Marla Gottschalk and Quentin Roach Add Further Supply Chain and Financial Expertise;

John Lederer to Retire at 2022 Annual Meeting

Highlights Plan to Drive Value and Governance Achievements

Sachem Head Continues to Demand Control of the Board

US Foods Holding Corp. (NYSE: USFD) (“US Foods” or the “Company”), one of the largest foodservice distributors in the United States, today announced that it has filed its preliminary proxy materials with the Securities and Exchange Commission (“SEC”) in connection with its upcoming 2022 Annual Meeting of Shareholders (the “2022 Annual Meeting”). The preliminary proxy statement is available on the investor relations section of the Company’s website at www.usfoods.com.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220328005977/en/

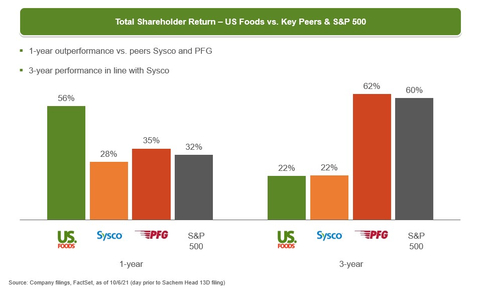

Total Shareholder Return – US Foods vs. Key Peers & S&P 500 (Graphic: Business Wire)

In connection with the filing of the preliminary proxy materials, the Board disclosed its slate of director candidates for the 2022 Annual Meeting, which includes two new independent director candidates, Marla Gottschalk and Quentin Roach, who have been appointed to the Board, effective immediately:

- Marla Gottschalk is an accomplished executive with more than 25 years of experience in Consumer Products. Ms. Gottschalk most recently served as Chief Executive Officer of The Pampered Chef Ltd., the premier direct seller of high-quality kitchen and entertaining products, from 2006 to 2013 and as President and Chief Operating Officer from 2003 to 2006. Prior to The Pampered Chef, Ms. Gottschalk served in a variety of senior roles at Kraft Foods, including as Senior Vice President of Financial Planning and Investor Relations, Executive Vice President and General Manager of the Post Cereal division, and Vice President of Marketing and Strategy of the Kraft Cheese Division. Ms. Gottschalk is currently a member of the boards of directors of Reynolds Consumer Products, Potbelly Sandwich Works, Big Lots, Inc. and privately-held UL, Inc., and was previously a strategic board advisor for privately-held Ocean Spray Cranberries, Inc. Ms. Gottschalk brings strong strategic, financial and governance acumen, informed by her prior executive and board experience, and qualifies as a financial expert.

- Quentin Roach has served as Senior Vice President and Chief Procurement Officer at Mondelez International since 2020 and brings more than two decades of global supply chain leadership experience. Prior to Mondelez, Mr. Roach served as the Chief Procurement Officer and Senior Vice President of Global Supplier Management and Workplace Enterprise Services at Merck & Co., Inc. and as the Senior Vice President and Chief Procurement Officer at Bristol Myers Squibb. Mr. Roach served in positions of increasing responsibility, including those related to supply chain management, at Bausch & Lomb, Strong Health, Delphi Corporation and General Motors Corporation. Mr. Roach has deep expertise in supplier relationship management, sourcing strategies and material procurement, as well as governance experience gained as an independent director on the board of ARMADA Supply Chain Solutions, a leading provider of supply chain management services for the foodservice industry.

As part of the Board’s refreshment process, John Lederer, US Foods’ former CEO and a director since 2010, will not stand for re-election at the 2022 Annual Meeting. The size of the Board has been temporarily increased from ten to 12 directors, effective immediately, and will revert to 11 directors, effective following the 2022 Annual Meeting.

“US Foods has demonstrated a consistent openness to change, substantially enhancing the composition and structure of our Board over the last several years to best support our efforts to create value for shareholders,” said Robert M. Dutkowsky, Chairman of the US Foods Board. “We have made every effort to work with Sachem Head to avoid a disruptive and unnecessary proxy fight, but Sachem Head has not engaged constructively. We believe that our Board, including the new additions announced today, collectively possess the right combination of relevant industry experience, expertise and fresh perspectives to oversee our management team’s execution of the Company’s strategy, which we are confident will deliver significant value to all shareholders. On behalf of the entire Board, I would like to thank John for his valuable contributions to the Board and the Company over the years. We are fortunate to have benefitted from his leadership and guidance and are incredibly grateful for all he has done for US Foods.”

Clear Plan to Drive Value Creation

US Foods recently introduced a long-range plan to drive profitable volume growth and margin expansion over the next three years. The Company’s strategy starts with a focus on profitably growing market share by delivering fresh, efficient and reliable quality and service, advancing differentiated solutions and accelerating the omni-channel platform to deliver an unmatched value proposition. Building off US Foods’ record results in 2021, the Company will further optimize gross margins by focusing on areas like increasing its private brand penetration, strategically managing vendors to lower its cost of goods, and piloting next generation pricing to dynamically optimize prices. The Company also is focused on improving operational efficiencies by bringing greater standardization and process discipline in the short term, while exploring further opportunities for automation in the long term. The Company’s plan includes a combination of programs that have successfully created shareholder value in the past, with some new initiatives that have and continue to show positive results. Over the last 18 months, the Company has added new, senior level talent and made important changes to its operating model, all of which will support the successful execution of the Company’s plan. In 2021 alone, the execution of many of these initiatives helped US Foods:

- Increase market share across all target customer types;

- Deliver 27% organic independent growth, in line with or better than peers1;

- Secure ~$1 billion in net new national customer wins over the last two years;

- Achieve the highest Gross Profit per case since IPO;

- Reduce administrative and selling costs by $130 million;

- Reduce assortment by 15%; and

- Achieve best-in-class one-year total shareholder return (TSR) of 56% as of October 6, 2021 (the last day prior to Sachem Head’s Schedule 13D), beating both US Foods’ peers and the S&P 500 and showing significant improvement from previous years, as the Company has led the post-pandemic recovery (see associated graph).

Building on this momentum, the Company expects to deliver ~$1.7 billion in Adjusted EBITDA in 2024, well ahead of pre-COVID pro forma Adjusted EBITDA of $1.45 billion2. US Foods is confident it has the right plan and the right Board and management team to capitalize on the significant opportunities ahead.

Longstanding and Ongoing Commitment to Governance Best Practices

US Foods’ director nominees for the 2022 Annual Meeting include individuals with expertise in the foodservice and restaurant industry as well as distribution, finance, technology, governance and C-suite operating experience. In addition, US Foods’ Board has a track record of effecting change in the service of US Foods’ shareholders:

- Added six new independent directors over the last four years, reflecting an average tenure of approximately four years as of the conclusion of the 2022 Annual Meeting;

- Separated the Chairman and CEO roles;

- Cultivated a Board with diverse directors comprising 45% of the proposed slate of candidates;

- Declassified the Board, as of its 2022 Annual Meeting;

- Eliminated the previous supermajority voting requirement to amend the bylaws, as highlighted in its 2021 proxy statement;

- Adopted a majority voting standard for director elections with a director resignation policy and a plurality carveout in uncontested director elections, a change that was implemented in 2021;

- Created “Value Creation Awards” in 2021, with vesting tied to rigorous TSR growth targets over a four-year performance period; and

- Implemented a rotation of committee chairs.

Sachem Head Refused to Engage in Good Faith

US Foods remains unwavering in its commitment to acting in the best interests of all shareholders and has gone to great lengths to facilitate an amicable resolution with Sachem Head to avoid a proxy contest. Since Sachem Head filed its Schedule 13D in October 2021, the US Foods Board has engaged seriously and with a sense of urgency, and the Board’s Nominating and Corporate Governance Committee approached interviews with Sachem Head’s candidates with an open mind. These are the facts:

- During private engagement between October and December 2021, Sachem Head proposed three candidates for election to the Board: Scott Ferguson (Sachem Head’s principal), Bernardo Hees and David Toy.

- In December 2021, consistent with practice and after conducting background checks, the Board interviewed each of Sachem Head’s three original nominees.

- Following the interviews, on December 17, 2021, US Foods offered Scott Ferguson a seat on the Board. The Board also offered to add a second new director with supply chain leadership experience and proposed to work with Sachem Head to identify the right candidate. Sachem Head was asking for three seats; US Foods offered two.

- After not hearing back from Sachem Head, the Board reached out again in early January to Mr. Ferguson. Mr. Ferguson made it clear there would be no path to settlement without Bernardo Hees’ involvement and did not engage beyond that.

- On February 14, 2022, Sachem Head leaked a shareholder letter to the media and then proceeded to nominate seven director candidates to the 10-member Board. This shareholder letter was the first time US Foods heard about the four additional Sachem Head candidates.

- On March 15, 2022, after conducting background checks, the Board reached out again to Sachem Head and offered to interview three of the four new candidates in another genuine attempt to explore a potential amicable resolution. Two days later, Sachem Head filed its preliminary proxy materials.

- On March 19, 2022, on a call with US Foods’ Chairman and another independent director, Mr. Ferguson refused the Board’s offer to interview any Sachem Head nominees, and demanded that the Board give Sachem Head the majority of seats on the Board. Even though he noted twice during the call that a potential proxy contest would be a “nail biter,” Mr. Ferguson further stated that he would proceed with his proxy contest if his demands were not met.

The Board remains open to constructive engagement with the goal of enhancing value for all US Foods shareholders, but notes that this requires a counterparty who is interested in finding a reasonable compromise.

Centerview Partners LLC and J.P. Morgan Securities LLC are acting as financial advisors to US Foods. Sidley Austin LLP is serving as legal counsel to US Foods.

About US Foods

With a promise to help its customers Make It, US Foods is one of America’s great food companies and a leading foodservice distributor, partnering with approximately 250,000 restaurants and foodservice operators to help their businesses succeed. With 69 broadline locations and more than 80 cash and carry stores, US Foods and its 28,000 associates provides its customers with a broad and innovative food offering and a comprehensive suite of e-commerce, technology and business solutions. US Foods is headquartered in Rosemont, Ill. Visit www.usfoods.com to learn more.

Additional Information

The Company intends to file a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the SEC in connection with the solicitation of proxies from the Company’s shareholders for the Company’s 2022 annual meeting of shareholders. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a copy of the definitive proxy statement, an accompanying WHITE proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge in the “SEC Filings” subsection of the “Financial Information” section of the Company’s Investor Relations website at https://ir.usfoods.com/investors or by contacting the Company’s Investor Relations department at Melissa.Napier@usfoods.com, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Participants in the Solicitation

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s shareholders in connection with matters to be considered at the Company’s 2022 annual meeting of shareholders. Information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers is included in the Company’s Proxy Statement on Schedule 14A for its 2021 annual meeting of shareholders, filed with the SEC on April 2, 2021, the Company’s Annual Report on Form 10-K for the year ended January 1, 2022, filed with the SEC on February 17, 2022, and in the Company’s Current Reports on Form 8-K filed with the SEC from time to time. Changes to the direct or indirect interests of the Company’s directors and executive officers are set forth in SEC filings on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4. These documents are available free of charge as described above. Updated information regarding the identities of potential participants and their direct or indirect interests, by security holdings or otherwise, in the Company will be set forth in the definitive proxy statement for the Company’s 2022 annual meeting of shareholders and other relevant documents to be filed with the SEC, if and when they become available.

Forward-Looking Statements

Statements in this press release which are not historical in nature are “forward-looking statements” within the meaning of the federal securities laws. These statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,” or similar expressions and are based upon various assumptions and our experience in the industry, as well as historical trends, current conditions, and expected future developments. However, you should understand that these statements are not guarantees of performance or results and there are a number of risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed in the forward-looking statements, including, among others: cost inflation/deflation and commodity volatility; competition; reliance on third party suppliers; interruption of product supply or increases in product costs; changes in our relationships with customers and group purchasing organizations; our ability to increase or maintain the highest margin portions of our business; effective integration of acquisitions; achievement of expected benefits from cost savings initiatives; fluctuations in fuel costs; economic factors affecting consumer confidence and discretionary spending; changes in consumer eating habits; our reputation in the industry; labor relations and costs; access to qualified and diverse labor; cost and pricing structures; changes in tax laws and regulations and resolution of tax disputes; governmental regulation; product recalls and product liability claims; adverse judgments or settlements resulting from litigation; disruptions of existing technologies and implementation of new technologies; cybersecurity incidents and other technology disruptions; management of retirement benefits and pension obligations; extreme weather conditions, natural disasters and other catastrophic events; risks associated with intellectual property, including potential infringement; indebtedness and restrictions under agreements governing indebtedness; potential interest rate increases; risks related to the impact of the ongoing COVID-19 outbreak on our business, suppliers, consumers, customers and employees; and potential costs associated with shareholder activism.

Non-GAAP Financial Measures

We report our financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). However, Adjusted EBITDA is a non-GAAP financial measure. We believe Adjusted EBITDA provides meaningful supplemental information about our operating performance because it excludes amounts that we do not consider part of our core operating results when assessing our performance. EBITDA is Net income (loss), plus Interest expense-net, Income tax provision (benefit), and Depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for (1) Restructuring costs and asset impairment charges; (2) Share-based compensation expense; (3) the noncash impact of LIFO reserve adjustments; (4) loss on extinguishment of debt; (5) Business transformation costs; and (6) other gains, losses or costs as specified in the agreements governing our indebtedness.

Management uses non-GAAP financial measures (a) to evaluate our historical and prospective financial performance as well as our performance relative to our competitors as they assist in highlighting trends, (b) to set internal sales targets and spending budgets, (c) to measure operational profitability and the accuracy of forecasting, (d) to assess financial discipline over operational expenditures, and (e) as an important factor in determining variable compensation for management and employees. EBITDA and Adjusted EBITDA are also used in connection with certain covenants and restricted activities under the agreements governing our indebtedness. We also believe these and similar non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties to evaluate companies in our industry.

We caution readers that our definition of Adjusted EBITDA may not be calculated in the same manner as similar measures used by other companies. The reconciliations of this non-GAAP financial measure to the most comparable GAAP financial measure is included in the schedule attached to this press release.

US FOODS HOLDING CORP. Non-GAAP Reconciliation (Unaudited) |

|||||||||||

|

|

For the quarter ended |

|||||||||

|

|

Consolidated US Foods |

|||||||||

($ in millions, except share and per share data) |

|

January 1, 2022 |

|

January 2, 2021 |

|

Change |

|

% |

|||

Net income (loss) available to common shareholders (GAAP) |

|

$ 59 |

|

|

$ (23 |

) |

|

$ 82 |

|

|

NM |

Series A Preferred Stock Dividends |

|

(10 |

) |

|

(13 |

) |

|

3 |

|

|

(23.1)% |

Net income (loss) (GAAP) |

|

69 |

|

|

(10 |

) |

|

79 |

|

|

NM |

Interest expense—net |

|

55 |

|

|

60 |

|

|

(5 |

) |

|

(8.3)% |

Income tax provision (benefit) |

|

20 |

|

|

(15 |

) |

|

35 |

|

|

NM |

Depreciation expense |

|

81 |

|

|

86 |

|

|

(5 |

) |

|

(5.8)% |

Amortization expense |

|

11 |

|

|

20 |

|

|

(9 |

) |

|

(45.0)% |

EBITDA (Non-GAAP) |

|

236 |

|

|

141 |

|

|

95 |

|

|

67.4% |

Adjustments: |

|

|

|

|

|

|

|

|

|||

Share-based compensation expense (1) |

|

12 |

|

|

11 |

|

|

1 |

|

|

9.1% |

LIFO reserve adjustments (2) |

|

15 |

|

|

16 |

|

|

(1 |

) |

|

(6.3)% |

Business transformation costs (3) |

|

5 |

|

|

14 |

|

|

(9 |

) |

|

(64.3)% |

COVID-19 bad debt benefit (4) |

|

— |

|

|

(18 |

) |

|

18 |

|

|

(100.0)% |

COVID-19 product donations and inventory adjustments (5) |

|

— |

|

|

10 |

|

|

(10 |

) |

|

(100.0)% |

COVID-19 other related expenses (6) |

|

2 |

|

|

(2 |

) |

|

4 |

|

|

(200.0)% |

Business acquisition and integration related costs and other (7) |

|

(8 |

) |

|

2 |

|

|

(10 |

) |

|

NM |

Adjusted EBITDA (Non-GAAP) |

|

262 |

|

|

174 |

|

|

88 |

|

|

50.6% |

NM - Not Meaningful

- Share-based compensation expense for expected vesting of stock awards and employee stock purchase plan.

- Represents the non-cash impact of LIFO reserve adjustments.

- Consists primarily of costs related to significant process and systems redesign across multiple functions.

- Includes the changes in the reserve for doubtful accounts expense reflecting the collection risk associated with our customer base as a result of the COVID-19 pandemic.

- Includes COVID-19 related expenses related to inventory adjustments and product donations.

- Includes COVID-19 costs that we are permitted to addback under certain agreements governing our indebtedness.

- Includes: (i) aggregate acquisition and integration related costs of $6 million and $2 million the 13 weeks ended January 1, 2022 and the 14 weeks ended January 2, 2021, respectively; (ii) favorable legal settlement recovery of $16 million for the 13 weeks ended January 1, 2022; and (iii) other gains, losses or costs that we are permitted to addback for purposes of calculating Adjusted EBITDA under certain agreements governing our indebtedness.

1 Organic independent volume growth excludes extra week in the 4th Quarter of FY 2020.

2 Assumes full run-rate synergies of $85 million from both Smart Foodservice and Food Group acquisitions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220328005977/en/

Contacts

INVESTOR CONTACT:

Melissa Napier

847-720-2767

Melissa.Napier@usfoods.com

Bruce Goldfarb / Pat McHugh

Okapi Partners

212-297-0720

MEDIA CONTACT:

Jamie Moser / Matthew Sherman

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449