Newly permitted areas hold potential for further gold and copper prospects.

LONDON, UK / ACCESSWIRE / March 19, 2024 / Meridian Mining UK. S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce the initial findings from positive metallurgical trials using a more selective reagent for copper sulphides. Preliminary results using Solvent 3418A achieved higher recoveries of copper ("Cu") than the ~92.4% achieved by the reagent PAX used in the 2023 PEA. Solvent 3418A is a common Cu reagent, engineered to also be an efficient collector of gold ("Au") and silver ("Ag"), which may lead to possible increases in their recoveries. Work is ongoing to verify the promising initial copper recoveries observed for future economic studies.

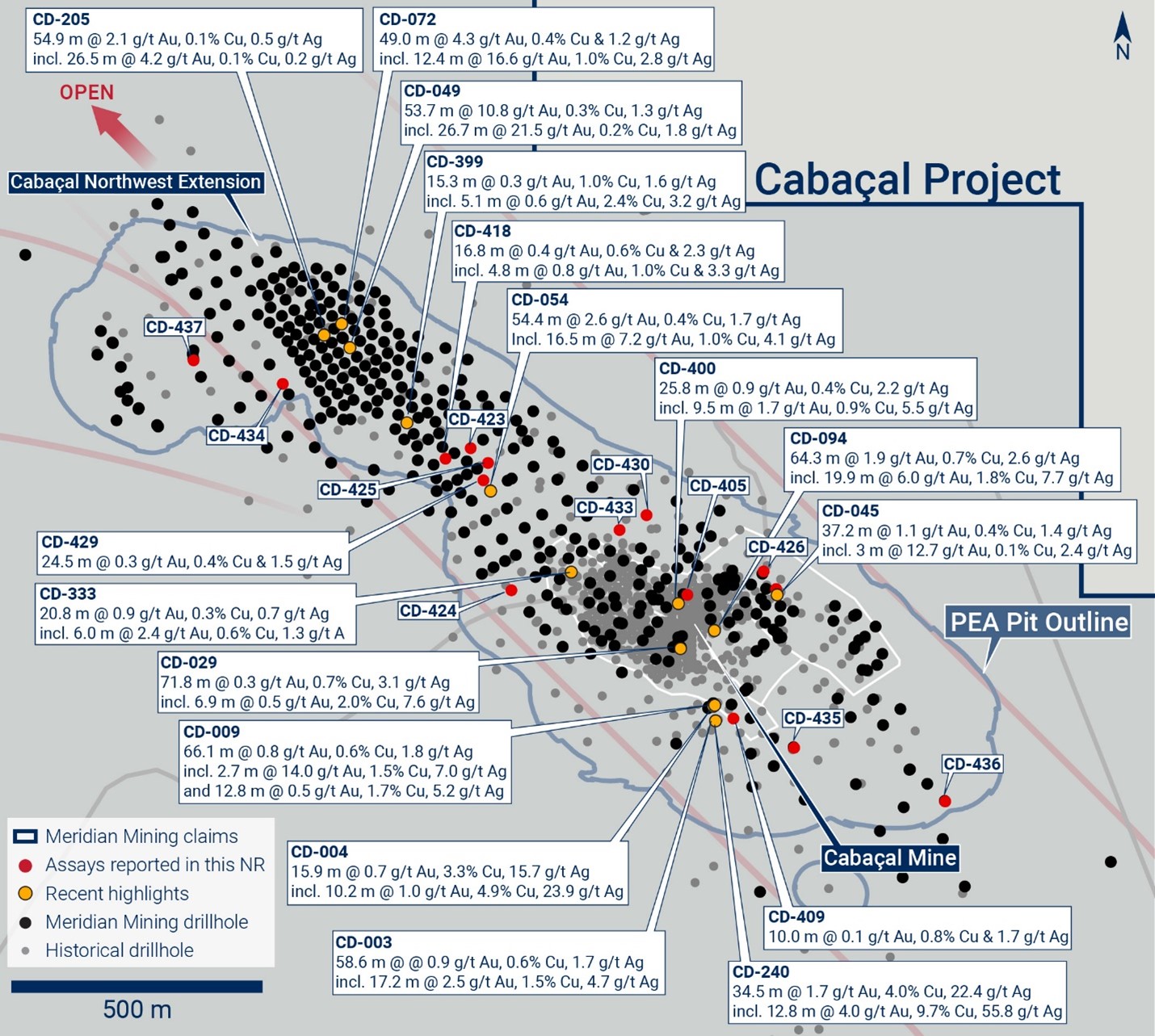

Cabaçal's Pre-Feasibility Study ("PFS") program of infill drilling ("Figure 1") is progressing well. The drill program is currently focussed on converting Inferred zones1 hosting moderate grades of gold and copper mineralization to a higher status. Drill results have included CD-418's 16.8m @ 1.2g/t AuEq2 and CD-409's 10.0m @ 1.1g/t AuEq. Cabaçal's post-PEA drill program includes some recent robust copper dominant intersections. Further drill results are pending.

With the simultaneous advancement of Cabaçal's PFS and Santa Helena's resource programs, the Company has focused on updating environmental permits and access agreements to unlock additional areas for further exploration upside. Multiple prospects hosting extensive copper and gold geochemical anomalies are being progressively opened to exploration.

Highlights Reported Today

- Metallurgical trials using Solvent 3418A show strong potential to increase Cabaçal's Cu recoveries;

- Gains in Au and Ag recoveries also likely using Solvent 3418A;

- Cabaçal PFS's drill program continues to return wide zones of "in-pit" copper gold and silver mineralization at shallow depths;

- CD-418: 16.8m @ 1.2g/t AuEq from 121.5m;

- Including 4.8m @ 2.2g/t AuEq from 132.5m;

- CD-409: 10.0m @ 1.1g/t AuEq from 74.0m;

- CD-429: 24.5m @ 0.8g/t AuEq from 36.6m;

- CD-418: 16.8m @ 1.2g/t AuEq from 121.5m;

- Meridian expands exploration footprint with newly permitted areas; and

- Multiple gold and copper prospects being unlocked to advance exploration programs.

Mr. Gilbert Clark, CEO, comments: "It is great to see our metallurgical optimization trials indicating the potential for even higher recoveries of Cu than we initially achieved with the PEA. If the Au and Ag results replicate our expectations, this can only improve the already high quality of Cabaçal's Cu, Au & Ag concentrates. In addition, Cabaçal's drill program will increase confidence in the deposit's resource base, with continued Cu-Au-Ag intercepts over the 2km length of the PEA's open pit. This will be the solid base for the PFS study where we hope to confirm Cabaçal as a long-life stand-alone mine development. We are opening up more areas for exploration, expanding our field programs to test for Au and Cu mineralization along the mine corridor and its extensions. Meridian's strategy and timing to advance this emerging Cu-Au VMS belt presents a strong investment opportunity for investors seeking exposure to a development-focussed copper gold company in Brazil".

1 See Meridian PR dated September 26, 2022

2 See PR's technical notes of AuEq equations, true thickness estimate is 80 to 90%.

Cabaçal Project Development And Resource Definition Program

Meridian is busily working on multiple fronts to advance the Cabaçal PFS. This includes a focus on optimising the metallurgical recoveries of Cu, Au & Ag, and having three rigs continuing the resource definition, with an emphasis on conversion of inferred resource to higher levels of confidence.

Cabaçal Metallurgical Update

The historical Cabaçal mine's metallurgical data and the Company's own testwork have confirmed the highly favourable metallurgical processing characteristics of the deposit's Cu-Au & Ag sulphide and free gold mineralization. Cabaçal's mineralization is characterized as soft to medium in hardness, with high recoveries via a relatively coarse 200-micron grind. Recommendations from the PEA included the evaluation of alternative reagents. The Company's metallurgical consultant, Mr. Norman Lotter, has scoped a series of tests using the selective collector Solvay 3418A ("3418A") in the rougher and copper cleaner circuit. 3418A is a widely used reagent that has a known ability to enhance copper and precious metal recoveries from sulphide mineralization, like that found at the Cabaçal deposit. Initial tests were performed using the Cabaçal PEA's master composite samples and initial results indicate higher recoveries of Cu, exceeding those used in the 2023 Preliminary Economic Assessment3. Repeat testing is scheduled to generate a comprehensive data set, to determine the total metal recoveries to be used in the PFS. Amongst the test samples are intervals with stronger or dominant copper mineralization. If 3418A continues to deliver higher metal recoveries, this will have a positive effect not only on these intersections but potentially on the broader haloes of Cu-Au mineralization currently below resource cut-off grades.

Comparative testwork was also undertaken to examine Cabaçal's flow sheet with and without a gold gravity circuit. Higher total Au recoveries were confirmed with the inclusion of a gravity circuit, than without. The importance of Au recovered by a gravity circuit extends to the Cabaçal belt's free Au, hosted both within the VMS mineralization and the late-stage gold over print.

The Santa Helena mine's historical floatation-only flow sheet excluded a gravity circuit and Au recoveries averaged 65%. This is the Au recovery factor used in the calculation of the 2022 Santa Helena Exploration Target4. Cabaçal's PEA outlined Au recoveries averaging 89.7%, via a combination of gravity and flotation circuits, a 38% difference. Santa Helena's mill's tailings data also records a much higher gold grade than Cabaçal's historical tailings and Meridian's own 2022 data.

The late-stage gold overprint has been outlined at Santa Helena5 and the potential for higher total gold recoveries, like those demonstrated at Cabaçal, will be determined by the planned metallurgical test program that will include a gravity circuit. If the potential for comparative Au recoveries is achieved from Santa Helena's metallurgical testwork, then a material increase in the Au recovery factor for the future resource calculations would be used.

Cabaçal Drilling Update

The Cabaçal resource development program continues, with three rigs currently deployed in the CNWE. Results recently received included holes from the end of the 2023 program, and initial holes from the mine area and extensions of the Cabaçal deposit to the south (Figure 1). Some holes such as CD-436 are from peripheral or close-out positions corresponding to known lower grade zones of the deposit and are inline with expectations for confirming the limits of pit design.3 See Meridian news release dated March 6, 2023

4 See Meridian news release dated December 5, 2023

5 See Meridian news releases dated March 29, 2022, and September 27, 2023.

Drill results from the CNWE include:

- CD-418 (CWNE): 15.3m @ 0.9g/t AuEq (0.1g/t Au, 0.5% Cu & 2.3g/t Ag) from 76.0m;

- 16.8m @ 1.2g/t AuEq (0.4g/t Au, 0.6% Cu & 2.3g/t Ag) from 121.5m;

- CD-423 (CWNE): 39.3m @ 0.5g/t AuEq from 78.4m (0.1g/t Au, 0.3% Cu & 0.4g/t Ag); including:

- 5.5m @ 1.3g/t AuEq (0.3g/t Au, 0.7% Cu & 0.9g/t Ag) from 106.8m;

- CD-429 (CWNE): 24.5m @ 0.8g/t AuEq (0.3g/t Au, 0.4% Cu & 1.5g/t Ag) from 36.6m; including:

- 1.7m @ 6.2g/t AuEq (2.0g/t Au, 2.9% Cu & 11.6g/t Ag) from 36.6m; and

- 44.4m @ 0.5 g/t AuEq (0.3g/t Au, 0.2% Cu & 0.6 g/t Ag) from 67.0m.

Drill results from the mine area and south of the mine included:

- CD-405: (CCZ) 16.9m @ 0.4g/t AuEq (0.3% Cu, 0.4g/t Ag) from 19.0m;

- 41.0m @ 0.5g/t AuEq (0.2g/t Au, 0.3% Cu, 1.2g/t Ag) from 47.0m; including:

- 8.4m @ 1.4g/t AuEq (0.4g/t Au, 0.7% Cu & 3.9g/t Ag) from 60.8m;

- 41.0m @ 0.5g/t AuEq (0.2g/t Au, 0.3% Cu, 1.2g/t Ag) from 47.0m; including:

- CD-409 (SCZ): 27.0m @ 0.6g/t AuEq (0.4% Cu & 1.0g/t Ag) from 74.0m; including:

- 10m @ 1.1g/t AuEq (0.1g/t Au, 0.8% Cu & 1.7g/t Ag) from 74.0m;

- 31.4m @ 0.6g/t AuEq (0.2g/t Au, 0.3% Cu & 1.5g/t Ag) from 116.0;

- CD-424 (SCZ): 27.2m @ 0.5g/t AuEq (0.2g/t Au, 0.2% Cu & 0.9g/t Ag) from 55.0m; and

- CD-435 (Cabaçal South): 51.6m @ 0.4g/t AuEq (0.1g/t Au, 0.3% Cu & 0.8g/t Ag) from 81.9m.

From the ongoing drill program and surface mapping program results, Cabaçal's open pitable mineralization in places remains open. The remaining drill program will seek to close out the mineralization so as to optimise the pit design that will be used in the PFS. Meridian's drill program at Cabaçal continues and is expected to deliver an updated drill hole data base to its independent resource and mine design consultants over Q2-Q3 of this year.

Figure 1: Highlights from recent drilling

Update on New Licencing Of Exploration Areas

The Company continues to work with local landholders and the state environment agency, SEMA, to increase the footprint of permitted land for exploration targeting. Environmental licences for exploration (Licença de Operação Provisória Mineral "LOPM") have recently been expanded. The project has historically defined gold and base metal stream anomalies and soil anomalies that cumulatively extend over kilometers in scale. Additional areas of the greenstone belt remain open for further sampling and testing.

To the south, additional access has been approved in areas to the west of Santa Helena. The Company has already initiated soil sampling where gaps in coverage exist in the BP Minerals sampling. 200 samples have been collected and have outlined a new Cu anomaly ~ 4km to the west of Santa Helena, extending over ~575m at a 150ppm threshold. Gold assay results for this soil anomaly are pending. The area and its extensions will be targeted with future surface geophysical programs.

The Company has also now added a total of 11 properties in the Cigarra area to the LOPM north of Cabaçal. This target lies within licences 866002/2016, 866455/2016, spanning 3,746 Ha across a 7km strike length of the northern extension of the Cabaçal Belt. The Company continues discussions with landholders to formalize agreements on some of the larger properties in the area. Historical records describe a geological / geochemical environment similar to that of the chloritic outcrops of the Cabaçal deposit setting in this region, with gold and base metal anomalies present.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023).

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at SGS and ALS laboratories in Belo Horizonte and Lima. At SGS, samples are dried, crushed with 75% passing <3 mm, split to give a mass of 250-300g, pulverized with 95% passing 150#. Gold analyses are conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by methods ICP40B and ICP40B_S (four acid digest with ICP-OES finish). Visible gold intervals are sampled by metallic screen fire assay method MET150-FAASCR. At ALS, samples are dried, crushed with 70% passing 85% passing 200#. Routine gold analyses have been conducted by Au‐AA24 (fire assay of a 50g charge with AAS finish). High‐grade samples (>10g/t Au) are repeated with a gravimetric finish (Au‐GRA22), and base metal analysis by methods ME-ICP61a and OG62 (four acid digest with ICP-AES finish). Visible gold intervals are sampled by metallic screen fire assay method Au‐SCR21. Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au_(g/t) * 65%Recovery) + (1.492*Cu(%) * 89%Recovery) + (0.474*Zn% * 89%Recovery)) + (0.013Ag(g/t) * 61%Recovery)).

Soils samples have been analysed at the accredited SGS laboratory in Belo Horizonte. gold analyses have been conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by portable XRF calibrated with certified references. ~10% of base metal results are verified by laboratory analysis at SGS using methods ICP40B (four acid digest with ICP-OES finish). Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps are retained for umpire testwork, and ultimately returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by ITAK and OREAS, supplementing laboratory quality control procedures.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assays reported in this press release.

Hole-id |

Dip |

Azi |

EOH |

Zone |

Int |

AuEq |

CuEq |

Au |

Cu |

Ag |

From |

CD-439 |

-21 |

045 |

100.5 |

ECZ |

|||||||

2.0 |

3.2 |

2.2 |

3.2 |

0.1 |

1.0 |

7.0 |

|||||

14.6 |

0.3 |

0.2 |

0.1 |

0.2 |

0.8 |

21.4 |

|||||

17.6 |

0.3 |

0.2 |

0.0 |

0.2 |

1.0 |

50.4 |

|||||

CD-437 |

-74 |

019 |

81.6 |

CWNE |

|||||||

1.1 |

0.3 |

0.2 |

0.0 |

0.2 |

0.2 |

31.9 |

|||||

13.3 |

0.3 |

0.2 |

0.1 |

0.1 |

0.6 |

48.3 |

|||||

CD-436 |

-90 |

000 |

100.3 |

CSTH |

|||||||

0.6 |

0.6 |

0.4 |

0.0 |

0.4 |

0.6 |

76.0 |

|||||

0.4 |

1.0 |

0.6 |

0.2 |

0.6 |

1.8 |

85.9 |

|||||

CD-435 |

-64 |

049 |

150.4 |

CSTH |

|||||||

51.6 |

0.4 |

0.3 |

0.1 |

0.3 |

0.8 |

81.9 |

|||||

Including |

2.5 |

1.6 |

1.0 |

0.1 |

1.0 |

1.9 |

105.3 |

||||

CD-434 |

-45 |

058 |

91.0 |

CWNE |

|||||||

0.9 |

4.7 |

3.2 |

1.1 |

2.5 |

4.1 |

37.4 |

|||||

2.2 |

0.3 |

0.2 |

0.2 |

0.1 |

0.1 |

47.8 |

|||||

9.1 |

0.6 |

0.4 |

0.3 |

0.3 |

0.9 |

56.1 |

|||||

CD-433 |

-50 |

060 |

92.0 |

ECZ |

|||||||

5.2 |

0.8 |

0.6 |

0.0 |

0.6 |

1.7 |

22.0 |

|||||

18.1 |

0.4 |

0.3 |

0.1 |

0.2 |

0.5 |

52.0 |

|||||

CD-430 |

-49 |

060 |

63.4 |

ECZ |

|||||||

6.0 |

0.8 |

0.5 |

0.2 |

0.5 |

0.5 |

32.0 |

|||||

CD-429 |

-51 |

060 |

145.7 |

CWNE |

|||||||

8.8 |

0.5 |

0.3 |

0.1 |

0.3 |

0.6 |

14.0 |

|||||

24.5 |

0.8 |

0.5 |

0.3 |

0.4 |

1.5 |

36.6 |

|||||

Including |

1.7 |

6.2 |

4.1 |

2.0 |

2.9 |

11.6 |

36.6 |

||||

44.4 |

0.5 |

0.3 |

0.3 |

0.2 |

0.6 |

67.0 |

|||||

9.2 |

0.5 |

0.3 |

0.1 |

0.3 |

0.6 |

118.8 |

|||||

CD-426 |

-21 |

045 |

84 |

ECZ |

|||||||

9.8 |

0.5 |

0.3 |

0.1 |

0.3 |

0.4 |

31.2 |

|||||

3.4 |

1.4 |

0.9 |

0.2 |

0.9 |

0.2 |

56.1 |

|||||

CD-425 |

-50 |

063 |

136.7 |

CWNE |

|||||||

7.2 |

0.5 |

0.3 |

0.1 |

0.3 |

0.6 |

52.0 |

|||||

13.4 |

0.4 |

0.3 |

0.2 |

0.2 |

0.0 |

85.1 |

|||||

14.9 |

0.5 |

0.4 |

0.2 |

0.3 |

0.5 |

104.8 |

|||||

CD-424 |

-50 |

061 |

105.2 |

SCZ |

|||||||

27.2 |

0.5 |

0.3 |

0.2 |

0.2 |

0.9 |

55.0 |

|||||

Including |

2.9 |

2.0 |

1.3 |

0.4 |

1.1 |

4.5 |

68.5 |

Hole-id |

Dip |

Azi |

EOH |

Zone |

Int |

AuEq |

CuEq |

Au |

Cu |

Ag |

From |

CD-423 |

-53 |

055 |

133.9 |

CWNE |

|||||||

9.1 |

0.9 |

0.6 |

0.1 |

0.6 |

0.8 |

24.0 |

|||||

Including |

1.6 |

3.0 |

2.0 |

0.3 |

1.9 |

1.8 |

25.9 |

||||

39.3 |

0.5 |

0.3 |

0.1 |

0.3 |

0.4 |

78.4 |

|||||

Including |

5.5 |

1.3 |

0.9 |

0.3 |

0.7 |

0.9 |

106.8 |

||||

CD-418 |

-49 |

060 |

153.7 |

CWNE |

|||||||

10.1 |

0.3 |

0.2 |

0.0 |

0.2 |

0.3 |

16.0 |

|||||

7.4 |

0.2 |

0.2 |

0.1 |

0.1 |

0.4 |

51.5 |

|||||

1.2 |

0.7 |

0.4 |

0.2 |

0.4 |

1.0 |

64.2 |

|||||

15.3 |

0.9 |

0.6 |

0.1 |

0.5 |

2.3 |

76.0 |

|||||

Including |

2.0 |

3.1 |

2.1 |

0.3 |

1.9 |

9.4 |

84.6 |

||||

7.6 |

0.3 |

0.2 |

0.1 |

0.1 |

0.8 |

99.7 |

|||||

16.8 |

1.2 |

0.8 |

0.4 |

0.6 |

2.3 |

121.5 |

|||||

Including |

2.4 |

2.5 |

1.7 |

0.7 |

1.3 |

5.1 |

122.1 |

||||

Including |

4.8 |

2.2 |

1.5 |

0.8 |

1.0 |

3.3 |

132.5 |

||||

CD-409 |

-89 |

000 |

163.6 |

SCZ |

|||||||

27.0 |

0.6 |

0.4 |

0.0 |

0.4 |

1.0 |

74.0 |

|||||

Including |

10.0 |

1.1 |

0.8 |

0.1 |

0.8 |

1.7 |

74.0 |

||||

31.4 |

0.6 |

0.4 |

0.2 |

0.3 |

1.5 |

116.0 |

|||||

CD-405 |

-60 |

044 |

91.2 |

CCZ |

|||||||

16.9 |

0.4 |

0.3 |

0.0 |

0.3 |

0.4 |

19.0 |

|||||

41.0 |

0.5 |

0.4 |

0.2 |

0.3 |

1.2 |

47.0 |

|||||

Including |

8.4 |

1.4 |

0.9 |

0.4 |

0.7 |

3.9 |

60.8 |

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com