Nighthawk Gold Corp. (“Nighthawk” or the “Company”) (TSX: NHK; OTCQX: MIMZF) reports significant drill assay results from the 24 and 27 Deposits (“24/27 Deposit”) located in the Colomac Centre Area and approximately 2 kilometres (“km”) east of the Colomac Main Deposit.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230906918070/en/

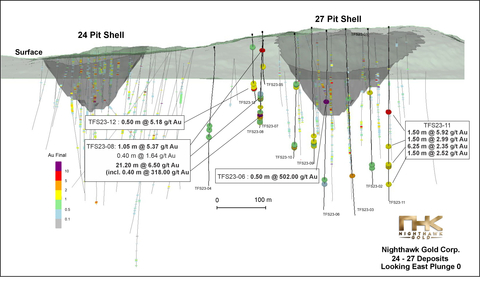

Figure 1 – 24/27 Deposit Drilling – Isometric View Looking East (Graphic: Business Wire)

Table 1 – Highlight Drill Assay Results from the 24/27 Deposit Drilling

Hole ID |

Deposit |

Highlight Assay Result |

TFS23-06 |

24/27 |

16.14 ounces per tonne gold (“oz/t Au”) (or 502.00 grams per tonne (“g/t Au”)) over 0.50 metres (“m”) |

TFS23-08 |

24/27 |

10.22 oz/t Au (or 318.00 g/t Au) over 0.40 m (within 6.50 g/t Au over 21.20 m) |

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut-off grade.

Nighthawk President & CEO Keyvan Salehi commented, “The 24/27 Deposit drilling returned spectacular results. We intersected some of the highest grades at the deposit in areas outside of the estimated PEA pit-shells1. We believe we are just scratching the surface on this zone’s potential, with more high-grade, near-surface gold to be discovered with additional drilling. If we were to discover a feeder source for these high-grade intercepts, with wider mineralized widths, it could be a game-changer for the Company. We are excited for our future drill programs, which will prioritize the 24/27 Deposit, given this immense potential and the proximity to the Colomac Main Deposit."

24/27 Deposit Drilling

The 24/27 Deposit is in the Colomac Centre Area and located 2 km northeast of the Colomac Main Deposit. The 24/27 Deposit represents two zones of near-surface, gold mineralization about 250 m apart. See Figure 4 for the 24/27 Deposit local map of the drilling. Mineralization at the 24/27 Deposit is hosted by grey-white smoky quartz veins in volcanic rocks along the geological contact with sedimentary rocks to the east. The contact is highlighted by a prominent electromagnetic anomaly. The combination of geophysics and geology will be utilized to generate new exploration targets along the underexplored 12 km contact (See Figure 7 for the 24/27 Deposit Electromagnetic Survey Map).

The 2023 drilling focused on the strike and depth extensions of the deposit, particularly in areas outside and in between the two pit-shells (as estimated in the Colomac Gold Project PEA1). The Company intersected significant high-grade gold mineralization in hole TFS23-06 just below and to the west of the 27 deposit pit-shell (see Figures 1, 2 and 5) and TFS23-08 along strike to the north of the 27 deposit pit-shell (see Figures 1, 3 and 6). The intercept expanded gold mineralization into the untested areas, potentially expanding the 27 deposit pit-shell and reducing the mineralization gap between the 24 and 27 deposit pit-shells. Coarse gold samples were intersected in 9 of the 12 drill holes.

The area between the 24 and 27 deposit pit-shells remains highly prospective for additional expansion of mineralization. Future step-out drilling, with systematic spaced holes to infill the untested areas between the two zones of mineralization, is required. In addition, surface exploration (e.g., prospecting and detailed mapping) along the 12 km geological contact zone that hosts the 24/27 Deposit is warranted to help generate targets for further exploration drilling.

Please see Tables 1 and 2 for the 24/27 Deposit Drill Assay Highlights and Summary Table, respectively.

Table 2 – Drill Assay Results Summary – 24/27 Deposit

Hole ID |

From (m) |

To (m) |

Interval Core Length (m) |

Grade (g/t Au) |

||||

24/27 Deposit |

||||||||

TFS23-01 |

No Significant Intervals |

|||||||

TFS23-02 |

120.00 |

121.00 |

1.00 |

1.81 |

||||

TFS23-03 |

274.50 |

275.45 |

0.95 |

3.59 |

||||

TFS23-04 |

179.00 |

180.00 |

1.00 |

0.54 |

||||

and |

195.00 |

196.00 |

1.00 |

0.60 |

||||

TFS23-05 |

58.35 |

59.25 |

0.90 |

1.24 |

||||

TFS23-06 |

137.10 |

137.60 |

0.50 |

502.00 |

||||

TFS23-07 |

135.00 |

142.50 |

7.50 |

1.05 |

||||

TFS23-08 |

33.00 |

34.05 |

1.05 |

5.37 |

||||

and |

139.85 |

140.25 |

0.40 |

1.64 |

||||

and |

149.00 |

170.20 |

21.20 |

6.50 |

||||

including |

155.00 |

155.40 |

0.40 |

318.00 |

||||

TFS23-09 |

234.15 |

244.50 |

10.35 |

0.64 |

||||

TFS23-10 |

101.25 |

108.20 |

6.95 |

0.60 |

||||

and |

237.00 |

244.50 |

7.50 |

1.04 |

||||

TFS23-11 |

164.00 |

165.50 |

1.50 |

5.92 |

||||

and |

232.00 |

233.50 |

1.50 |

2.99 |

||||

and |

268.00 |

274.25 |

6.25 |

2.35 |

||||

and |

308.00 |

309.50 |

1.50 |

2.52 |

||||

TFS23-12 |

109.00 |

110.00 |

1.00 |

1.30 |

||||

and |

117.00 |

122.00 |

5.00 |

0.86 |

||||

including |

120.00 |

120.50 |

0.50 |

5.18 |

||||

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

Hole ID |

Easting |

Northing |

Elevation |

Length |

Azimuth |

Dip |

||||||

NAD 83 Zone 11 |

(m) |

|||||||||||

24/27 Deposit |

||||||||||||

TFS23-01 |

595400.1 |

7144734 |

388.15 |

15.80 |

95 |

-58 |

||||||

TFS23-02 |

595400.1 |

7144734 |

388.15 |

300.00 |

95 |

-58 |

||||||

TFS23-03 |

595391 |

7144780 |

387.75 |

351.00 |

95 |

-61 |

||||||

TFS23-04 |

595440.1 |

7145050 |

358.59 |

306.00 |

95 |

-50 |

||||||

TFS23-05 |

595459.8 |

7144950 |

369.27 |

99.00 |

95 |

-45 |

||||||

TFS23-06 |

595360 |

7144819 |

385 |

360.00 |

95 |

-58 |

||||||

TFS23-07 |

595400 |

7144951 |

383 |

196.00 |

95 |

-50 |

||||||

TFS23-08 |

595400 |

7144951 |

383 |

180.00 |

95 |

-61 |

||||||

TFS23-09 |

595388 |

7144850 |

390 |

282.00 |

95 |

-53 |

||||||

TFS23-10 |

595357 |

7144885 |

380 |

270.00 |

95 |

-54 |

||||||

TFS23-11 |

595407 |

7144691 |

391 |

342.00 |

95 |

-57 |

||||||

TFS23-12 |

595409 |

7144972 |

379 |

150.00 |

95 |

-45 |

||||||

Technical Information

The pit-shells in Figures 1, 4, 5, 6, and 7 are from the Colomac Gold Project PEA1 and was completed by Ausenco Engineering Canada Inc. Nighthawk has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. Drill core samples were transported in security-sealed bags for analyses at ALS Global Assay Laboratory in Vancouver, BC (“ALS Global”). ALS Global is an ISO/IEC 17025 accredited laboratory. The halved drill core is stored on site and pulps are returned and stored for record. As part of its QA/QC program, Nighthawk inserts external gold standards (low to high-grade), blanks and duplicates every 20 samples in addition to the standards, blanks, and pulp duplicates inserted by ALS Global.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for Nighthawk, who is the “Qualified Person” as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About Nighthawk Gold Corp.

Nighthawk is a Canadian-based gold exploration and development company with control of 947 km2 of District Scale Property located north of Yellowknife, Northwest Territories, Canada. The Company’s flagship asset is the large-scale, Colomac Gold Project. The 2023 PEA1 demonstrated the Project’s potential for 290,000oz/year operation over 11.2-year conceptual mine life that could generate a C$1.2 billion NPV5% and 35% IRR (after taxes) based on a US$1,600/oz gold price assumption. Nighthawk’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards rapidly advancing its assets towards a development decision.

Keyvan Salehi |

Salvatore Curcio |

Allan Candelario |

||

President & CEO |

CFO |

VP, Investor Relations & Corporate Development |

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to the Company’s Mineral Resource Estimates, PEA and the potential extractability of the open pit and underground mineralization, the potential expansion of Mineral Resource Estimates, the potential for the economics of the Project to be realized and to improve, the potential for higher-grade assay results, the potential of the Project to be developed, the large-scale and robust nature of the Project PEA, the advancement of the PEA towards a higher-level economic study, the continued exploration and drilling initiatives and having the necessary funding required to complete these initiatives, the prospectivity of exploration targets, the potential discovery of a ‘feeder source” the potential economic viability of the assets, the status of the Project camp site, and the advancement of projects towards a development decision. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “add” or “additional”, “advancing”, “anticipates” or “does not anticipate”, “appears”, “believes”, “can be”, “conceptual”, “confidence”, “continue”, “convert” or “conversion”, “deliver”, “demonstrating”, “estimates”, “encouraging”, “expand” or “expanding” or “expansion”, “expect” or “expectations”, “forecasts”, “forward”, “goal”, “improves”, “increase”, “intends”, “justification”, “plans”, “potential” or “potentially”, “promise”, “prospective”, “prioritize”, “reflects”, “scheduled”, “suggesting”, “support”, “updating”, “upside”, “will be” or “will consider”, “work towards”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”.

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nighthawk to be materially different from those expressed or implied by such forward-looking information, including risks associated with required regulatory approvals, the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, the ongoing wars and their effect on supply chains, environmental risks, COVID-19 and other pandemic risks, permitting timelines, capex, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Nighthawk's annual information form for the year ended December 31, 2022, available on www.sedarplus.ca. Although Nighthawk has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Nighthawk does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Cautionary Statement regarding the PEA

The reader is advised that the PEA referenced in this press release is only a conceptual study of the potential viability of the Project's mineral resource estimates, and the economic and technical viability of the Project and its estimated mineral resources has not been demonstrated. The PEA is preliminary in nature and provides only an initial, high-level review of the Project's potential and design options; there is no certainty that the PEA will be realized. The PEA conceptual LOM plan and economic model include numerous assumptions and mineral resource estimates including Inferred mineral resource estimates. Inferred mineral resource estimates are too speculative geologically to have any economic considerations applied to such estimates. There is no guarantee that Inferred mineral resource estimates will be converted to Indicated or Measured mineral resources, or that Indicated or Measured resources can be converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability, and as such there is no guarantee the Project economics described herein will be achieved. Mineral resource estimates may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, and other factors, as more particularly described in the Cautionary Statements at the end of this news release.

1For more information on the Colomac Gold Project Preliminary Economic Assessment (“PEA”), please refer to the NI 43-101 technical report titled “Colomac Gold Project NI 43-101 Technical Report and Preliminary Economic Assessment, Northwest Territories, Canada” dated June 9, 2023 which is available on SEDAR+ www.sedarplus.ca the Company’s website (www.nighthawkgold.com).

View source version on businesswire.com: https://www.businesswire.com/news/home/20230906918070/en/

The 24/27 Deposit drilling returned spectacular results...We believe we are just scratching the surface on this zone’s potential, with more high-grade, near-surface gold to be discovered with additional drilling.

Contacts

FOR FURTHER INFORMATION PLEASE CONTACT:

NIGHTHAWK GOLD CORP.

Tel: +1 (416) 863-2105; Email: info@nighthawkgold.com

Website: www.nighthawkgold.com