GPO Plus, Inc. (OTCQB: GPOX) shares are earning investors' attention, evidenced by an over 22% rally from its June lows. The better news- GPO Plus, Inc. is reclaiming its higher price on higher-than-average volume. That could bode well for future trading sessions, especially if the precedent of "volume precedes price" holds true. For this company, it likely will, considering GPOX is doing the right things at the right time to create appreciable shareholder value. That includes advancing an ambitious 2023 agenda expected to lead to its opening its 1000th retail sales before the year-end.

Store openings aren't the only value drivers. Also contributing to the mix is an excellent asset and technology portfolio, including Distro+ and The Feel Good Shop+, two assets contributing to what's expected to be a blockbuster year for the company. In fact, the revenue-generating firepower inherent to its asset portfolio, business partnerships, and expanding reach into retail sales channels can do more than generate record-setting revenues; it positions GPOX better than any time in its history to benefit from a wave of momentum that will turn milestones reached into catalysts. That mission is in progress.

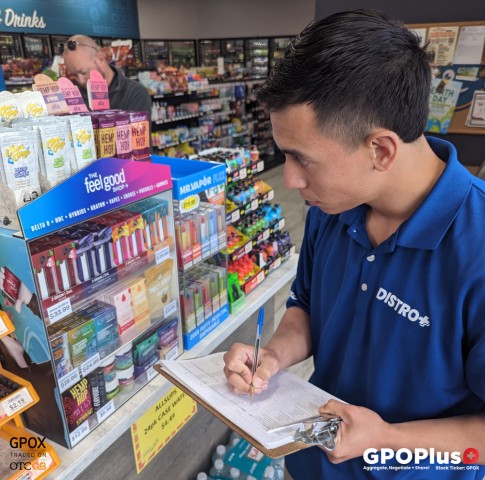

White Glove Service Model A Game-Changer

GPOX noted in a release last Thursday that its primary value driver, "White Glove" service, is now active in 100+ retail locations, with an additional 116 sites to be added by the end of August 2023. That's a big deal, considering it led to an increase of over 320% in gross revenues for the 4th Quarter of their fiscal year ending April 30, 2023. That growth compared to 3rd Quarter results. Keep in mind that consecutive growth is a bullish measure, and with the pace of retail sales locations openings during the back half of 2023 accelerating, those triple-digit percentage gains could stay in fashion.

GPOX appears optimistic that they will. They especially note the valuable contributions from its primary revenue driver, "White Glove" Direct to Store Delivery ("DSD), whose successful deployment has been instrumental in attracting a wave of retail store interest. It should.

The new service includes new point-of-sale displays for its flagship brand, "The Feel Good Shop+" and "Mr. Vapor." But the service goes way beyond point-of-sale marketing materials. The "White Glove" service handles virtually every part of the product placement, from initial orders to regular on-site check-ups, to ensure inventories are maintained, marketing materials are correctly posted, and its displays are doing their job to attract consumer attention and generate sales. Once implemented, store managers generally only need to sign a record of receipt and collect the sales. That's more than an attractive feature; it's a game-changer to traditional vendor relationships.

Most, even the industry giants like Walmart (NYSE: WMT), Rite Aid (NYSE: RAD), and CVS (NYSE: CVS), have relationships where a few large vendors drop off pallets of products to a stock room at the back of the store. The service ends there. And, it's fair to suggest managers generally don't like the arrangement. Taking feedback, GPOX designed a better way to do business.

They tell their retail partner that if they can establish their shelf space with high sell-through products, they will do all the groundwork to keep the products stocked, rotated and, most importantly, provide the marketing materials needed to attract business. The reception to that proposition has been transformative to GPOX's growth.

Providing Best-In-Class Personal Service

Brett H. Pojunis, CEO of GPOX, commented on his company's accelerating growth by saying, "We are incredibly pleased with the results and feedback from our retail partners. Our strategy to provide a best-in-class, state-of-the-art, technology-driven approach to direct store delivery ("DSD") has proven there's an extraordinary opportunity to capture additional market share." It's an opportunity his company is exploiting. And GPOX can cash in in a big way by filling a niche service that's desperately needed.

Mr. Pojunis noted, "Convenience stores typically obtain 80% to 85% of their merchandise from a few primary distributors, then chase multiple sources for the remaining lifestyle goods ranging from nutraceuticals to sunglasses. By focusing on the 10% to 15% of inventory typically sourced from multiple distributors and vendors, we aim to become the premier provider of our white glove DSD service model. Our drivers go above and beyond, ensuring shelves are stocked, inventory is replenished, then presenting the store manager with an order confirmation on a tablet prior to leaving the store." The success of its new service program has already prompted GPOX's retail customers to request additional product offerings. That's an opportunity that GPOX is seizing.

A recent update from GPOX highlighted its capitalizing on increasing demand by allocating the resources needed to roll out 319 retail stores quickly and efficiently. With the introduction of its Mini Hubs, warehouses that support Regional Hubs, GPOX is positioned to add other specialty retailers in that region and recruit outside sales reps and Independent Sales organizations (ISO's). Furthermore, GPOX receives valuable point-of-sale data, allowing them to optimize its product mix and introduce higher margin "white label products" such as its Yuengling Ice Cream and Gummy line. The arrangement is a win-win, increasing top-line revenues and unit economics for GPOX and the client.

Transforming GPOX Into A Rev-Gen Powerhouse

That arrangement is helping transform GPOX into a larger company faster than many may have expected. Supporting that presumption, GPOX said it's seeing a lift in monthly sales per location activated from $580 to over $2,120, leading FY Q4 revenues to post over $430,000 compared to just over $102,000 in Q3 of the same fiscal year. Final audited revenue totals will be published in its 10K filings. While the surge in Q4 is impressive, what's ahead should be appreciably better.

That expectation is warranted, noting that GPOX now services approximately 570 stores across 12 states centralized in the Southwest and Midwest regions of the United States. That total is growing. GPOX identified 316 locations approved for the new program, with approximately 100 already active. Following those activations, another 116 stores will be activated in Dallas and Austin, Texas, and Albuquerque, New Mexico, scheduled to occur before the end of August 2023. In addition, GPOX said it intends to activate an additional 103 stores in Wyoming, Kansas, and Missouri marketplaces by the end of October 2023. Totaling those openings, the phrase "growing at warp speed" is justified.

And there is no stopping point. GPOX wants to capitalize on its business model and open thousands of additional locations. That's made possible through Mini Hubs, whose sales teams actively manage placements and work to add other specialty retailers like gas stations, smoke shops, vape shops, and liquor stores. According to the model, each Mini Hub can service up to 150 locations, with 100 being the minimum to open the Mini Hub cost-effectively. This equates to an initial goal of 1,000 to 1,500 retail locations supported by its Regional Hub in Lubbock, Texas.

Seize On The Valuation Disconnect

All tolled, the update last Thursday from GPOX can be best described as a "buy the news" event. At roughly $0.18 a share, GPOX stock is priced at ground floor levels, with its intrinsic assets alone able to justify a significantly higher price. But like all companies, GPOX also deserves its multiple from a forward-looking perspective. In that instance, current prices are far short of appropriate. In fact, they neglect entirely the value earned from a company expected to post up to $14 million in revenues in its new fiscal year. And even that estimate could be conservative. (*share price on 7/7/23, Yahoo! Finance, 11:05 AM EST)

With its 1000th store expected to open this year and sales projected to track the current $2120 per month, GPOX could surprise to the upside, scoring upwards of $25 million in revenues. Combining either estimate with a tightly held share float, the path of least resistance for GPOX is likely higher. And by no small measure.

The numbers in play expose a GPOX worthy of a share price in dollars instead of cents. That will likely come as the GPOX retail development story takes shape during the remainder of this year. In the meantime, current share prices aren't necessarily bad; they present investors with a ground floor price for a fast-growing and dynamic company. Of course, windows of opportunity only stay open for a short time.

In GPOX's case, with volume picking up and a solid bounce off its recent lows, this window may close quickly. In fact, the opportunity to pay wholesale prices for a strengthening retail player probably won't last much longer. In other words, consider this value play sooner than later.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for GPO Plus, Inc.. for a period of one month ending on 08/03/23. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Country: United States

Website: https://primetimeprofiles.com/