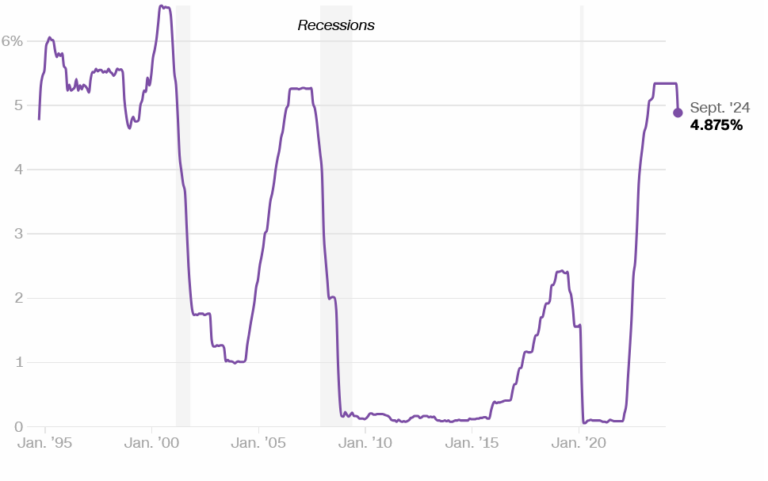

The stock market went crazy after the half point cut by the federal reserve? Should you rejoice like the stock market? Take a look at the chart above showing all the recessions in the last 30 or so years. Do you notice a trend? What is the chart telling us about our probability of a recession this cycle? What happens to mortgage rates and in turn real estate prices?

What can we learn from the chart on past recessions?

The stock market is partying like never before touching on historic highs. Essentially the stock market is “believing” the fed that all is well and peachy in the economy and that is why they are cutting rates. This narrative is a bit naïve and I am surprised the markets are buying this explanation. Unfortunately history is showing a much different story.

Based on the chart above, every single time in the last 30 years when the federal reserve cut rates a recession followed. There has not been a single case where this did not occur (I’m factoring out Covid in 2019 as that was an anomaly/one time event) but yet even with this history, the market is predicting something entirely opposite.

Will the federal reserve prevail in preventing a recession?

Although we have some new fancy terms like “recalibration”, I have yet to see a compelling argument as to why this economy is radically different than the last 30 years.

Unfortunately based on the data, I am 100% in the camp that we will have a recession. What the federal reserve and federal government has done is merely goose the economy to delay the recession.

At the end of the day employment is declining and more companies are tightening, consumers are finally running out of the Covid cash, and delinquencies are exceeding pre 2019 levels.

At the same time, the federal reserve did a huge rate cut to ensure full employment which ironically has raised mortgage rates and also many shorter term rates. In essence the market euphoria is blunting the effects of rate cuts and actually doing the opposite by making everything more expensive.

What does the chart above mean for mortgage rates?

Over the next 4-6 months mortgage rates will trade around where they have been for the year. Mid next year rates should decline a little closer to 5.5%-6% range when the economy really starts to slow. Unfortunately, the huge federal deficit is going to keep rates considerably higher than they were before covid and rates around 6% are going to be the new norm for mortgages for the foreseeable future.

What should you do regarding interest rates?

Full disclosure: I’m not a mortgage broker as I am a private lender so if you are looking for advice on your mortgage consult another professional. With that said, I think rates will fall about ¾% from where they are today sometime next year so personally if I were looking to refinance, I would wait for rates to drop.

How will real estate prices be impacted?

For the next 4-6 months, I don’t see any huge changes. The federal reserve and federal government will continue to prop up the economy through stimulus which will keep house prices give or take 5% either way. The real change comes next year when there is an economic reset and the market comes to grips that interest rates are never returning to the 3-4% range.

Summary

I would caution everyone not to buy into the market Euphoria. History shows in the chart above that over the last 30 years there is a 100% probability of an economic reset. Although Covid definitely changed the economy it did not change physics where everything that goes up must eventually come down. We are not in a new normal. The economy is slowly falling back into old patterns with unemployment starting to pick up, defaults increasing, and banks becoming increasingly tighter on their underwriting. All these factors add up to one answer, an economic reset.

Although the reset might not happen like past recessions due to huge government stimulus and a federal reserve aggressively trying to get ahead of the cure it will ultimately happen. Government spending and stimulus will ultimately run out and the economy will correct like it always has. This means that eventually there will be a real estate reset and also an opportunity for lower rates (just not as low as pre Covid).

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Media Contact

Company Name: Fairview Lending

Contact Person: Glen Weinberg

Email: Send Email

Phone: +1 (404) 846-4718

Country: United States

Website: www.fairviewlending.com