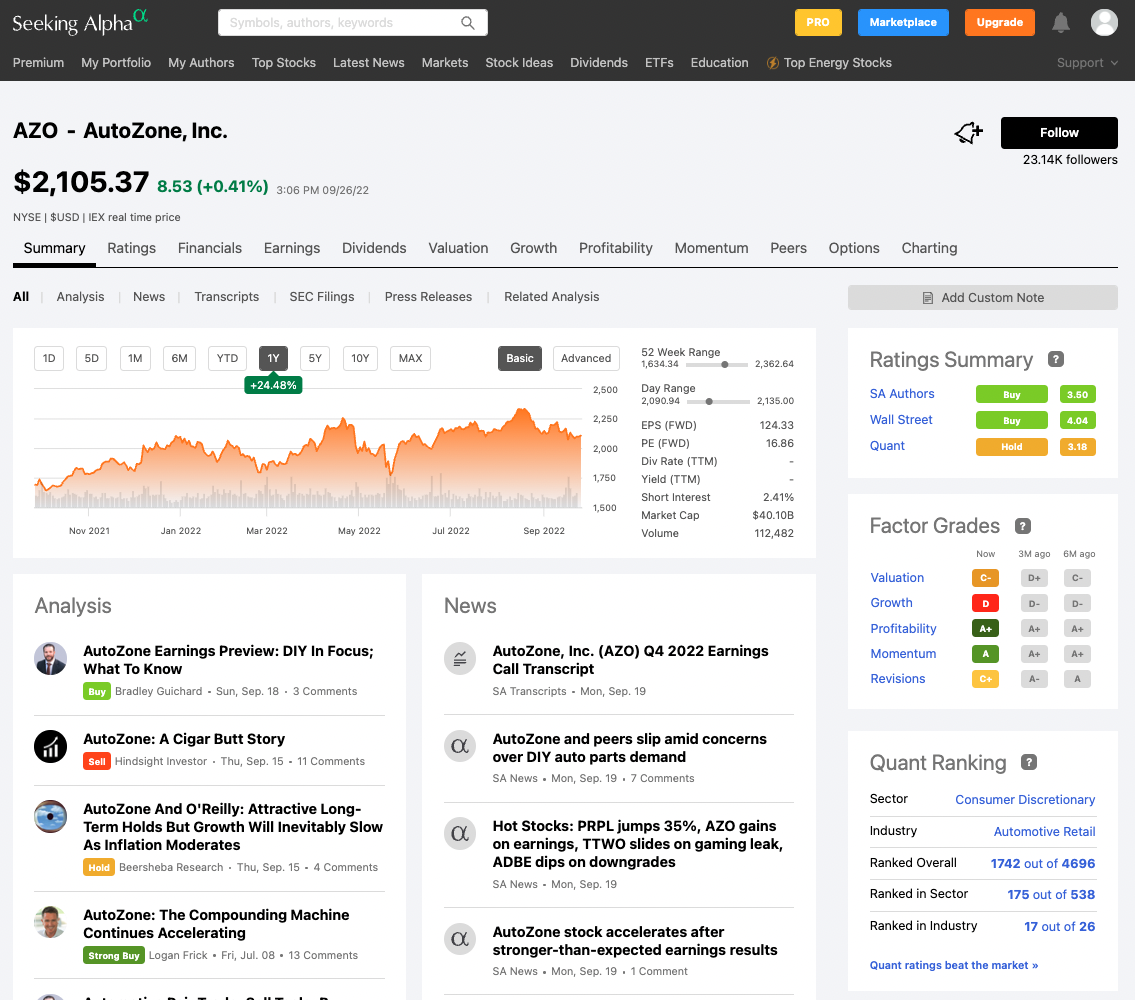

4. Seeking Alpha - The Best Stock Picking Service with Investment Analysis/ResearchSeeking Alpha caters to the research-oriented investor and takes a different approach than Motley Fool. Stock picking ideas are crowdsourced from nearly 10,000 contributors, as opposed to an in-house research team.

The result? A community of serious investors with a diverse set of global stock trading opinions.

(Source: Seeking Alpha)

Seeking Alpha offers a free, premium and pro subscription. The premium option is great for analytical investors, unlocking access to hundreds of investment ideas and individual stock ratings based on Seeking Alpha Authors’ ratings, Wall Street Analysts’ ratings, and proprietary metrics like Quant Ratings, Factor Grades, and more.

(Source: Seeking Alpha)

Seeking Alpha is one of the best stock picking services for investors who want to DIY.

Is it trustworthy? YES. Seeking Alpha is one of the world’s largest investment communities - their research is used by investment professionals all over the world

Track Record: Seeking Alpha posts results for its proprietary ratings algorithms and data for the performance of each author. Beyond this, investment decisions are up to you (investor) so it is difficult to assign a track record score.

Cost: The premium subscription costs $239/year, which is comparable to other platforms in terms of features. The pro version includes all premium features plus VIP service and access to ‘under the radar’ opportunities.

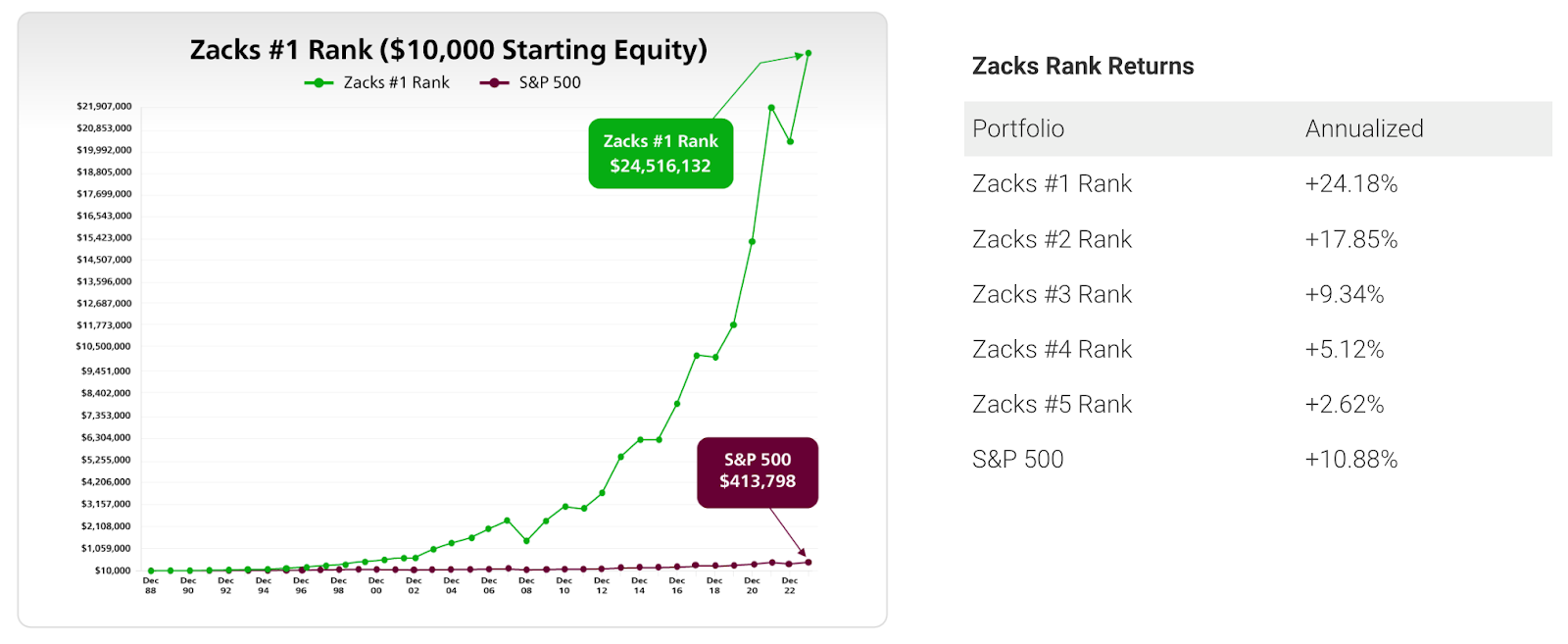

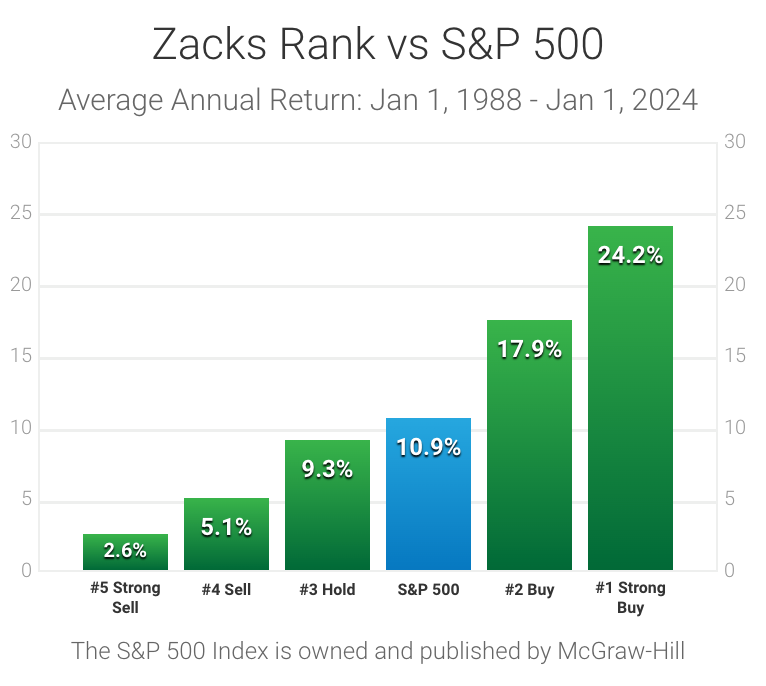

Zacks Investment Research, commonly known as Zacks, was founded in the 1970s. Its Zacks Rank stock-rating system has consistently provided some of the highest performing stock recommendations for decades:

Source: Zacks

Zacks is best known for the Zacks Rank, a stock-rating system that helps individual investors find the best companies to outperform the market with ‘earnings estimate revisions.’ Ranks range from #1 (Strong Buy) to #5 (Strong Sell).

While it does offer some free services, Zacks Premium is its most popular product since it allows investors to unlock all the Zacks Rank features, including:

- Zacks #1 Rank List (which you can filter by sector, industry, price, date, value score, and more)

- Access to a dedicated service team

- An Earnings ESP Filter - determines the likelihood of an earnings surprise before it’s reported

- Zacks Premium Screens

- A portfolio of 50 long-term gain potential stocks, known as the Focus List

And more…

To get the most out of this stock prediction website, you’ll still need to do some of your own manual research. But the fact that they’ve stuck to the same fundamental strategy since 1978 (Zacks Rank inception) means it’s proven and works.

If you’re looking for a platform that not only focuses on fundamentals, but who has arguably the best stock-picking record since the 1980s…

Then Zacks Investment Research might be right for you.

Unlike The Motley Fool’s Stock Advisor, Zacks Premium doesn’t directly tell you which stocks to buy each month. Instead, they provide daily Zacks Rank updates and suggest you buy the Zacks Rank #1 stocks and sell the Zacks Rank #5 stocks.

Is it trustworthy? YES. Like The Motley Fool, Zacks has developed a great brand reputation over the years. Its site is a bit outdated, but it's easy enough to understand and find what you’re looking for. Like Stock Advisor, Zacks Premium shows its performance data very clearly.

Track Record: Well, Since 1988, Zacks Rank #1 Strong Buy stocks have consistently outperformed the S&P 500:

Source: Zacks

Since the 1970s, Zacks has been dedicated to independent research and sharing its profitable discoveries with investors.

Cost: A subscription to Zacks Premium costs $249/year.

All of the best stock picking services have a few things in common: a good historical track record, trustworthiness, and affordability.

But if you’re looking for the best stock picking service in 2024, there isn’t one single answer. It will depend on your needs, budget, and trading style.

Not only do you want to find out WHO has proven strategies and resources, but HOW you can produce similar results.

All of the services in this article fit the bill — they offer a high-quality, high-value service for a price that matches the value you get from them.

Go ahead — explore some of the services above and see which one speaks to you. Happy investing!

SPY shares were trading at $506.96 per share on Thursday afternoon, up $0.70 (+0.14%). Year-to-date, SPY has gained 6.66%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Ryan Taylor

Ryan is a Property Financial Analyst and active real estate agent in Michigan. He has worked in the retirement industry for Voya Financial and Alerus Financial as a Retirement Analyst. Ryan holds a bachelor's degree in business from Ferris State University.

The post Stock Recommendation Services: What’s the Best Stock Picking Service? appeared first on StockNews.com