Sinopec Achieved Good Performance in 2024 Q1

BEIJING, CHINA / ACCESSWIRE / April 28, 2024 / China Petroleum & Chemical Corporation ("Sinopec Corp." or the "Company") (HKEX:00386)(SSE:600028) today announced its unaudited first quarterly results for the three months ended 31 March 2024.

Financial Highlights

- In accordance with the IFRS, the Company's revenue for the first quarter of 2024 was RMB 789.967 billion; the net profit attributable to shareholders of the Company was RMB 18.721 billion; the basic earnings per share were RMB 0.156. In accordance with the CASs, the net profit attributable to equity shareholders of the Company for the first quarter was RMB 18.316 billion; the basic earnings per share were RMB 0.153.

- The Company achieved high quality operating results. In the first quarter, the Company's oil and gas production reached 128.78 million barrels of oil equivalent, up by 3.4% year on year, with natural gas production reaching 350.46 billion cubic feet, up by 6.0% year on year. The Company processed 63.30 million tonnes of crude oil, up by 1.7% year on year, and total sales volume of refined oil products was 59.81 million tonnes, up by 6.5% year on year. The ethylene production was 3.279 million tonnes, and the total chemicals sales volume was 19.51 million tonnes.

Operational Review

In the first quarter of 2024, China's economy continued to pick up, with gross domestic product (GDP) up by 5.3% year on year. The international crude oil prices fluctuated with upward trend and the spot price of Platt's Brent for the first quarter averaged USD83.2 per barrel, up by 2.4% year on year. The domestic demand for natural gas rapidly increased, and the demand for refined oil products maintained growth. Domestic demand for chemical products increased at a faster pace year on year, and the chemical margin was at a low level due to continual newly-released production capacity and rising raw material prices.

The Company closely followed the market demand, further optimised both of the whole business chain and the regions, strengthened the coordination of production and marketing, made great efforts to expand markets and sales, and achieved good performance. In accordance with CASs, net profit attributable to equity shareholders of the Company was RMB18.316 billion in the first quarter of 2024. In accordance with IFRS, net profit attributable to shareholders of the Company was RMB18.721 billion in the first quarter of 2024.

Exploration and Production: The Company intensified efforts in high quality exploration, expanded the scale of profitable production capacity, and made positive progress in increasing reserve, production and profit. In exploration, we strengthened risk exploration, trap pre-exploration and integrated evaluation exploration, and made important breakthroughs in the regions such as Tarim Basin, Sichuan Basin and Jianghan Basin. In development, we accelerated the capacity building of Jiyang and West Junggar oilfields, and sped up capacity building of natural gas in West Sichuan and Shunbei. We further improved integrated gas system covering production, supply, storage and sales, optimised the resources structure of LNG import, and achieved an improvement in the profitability of whole natural gas business chain. In the first quarter, the Company's oil and gas production reached 128.78 million barrels of oil equivalent, up by 3.4% year on year, with natural gas production reaching 350.46 billion cubic feet, up by 6.0% year on year. The exploration and production segment realised earnings before interest and tax (EBIT) of RMB14.823 billion.

Exploration and Production |

Unit |

Three-month period ended 31 March |

Changes |

|

|---|---|---|---|---|

2024 |

2023 |

(%) |

||

| Oil and gas production | million boe |

128.78 |

124.60 |

3.4 |

| Crude oil production | million barrels |

70.36 |

69.49 |

1.3 |

| China | million barrels |

63.11 |

61.86 |

2.0 |

| Overseas | million barrels |

7.25 |

7.63 |

(5.0) |

| Natural gas production | billion cubic feet |

350.46 |

330.47 |

6.0 |

| Realised crude oil price | USD/barrel |

75.43 |

75.21 |

0.3 |

| Realised natural gas price | RMB/cubic meter |

1.98 |

2.10 |

(5.7) |

Note: For domestic production of crude oil, 1 tonne = 7.10 barrels. For overseas production of crude oil, 1 tonne = 7.26 barrels. For production of natural gas, 1 cubic meter = 35.31 cubic feet.

Refining: The Company followed up closely with the market change, vigorously optimised production operation to maximise the overall profits along the business chain. We flexibly adjusted the product slate, and increased production of market-oriented products such as gasoline and kerosene. We scaled up export volume and optimised arrangement for exports. We controlled the progress of carrying forward the "oil to specialties" and "oil to chemicals" projects, and the structural adjustment projects and the transformation and upgrading projects were proceeded in an orderly manner. In the first quarter, the Company processed 63.30 million tonnes of crude oil, up by 1.7% year on year, yielding 38.83 million tonnes of refined oil products, up by 4.1% year on year. The refining segment realised EBIT of RMB6.887 billion.

Refining |

Unit |

Three-month period ended 31 March |

Changes |

|

|---|---|---|---|---|

2024 |

2023 |

|||

Refinery throughput |

million tonnes |

63.30 |

62.24 |

1.7 |

| Gasoline, diesel and kerosene production | million tonnes |

38.83 |

37.30 |

4.1 |

Gasoline |

million tonnes |

16.22 |

15.16 |

7.0 |

Diesel |

million tonnes |

14.75 |

15.58 |

(5.3) |

Kerosene |

million tonnes |

7.86 |

6.56 |

19.8 |

| Light chemical feedstock production | million tonnes |

10.18 |

10.61 |

(4.1) |

Light product yield |

% |

74.26 |

74.82 |

(0.56) percentage points |

Refining yield |

% |

94.94 |

94.88 |

0.06 percentage points |

Note: Including 100% production of domestic joint ventures.

Marketing and Distribution: The Company brought our advantages of integrated business into full play, strengthened the market judgement and the integration of production and sales, and made full effort to expand the market and improve profit. We carried forward differentiated marketing tactics. The sales volume of gasoline rose by 5.4% and the retail volume of vehicle LNG was up by 119.3%. We actively promoted the development of EV battery charging and swapping business, steadily stepped up efforts in demonstrating application scenarios of hydrogen mobility, and transformed to an integrated energy service provider of fuel, gas, hydrogen, electricity and non-fuel services. We carried out characteristic marketing campaigns to improve the quality and profitability for the non-fuel business. In the first quarter, total sales volume of refined oil products was 59.81 million tonnes, up by 6.5% year on year. The marketing and distribution segment realised EBIT of RMB8.678 billion.

Marketing and Distribution |

Unit |

Three-month period ended 31 March |

Changes (%) |

|

|---|---|---|---|---|

2024 |

2023 |

|||

| Total sales volume of refined oil products | million tonnes | 59.81 |

56.16 |

6.5 |

| Total domestic sales volume of refined oil products | million tonnes | 45.58 |

44.57 |

2.3 |

Retail |

million tonnes | 29.31 |

29.36 |

(0.2) |

Direct sales & Distribution |

million tonnes | 16.27 |

15.21 |

7.0 |

Note: The total sales volume of refined oil products includes the amount of trading volume.

Chemicals: In the face of tough external environment of the continuous newly-released production capacity and weak chemical margin, the Company closely followed the market demand, reinforced cost control, optimised the structure of feedstock, facilities and products with a profit-driven orientation. We maintained high utilisation rate in profitable facilities, and reduced production or shut down units of products with no marginal contribution. Integration of production, marketing, research and application was further cemented to steadily increase the proportion of high value-added products. In the first quarter, the ethylene production was 3.279 million tonnes, and the total chemicals sales volume was 19.51 million tonnes. The chemicals segment realised EBIT of RMB-1.609 billion.

Chemicals |

Unit |

Three-month period ended 31 March |

Changes (%) |

|

|---|---|---|---|---|

2024 |

2023 |

|||

| Ethylene | thousand tonnes | 3,279 |

3,347 |

(2.0) |

| Synthetic resin | thousand tonnes | 4,837 |

4,816 |

0.4 |

| Synthetic rubber | thousand tonnes | 342 |

349 |

(2.0) |

| Monomers and polymers for synthetic fibre | thousand tonnes | 2,044 |

2,034 |

0.5 |

| Synthetic fibre | thousand tonnes | 306 |

258 |

18.6 |

Note: Including 100% production of domestic joint ventures.

Capital expenditure: In the first quarter, the total capital expenditure was RMB20.5 billion. The capital expenditure of the E&P segment was RMB13.5 billion, mainly for the crude production capacity building in Jiyang and Tahe, natural gas production capacity building in West Sichuan, as well as the construction of oil and gas storage and transportation facilities, such as Longkou LNG project. The capital expenditure of the refining segment was RMB4.1 billion, mainly for Zhenhai Expansion, and technical modification of Guangzhou and Maoming refineries, etc. The capital expenditure of the marketing and distribution segment of RMB0.6 billion, mainly for the development of the integrated energy station network, the renovation of the existing marketing network, and the development of non-fuel business and construction of other projects. The capital expenditure of the chemical segment was RMB2.1 billion, mainly for the construction of ethylene projects in the second phase of Zhenhai and Maoming, etc. The capital expenditure of corporate and others was RMB0.2 billion, mainly for R&D and the construction of IT projects, etc.

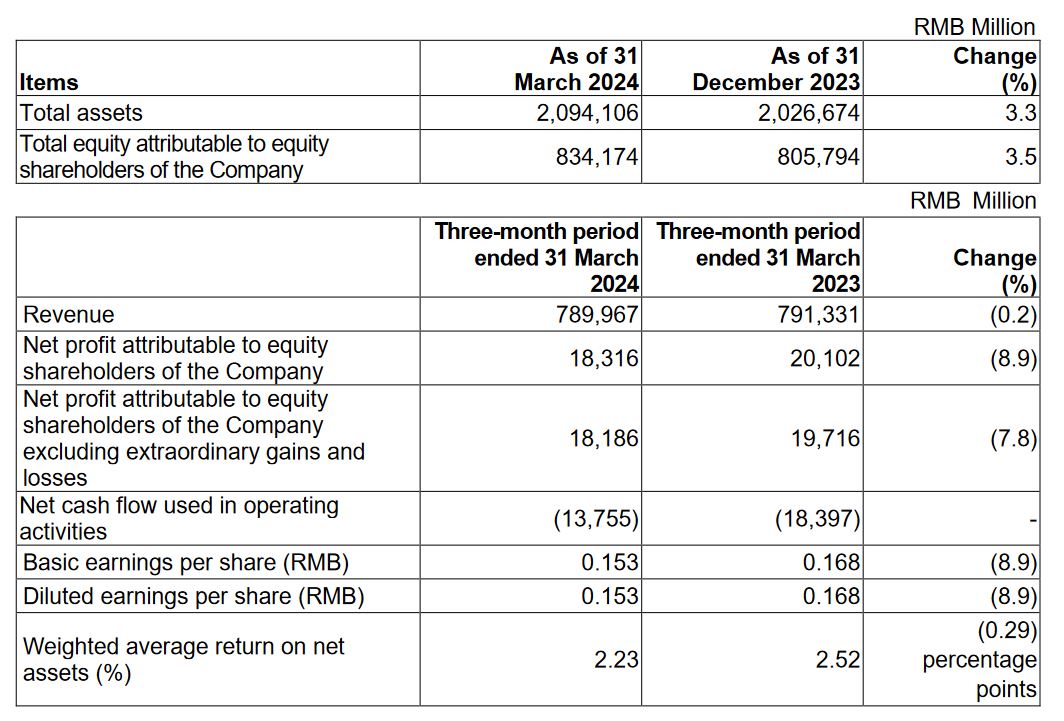

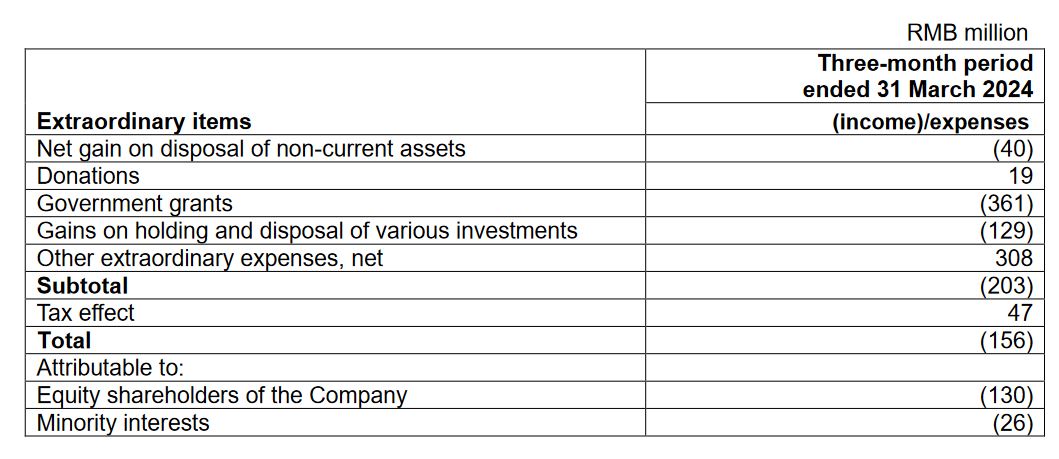

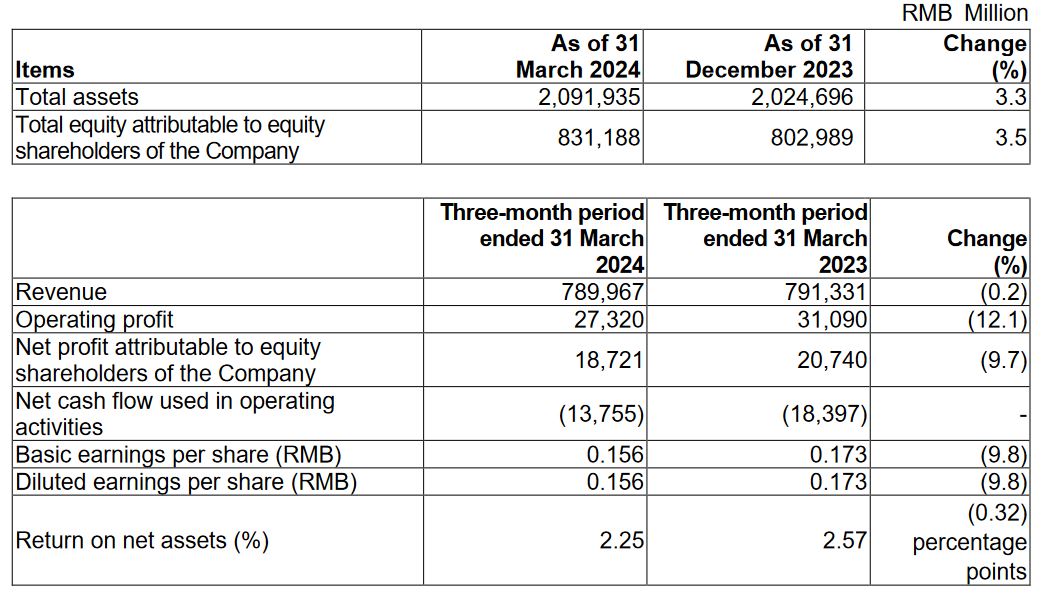

Appendix: Principal financial data and indicators

Principal financial data and indicators prepared in accordance with CASs

Principal financial data and indicators prepared in accordance with IFRS

About Sinopec Corp.

Sinopec Corp. is one of the largest integrated energy and chemical companies in China. Its principal operations include the exploration and production, pipeline transportation and sale of petroleum and natural gas; the production, sale, storage and transportation of refinery products, petrochemical products, coal chemical products, synthetic fibre, and other chemical products; the import and export, including an import and export agency business, of petroleum, natural gas, petroleum products, petrochemical and chemical products, and other commodities and technologies; and research, development and application of technologies and information; hydrogen energy business and related services such as hydrogen production, storage, transportation and sales; battery charging and swapping, solar energy, wind energy and other new energy business and related services.

Disclaimer

This press release includes "forward-looking statements". All statements, other than statements of historical facts that address activities, events or developments that Sinopec Corp. expects or anticipates will or may occur in the future (including but not limited to projections, targets, reserve volume, other estimates and business plans) are forward-looking statements. Sinopec Corp.'s actual results or developments may differ materially from those indicated by these forward-looking statements as a result of various factors and uncertainties, including but not limited to the price fluctuation, possible changes in actual demand, foreign exchange rate, results of oil exploration, estimates of oil and gas reserves, market shares, competition, environmental risks, possible changes to laws, finance and regulations, conditions of the global economy and financial markets, political risks, possible delay of projects, government approval of projects, cost estimates and other factors beyond Sinopec Corp.'s control. In addition, Sinopec Corp. makes the forward-looking statements referred to herein as of today and undertakes no obligation to update these statements.

Investor Inquiries:

Beijing

Tel:(86 10) 5996 0028

Fax:(86 10) 5996 0386

Email:ir@sinopec.com

Media Inquiries:

Hong Kong

Tel:(852) 2522 1838

Fax:(852) 2521 9955

Email:sinopec@prchina.com.hk

File: 【Press Release】Sinopec Corp. Announces 2024 Q1 Results

SOURCE: China Petroleum & Chemical Corporation

View the original press release on accesswire.com