Restored Indico Field Production in the CPO-5 Block

More Exploration Success in Colombia and Ecuador

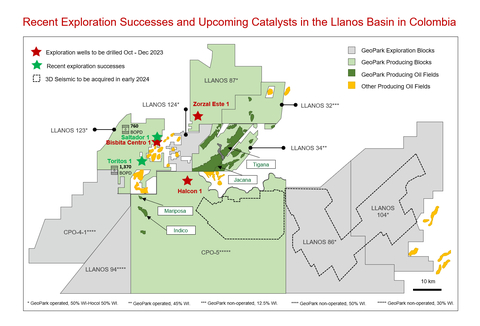

Multiple Exploration Catalysts Underway

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent Latin American oil and gas explorer, operator and consolidator, today announces its operational update for the three-month period ended September 30, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231018554166/en/

Recent Exploration Successes and Upcoming Catalysts in the Llanos Basin in Colombia (Graphic: Business Wire)

Oil and Gas Production Back Online

- GeoPark is currently producing approximately 39,000 boepd1

- 3Q2023 consolidated average oil and gas production of 34,778 boepd, below its potential mainly due to temporarily shut-in production in the CPO-5 block (GeoPark non-operated, 30% WI) in Colombia and in the Fell block (GeoPark operated, 100% WI) in Chile

- 12 rigs currently in operation (7 drilling rigs and 5 workover rigs), including 5 drilling rigs on exploration and appraisal wells

Colombia - Llanos Basin: New Exploration Success and Drilling High-Potential Prospects

Llanos 34 Block (GeoPark operated, 45% WI):

- The third horizontal development well initiated testing in early October 2023 and is currently producing approximately 1,800 bopd from the Mirador formation

- GeoPark has already spudded the fourth and fifth horizontal wells, which are expected to reach total depth in November 2023

- The block is currently producing approximately 54,200 bopd gross (vs 53,367 bopd gross in 3Q2023)

CPO-5 Block:

- The operator spudded the Halcon 1 exploration well in late September, targeting the exploration potential of the Guadalupe formation in the northern part of the CPO-5 block, close to the southern part of the Llanos 34 block, expected to reach total depth in late October 2023

- In late September 2023, the operator received approval from the regulator (ANH) to resume production in the Indico 6 and Indico 7 wells2, which are currently producing 7,500-8,000 bopd gross in aggregate. These wells could potentially increase and stabilize their combined production at approximately 9,000 bopd gross before year-end, depending on reservoir performance

- The block is currently producing approximately 23,800 bopd gross (vs 16,877 bopd gross in 3Q2023)

Llanos 123 Block (GeoPark operated, 50% WI-Hocol 50% WI):

- The Toritos 1 exploration well reached total depth in September 2023

- Logging information indicated hydrocarbon potential in the Barco (Guadalupe) and Gacheta formations

- The well initiated testing activities in late September 2023 and is currently producing approximately 1,370 bopd of 14 degrees API with a 1.5% water cut from the Barco (Guadalupe) formation

- The block is currently producing approximately 2,140 bopd gross (vs 626 bopd gross in 3Q2023)

Ecuador - Oriente Basin: New Exploration Success

Perico Block (GeoPark non-operated, 50% WI):

- The Perico Centro 1 exploration well reached total depth in September 2023

- Preliminary logging information indicated hydrocarbon potential in the U-sand formation

- The well initiated testing in late September 2023 and is currently producing approximately 830 bopd of 28 degrees API with a 1% water cut

- The block is currently producing approximately 2,400 bopd gross (vs 1,318 bopd gross in 3Q2023)

Returning More Value to Shareholders and Maintaining a Strong Balance Sheet

- Quarterly Dividend of $0.132 per share, or $7.5 million, paid on September 7, 2023, representing an annualized dividend of approximately $30 million (or $0.52 per share), a 5% dividend yield3

- Repurchased 2.2 million shares, or 4% of total shares outstanding, for $23.6 million since January 1, 2023

- Cash and cash equivalents of $106 million4 as of September 30, 2023

Upcoming Catalysts

- Drilling 10-12 gross wells in 4Q2023, targeting attractive conventional, short-cycle development and exploration projects

-

Key projects include:

- CPO-5 block: Currently drilling the Halcon 1 exploration well

- Llanos 123 block: Currently drilling the Bisbita Centro 1 exploration well

- Llanos 87 block (GeoPark operated, 50% WI-Hocol 50% WI): Currently drilling the Zorzal Este 1 exploration well

- Llanos 34 block: Currently drilling 2 additional horizontal development wells

- Perico block: Currently drilling the Perico Norte 4 appraisal well

GeoPark Chief Financial Officer Transition

GeoPark announced that Veronica Davila, Chief Financial Officer, will be stepping down from her role to pursue new career opportunities effective November 30, 2023. The Company has commenced a formal search process for a replacement and has appointed Ignacio Mazariegos to serve as interim Chief Financial Officer, upon Ms. Davila’s departure.

Mr. Mazariegos joined GeoPark in 2010 and currently serves as Director of New Business, where he leads and supports the Company’s growth and profitability through acquisitions and strategic partnerships. Mr. Mazariegos and Ms. Davila will work closely over the coming weeks to ensure a smooth transition.

Andres Ocampo, Chief Executive Officer said: “On behalf of our entire team, I would like to thank Veronica for her commitment and contributions to GeoPark. Since joining the Company in 2016, Veronica has been a valuable team member, and we wish her well in her future endeavors.”

Breakdown of Quarterly Production by Country

The following table shows production figures for 3Q2023, as compared to 3Q2022:

|

3Q2023 |

3Q2022 |

||||

Total

|

Oil

|

Gas

|

Total

|

% Chg. |

||

Colombia |

31,780 |

31,668 |

672 |

|

33,338 |

-5% |

Ecuador |

659 |

659 |

- |

|

1,194 |

-45% |

Chile |

1,565 |

172 |

8,361 |

|

2,425 |

-35% |

Brazil |

774 |

11 |

4,578 |

|

1,439 |

-46% |

Total |

34,778 |

32,510 |

13,610 |

|

38,396 |

-9% |

a) |

Includes royalties and other economic rights paid in kind in Colombia for approximately 5,045 bopd in 3Q2023. No royalties were paid in kind in Ecuador, Chile or Brazil. Production in Ecuador is reported before the Government’s production share of approximately 194 bopd. |

Quarterly Production

(boepd) |

3Q2023 |

2Q2023 |

1Q2023 |

4Q2022 |

3Q2022 |

Colombia |

31,780 |

33,045 |

32,580 |

33,749 |

33,338 |

Ecuador |

659 |

634 |

990 |

1,259 |

1,194 |

Chile |

1,565 |

1,690 |

1,988 |

2,291 |

2,425 |

Brazil |

774 |

1,212 |

1,020 |

1,134 |

1,439 |

Total a |

34,778 |

36,581 |

36,578 |

38,433 |

38,396 |

Oil |

32,510 |

33,672 |

33,801 |

35,451 |

34,875 |

Gas |

2,268 |

2,909 |

2,777 |

2,982 |

3,521 |

a) |

In Colombia, production includes royalties paid in kind, and in Ecuador it is shown before the Government’s production share. |

Oil and Gas Production Update

Consolidated:

Oil and gas production in 3Q2023 was 34,778 boepd, down by 9% compared to 3Q2022, due to lower production in Colombia, Chile, Brazil and Ecuador. Oil represented 93% and 91% of total reported production in 3Q2023 and 3Q2022, respectively.

GeoPark is currently producing approximately 39,000 boepd5.

Colombia:

Average net oil and gas production in Colombia decreased by 5% to 31,780 boepd in 3Q2023 compared to 33,338 boepd in 3Q2022, mainly resulting from lower production in the Llanos 34 and CPO-5 blocks, partially offset by higher production in the Platanillo block (GeoPark operated, 100% WI) and to a lesser extent, new production coming on in the Llanos 123 block.

Oil and gas production in GeoPark’s main blocks in Colombia:

- Llanos 34 block net average production decreased by 7% to 24,015 bopd (or 53,367 bopd gross) in 3Q2023 compared to 3Q2022, mainly due to the natural decline of the fields and to a lesser extent temporary local blockades that partially affected production and operations for 10 days

- CPO-5 block net average production decreased by 10% to 5,063 bopd (or 16,877 bopd gross) in 3Q2023 compared to 3Q2022. Production in 3Q2023 has been below its potential due to shut-ins of the Indico 6 and Indico 7 wells, which are currently producing approximately 7,500-8,000 bopd gross in aggregate. These two wells could potentially increase and stabilize their combined production at approximately 9,000 bopd gross before year-end, depending on reservoir performance

- Platanillo block average production increased by 35% to 2,027 bopd in 3Q2023 compared to 3Q2022

- Llanos 123 block net average production was 313 bopd (or 626 bopd gross) in 3Q2023, reflecting partial production from the Saltador 1 exploration well that initiated testing during the quarter

Recent Activity in the Llanos Basin

Llanos 34 Block

- The third horizontal development well initiated testing in early October 2023 and is currently producing approximately 1,800 bopd from the Mirador formation

- GeoPark has already spudded the fourth and fifth horizontal wells, which are expected to reach total depth in November 2023

CPO-5 Block

- The operator spudded the Halcon 1 exploration well in late September, targeting the exploration potential of the Guadalupe formation in the northern part of the CPO-5 block, close to the southern part of the Llanos 34 block

- Preliminary activities are underway to acquire over 230 square kilometers of 3D seismic, expected to be executed in early 2024

- This 3D seismic acquisition is expected to add additional exploration prospects to GeoPark’s organic exploration inventory

Llanos 123 Block

- The Toritos 1 exploration well reached total depth in September 2023

- Logging information indicated hydrocarbon potential in the Barco (Guadalupe) and Gacheta formations

- Testing activities initiated in late September 2023, and the well is currently producing approximately 1,370 bopd of 14 degrees API with a 1.5% water cut from the Barco (Guadalupe) formation

- The Saltador 1 exploration well, which started testing in July 2023, was the first exploration success in the Llanos 123 block and continues producing approximately 760 bopd of 16 degrees API with a 4% water cut from the Barco (Guadalupe) formation

- Based on these positive results, on October 12, 2023, GeoPark spudded a new exploration well, Bisbita Centro 1, targeting an exploration prospect located 1.5 km south of the Saltador 1 well

Llanos 87 Block

- GeoPark spudded the Zorzal Este 1 exploration well on October 5, 2023, and it is expected to reach total depth in early November 2023

Llanos 124 Block (GeoPark operated, 50% WI-Hocol 50% WI):

- Cucarachero 1 exploration well reached total depth in August 2023

- The well encountered reservoir in the Cuervo formation with no evidence of hydrocarbons

Llanos 86 and Llanos 104 Blocks (GeoPark operated, 50% WI-Hocol 50% WI):

- The Llanos 86 and Llanos 104 blocks are adjacent to the eastern side of the CPO-5 block

- Preliminary activities are underway to acquire over 650 square kilometers of 3D seismic, expected to be executed in early 2024

- This 3D seismic acquisition is expected to add additional exploration prospects to GeoPark’s organic exploration inventory

Ecuador:

Average net oil production in Ecuador before the Government’s share decreased 45% to 659 bopd in 3Q2023, (approximately 465 bopd after the Government’s share), compared to 1,194 bopd in 3Q2022, mainly due to the natural decline of the fields.

Ecuador is currently producing approximately 2,400 bopd gross, following the successful drilling and testing of the Yin 2 and the Perico Centro 1 wells.

The Government’s production share varies with oil prices and is approximately 30-40%, considering an Oriente crude oil price of $70-100 per bbl.

Recent Activity in the Perico Block

- The Perico Centro 1 exploration well reached total depth in September 2023

- Preliminary logging information indicated hydrocarbon potential in the U-sand formation

- The well initiated testing in late September 2023 and is currently producing approximately 830 bopd of 28 degrees API with a 1% water cut

- The Yin 2 well started production tests in mid-August 2023 and is currently producing approximately 740 bopd of 30 degrees API with a 1% water cut from the U-sand formation

- Based on these positive results, on October 8, 2023 the operator spudded a new appraisal well, the Perico Norte 4, which is expected to reach total depth in late October 2023

Chile:

Average net production in Chile decreased 35% to 1,565 boepd in 3Q2023 compared to 2,425 boepd in 3Q2022, resulting from the natural decline of the fields, limited drilling activities and temporarily shut-in oil production due to commercial negotiations. GeoPark reached an agreement with the oil off-taker and as of August 2023 it gradually started reopening temporarily shut-in oil production of 400 bopd.

The production mix was 89% natural gas (vs 84% in 3Q2022) and 11% light oil (vs 16% in 3Q2022).

Brazil:

Average net production in the Manati field (GeoPark non-operated, 10% WI) in Brazil decreased 46% to 774 boepd in 3Q2023 compared to 1,439 boepd in 3Q2022. Production in Manati was temporarily interrupted for 24 days during 3Q2023 due to lower gas demand. Production restarted in late September 2023 and the Manati field’s net production is approximately 1,550 boepd.

The production mix was 99% natural gas and 1% oil and condensate in both 3Q2023 and 3Q2022.

Other News

Notice of change of Auditor (from EY Argentina to EY Colombia)

GeoPark announced that it changed its auditors from Pistrelli, Henry Martin y Asociados S.R.L. (or EY Argentina) to Ernst & Young Audit S.A.S. (or EY Colombia), being both member firms of EY Global Limited.

EY Argentina resigned as auditor of GeoPark effective September 29, 2023, and GeoPark’s Board of Directors appointed EY Colombia, as the successor auditor of the Company until the next Annual General Meeting.

EY Argentina’s audit reports on GeoPark’s consolidated financial statements as of and for the years ended December 31, 2022 and 2021 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. In addition, there have been no reportable events or disagreements (as defined in Item 16F(a)(1) (iv) and (v) of Form 20-F) between GeoPark and EY Argentina.

Reporting Date for 3Q2023 Results Release, Conference Call and Webcast

GeoPark will report its 3Q2023 financial results on Wednesday, November 8, 2023, after the market close. In conjunction with the 3Q2023 results press release, GeoPark management will host a conference call on November 9, 2023, at 10:00 am (Eastern Daylight Time) to discuss the 3Q2023 financial results.

To listen to the call, participants can access the webcast located in the “Invest with Us” section of the Company’s website at www.geo-park.com, or by clicking below:

https://events.q4inc.com/attendee/344411932

Interested parties may participate in the conference call by dialing the numbers provided below:

United States Participants: +1 (646) 904-5544

International Participants: +1 (833) 470-1428

Passcode: 865697

Please allow extra time prior to the call to visit the website and download any streaming media software that might be required to listen to the webcast.

An archive of the webcast replay will be made available in the “Invest with Us” section of the Company’s website at www.geo-park.com after the conclusion of the live call.

1 |

Estimated average production from October 10, 2023, to October 16, 2023. |

2 |

These two wells were drilled in late 2022 and have been shut-in following the ANH request that the operator suspend production until certain required surface facilities were completed. |

3 |

Based on GeoPark’s average market capitalization from September 1 to September 29, 2023. |

4 |

Unaudited. |

5 |

Estimated average production from October 10, 2023, to October 16, 2023. |

NOTICE

Additional information about GeoPark can be found in the “Invest with Us” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and percentages included in this press release have been rounded for ease of presentation. Percentages included in this press release have not in all cases been calculated on the basis of such rounded amounts, but on the basis of such amounts prior to rounding. For this reason, certain percentages in this press release may vary from those obtained by performing the same calculations on the basis of the amounts in the financial statements. Similarly, certain other amounts included in this press release may not sum due to rounding.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this press release can be identified by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding various matters, including, production guidance, shareholder returns, Adjusted EBITDA, capital expenditures and free cash flow. Forward-looking statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

Oil and gas production figures included in this release are stated before the effect of royalties paid in kind, consumption and losses. Annual production per day is obtained by dividing total production by 365 days.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231018554166/en/

Contacts

INVESTORS:

Stacy Steimel

Shareholder Value Director

T: +562 2242 9600

ssteimel@geo-park.com

Miguel Bello

Market Access Director

T: +562 2242 9600

mbello@geo-park.com

Diego Gully

Investor Relations Director

T: +55 21 99636 9658

dgully@geo-park.com

MEDIA:

Communications Department

communications@geo-park.com