Get ready for rate cuts!

That is the only logical way to interpret recent Fed statements including Powell’s very interesting comments to Congress on Tuesday.

Let’s break it all down in this week’s Reitmeister Total Return commentary.

Market Commentary

Alan Greenspan was the primary advocate for the Fed to be more transparent in its messages to the market. And each Fed chairman since has embraced, and even improved the Fed’s ability to signal what lies ahead.

Think about how you take action. First you have an idea...then contemplate the pros and cons...and if the right choice, then you take action.

The Fed’s process in changing policy is not much different. The only added ingredient is first sharing those notions with the public helping to pave the way for smoother adoption.

Another way to consider this notion is a long appreciated concept that “the market hates uncertainty”.

Uncertainty of what lies ahead leads to sometimes nasty selloffs and price dislocations until certainty and clarity returns. So, it is in the Fed’s best interest to alleviate uncertainty to have more rational reactions.

No this doesn’t mean that the Fed says things like “We will absolutely lower rates at the upcoming September 18th meeting”. That’s because they want to maintain the right to change their minds if the next rounds of data prove that to be an ill-conceived notion.

Instead, you will get quotes like Powell has stated recently. Like last week when saying that the Fed is encouraged by recent inflation data and is becoming more inclined to lower rates if it stays on this path.

And here is an interesting quote from Tuesday’s testimony before congress:

“Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

This is a dramatic shift from previous comments where he talked about the dangers of not extinguishing high inflation before lowering rates. The fear being that any hot embers of inflation left in the economy could restart a fire making it all the harder to get inflation under control.

Now he is pointing out the opposite...the dangers of keeping rates too high for too long as being harmful to the economy and employment. It doesn’t take a linguistics expert to appreciate that he is preparing investors for forthcoming rate cuts.

The pressing question is WHEN?

The next Fed meeting is on July 31st. That seems a notch too soon with current odds placed at only 5% chance of a cut. Yet it is fun to contemplate how stocks would leap ahead if indeed that is when the first rate cuts are served up.

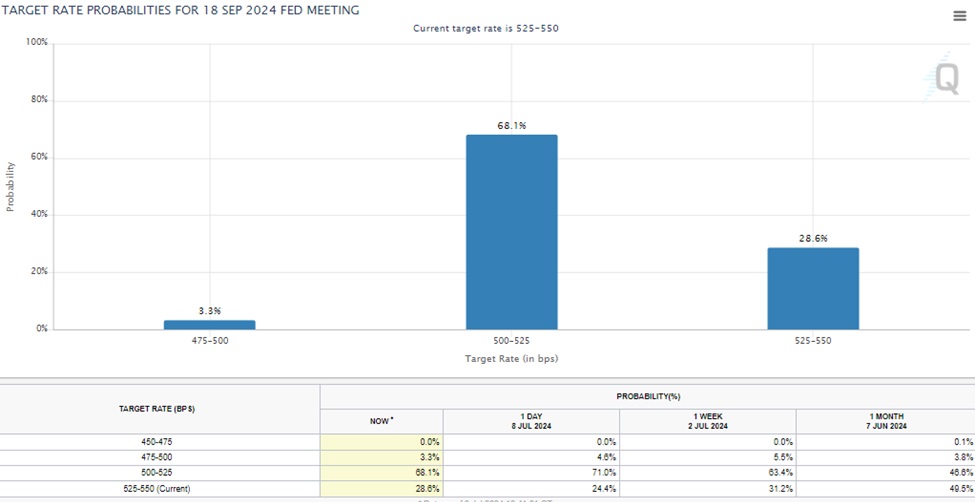

More likely they use that meeting to further prepare investors for the first cut on September 18th.

That September meeting now stands at 71% probability of a rate cut whereas it was only a 50/50 proposition just a month ago.

It will be interesting to see how these probabilities change after these 4 July events:

7/11 CPI report

7/12 PPI report

7/26 PCE report (Fed’s preferred inflation measure)

7/31 Fed rate decision and announcement

Long time readers will no doubt remember that I thought the market was wrong for a long time about when rate cuts would be served up. That is because I have an economics background and better appreciate that it is an inexact science leading academics, like we have in the Fed, to be extremely patient. Like the carpentry expression “measure twice...cut once”.

Thus, I knew that previous calls for cuts at the end of 2023 were outrageous. Same was truly in early 2024 as stocks continued to rally even as inflation data was not cooling down as quickly as hoped for.

But now I have to agree that the stars align for rate cuts BECAUSE of the clear change in language from the Fed. That paves the way for action with the 9/18 meeting being the most logical starting point.

The more curious notion is about how stocks will react given the gains already in hand for the S&P 500 (SPY) now knocking on the door of another record high at 5,600. This might usher in a classic “buy the rumor, sell the news” reaction.

Meaning that investors are always looking ahead...like 4-6 months out. That is why the stock market bottoms during bear markets well before the economy rebounds. It is the anticipation of these events that spark buying activity.

The same thing is likely taking place now. That the gains in hand are in great part about the forthcoming economic catalyst of lowering rates. So, it is possible the market stalls out, or even retreats, shortly after that first rate cut announcement.

Yet what I think is a more compelling narrative is that the S&P 500 will see a sell off. That’s because right now that is the only index clearly on the rise because of the Flight to Quality trade pushing investors to cluster in the Magnificent 7 stocks.

This has those shares priced for perfection with an appropriate round of profit taking on the horizon. That shift out of larger stocks should have more money filtering to deserving small and mid caps.

Do remember that the Russell 2000 (small cap index) is actually floating around breakeven on the year. That dramatic underperformance relative to its large cap peers will likely reverse as rates get cut leading to a more Risk On market. That typically has investors seeking more growth, which is a hallmark of smaller stocks.

Putting it altogether, we are still very much in a bull market. However, the shape of gains after rates get cut will look quite different than what has outperformed year to date.

Thus, get ready to shift to a more Risk On investing strategy as the odds of a rate cut becomes a greater certainty. And yes, a higher allocation to small caps will be on the menu as well.

The POWR Ratings continues to be one of the best ways to find stocks to outperform. ESPECIALLY when small stocks are in favor given its small cap bias.

Learn more about my favorite POWR Ratings stocks in the next section...

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

Plus 2 specialty ETFs that are benefiting from some of the hottest investment trends.

These hand selected picks are all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these lucky 13 trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $556.05 per share on Tuesday afternoon, up $0.77 (+0.14%). Year-to-date, SPY has gained 17.73%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Is it Time to Buy Small Cap Stocks? appeared first on StockNews.com