VANCOUVER, British Columbia, June 27, 2024 (GLOBE NEWSWIRE) -- First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) ("First Atlantic", "FAN", or "the Company") is delighted to welcome Dr. Ron Britten, a world-renowned nickel expert with a specialty in awaruite, as a Technical Advisor for the Company's wholly owned Atlantic Nickel Project located in Newfoundland, Canada. Dr. Britten's expertise in nickel deposits is exemplified by his discovery of the Decar awaruite project in British Columbia. His deep understanding of this unique nickel mineralization will be invaluable to First Atlantic's exploration and development efforts. The Company is also pleased to announce the appointment of Mr. Rahim Kassim-Lakha, a global investment and capital markets professional, as a Strategic Advisor. These strategic additions to the advisory team, effective immediately, position First Atlantic to lead the charge in exploring and developing the first awaruite nickel project in Atlantic Canada.

Highlights

- Dr. Ron Britten, world-renowned nickel expert, joins First Atlantic as Technical Advisor, having discovered and advanced the first large-scale awaruite nickel project in North America with over 10 billion pounds of nickel contained1.

- Recipient of H.H. "Spud" Huestis Award for excellence in prospecting and mineral exploration, Britten authored scientific papers on awaruite nickel as a new deposit type, including "Regional Metallogeny and Genesis of a New Deposit Type— Disseminated Awaruite (Ni3Fe) Mineralization Hosted in the Cache Creek Terrane2" in Society of Economic Geologists in 2017.

- Britten's expertise in awaruite nickel deposits is crucial to First Atlantic's 30km district scale Atlantic Nickel Project in Newfoundland.

- Rahim Kassim-Lakha, CEO of Blue Sail Capital, joins as Strategic Advisor for corporate development and financing.

- $2.1 million charity flow-through financing completed, with a strategic investor acquiring a 9.98% equity position pursuant to an Investor Rights Agreement.

Geological Advisor - Ron Britten

First Atlantic is excited to welcome Dr. Ron Britten as a Technical Advisor. Britten, a recipient of the H.H. "Spud" Huestis Award, has over 40 years of experience, specializing in nickel-iron alloy (awaruite) exploration and development. He discovered and advanced the first large-scale awaruite nickel project in North America, which led to a resource containing over 10 billion pounds of nickel. Britten has authored scientific papers on awaruite nickel as a new deposit type, including a publication in the prestigious Economic Geology journal.

As a co-founder of First Point Minerals Corp. (later FPX Nickel Corp.), Britten played a crucial role in exploring and advancing the Baptiste awaruite deposit. He employs a systematic approach, focusing on mapping, sampling, and geophysics to design specialized programs for discovering and delineating awaruite nickel mineralization. The Company believes Britten will be a valuable asset in the continued exploration and development of the Atlantic Nickel Project.

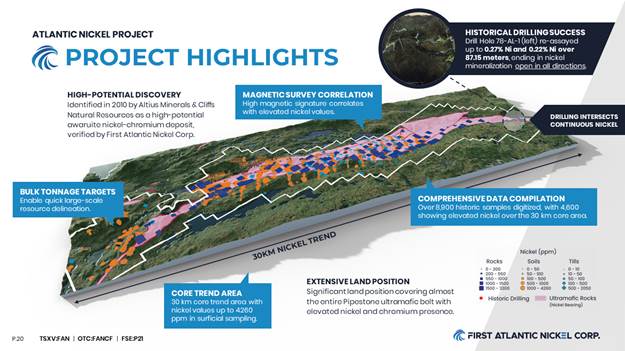

Figure 1: Atlantic Nickel Project Highlights

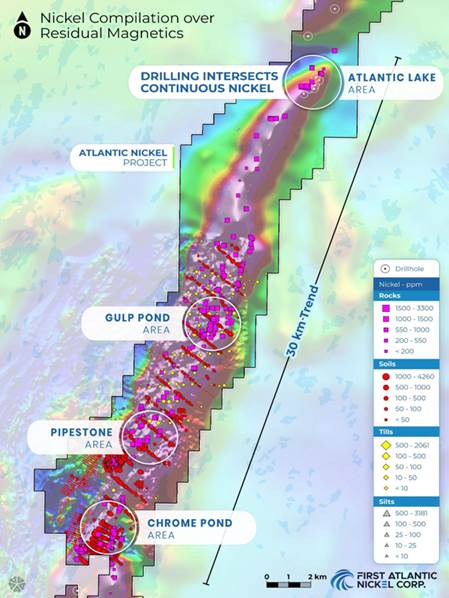

Figure 2: Atlantic Nickel Project map displaying priority target areas (zones) with nickel sample results overlaid on magnetic survey data. These zones remain open along trend.

Adrian Smith, CEO of First Atlantic, comments, "We are delighted to welcome Ron Britten as a Technical Advisor. Ron's experience in nickel, including discovering and advancing the Decar project in British Columbia, North America's only defined awaruite nickel resource with a 10 billion pound nickel endowment, will be invaluable to First Atlantic. The Decar project has attracted strategic partners such as Toyota, Outokumpu, Sumitomo Mining, JOGMEC and other strategic investors. With Ron's expertise and our recently completed financing, First Atlantic is well positioned to lead the charge in exploring and developing the first large-scale awaruite nickel project in Atlantic Canada. We look forward to Ron's contributions in helping us achieve this exciting goal."

Figure 3: Ron Britten, PhD., receiving the H.H. "Spud" Huestis Award for excellence in prospecting and mineral exploration in recognition of their efforts in identifying and commencing development of a new type of nickel deposit.

Strategic Financial Advisor - Rahim Kassim-Lakha

First Atlantic is thrilled to have Rahim Kassim-Lakha join the team as a Strategic Advisor. Kassim-Lakha, the founder and CEO of Blue Sail Capital, brings over 28 years of experience in global investing, capital markets expertise, and M&A advisory. Before establishing Blue Sail Capital, he held senior and executive roles at renowned institutions, including PE firm, Fidelity Capital in Boston, and US Global Investors in Texas, where he managed over $1 Billion USD in assets under management with three award-winning funds.

As a Strategic Advisor, Kassim-Lakha will leverage his capital markets expertise to guide strategic decisions and evaluate corporate development opportunities. His extensive experience in raising capital and structuring financial transactions will be a significant asset as First Atlantic advances its projects and seeks to maximize shareholder value.

Mr. Kassim-Lakha commented, "I look forward to assisting First Atlantic as it advances the Atlantic Nickel Project and other corporate initiatives. First Atlantic is amassing a very talented team and I am pleased to join at such an integral time in the Company's growth and development."

$2.1 Million Financing Closed Led by Strategic Investor

First Atlantic recently closed a financing for $2,084,999.91 with securities issued at $0.21 and no warrants, at a 58% premium to the Company’s 10 VWAP (see new release dated June 20, 2024) which was led by a corporate strategic investor who took a 9.98% stake in the Company. The Company wishes to clarify that the securities issued were charity flow-through common shares, not flow-through common shares as previously noted. Upon closing, the Company and the corporate strategic investor also entered into an Investor Rights Agreement, which will grant the investor the right to participate in subsequent equity financing to maintain their current interest up to 9.98%. Pursuant to the Investor Rights Agreement, First Atlantic is unable to disclose the identity of the corporate strategic investor or provide any details that would directly or indirectly reveal the investor's identity. The operating team is now focused on executing a fully funded planned 5,000m drilling campaign exploring for multi-billion-ounce nickel deposits in its 30-kilometer core nickel trend in the Pipestone Ophiolite Complex in Newfoundland.

Following the Company’s announcement on May 14, 2024, regarding the engagement of Think Ink Marketing Data and Email Services, Inc. for public relations marketing services, the Company reports that, under the terms of the agreement, it paid an initial 20% of the contract amount (as disclosed on May 14, 2024) as an up-front deposit upon signing and it will pay the remaining 16% of the contract amount per month for services during months two through six. These payments are funded by proceeds from the private placement that closed in December 2023, as well as from warrant and stock option exercises completed by the Company.

Investors are invited to sign up for the official FAN (First Atlantic Nickel) List found at www.fanickel.com and can follow First Atlantic Nickel on the following social media.

https://twitter.com/FirstAtlanticNi

https://www.facebook.com/firstatlanticnickel

https://www.linkedin.com/company/firstatlanticnickel/

For more information:

First Atlantic Nickel Relations

Robert Guzman

Tel: +1 844 592 6337

Rob@fanickel.com

http://www.fanickel.com

Disclosure

Adrian Smith, P.Geo., is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company that owns 100% of the Atlantic Nickel Project, a large scale significant nickel awaruite project in Newfoundland and Labrador, Canada. By eliminating the need for smelting, nickel in the form of awaruite reduces dependence on foreign entities of concern for both supply and processing, thereby strengthening supply chain security. In 20223, the US Government designated nickel as a critical mineral, highlighting its importance to the nation's economy and security.

The Atlantic Nickel Project is a special asset due to its unique combination of size, location, proximity to infrastructure, and the presence of awaruite. By developing this domestic awaruite nickel project, First Atlantic aims to enhance supply chain security for the stainless steel and electric vehicle industries in the USA, Canada, and Europe. The Company's strategic location and focus on awaruite nickel position it to play a key role in meeting the growing demand for responsibly sourced nickel in these sectors.

The Company is committed to responsible exploration, environmental stewardship, and working closely with local communities to create sustainable economic opportunities. With its experienced team and the project's significant potential, the Company is well-positioned to contribute to the future of the nickel industry and the global transition to a cleaner, more secure energy future.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the purpose of the engagement of the technical advisor and financial advisor, the Company’s objectives, goals or future plans, statements, and estimates of market conditions. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. Additional factors and risks including various risk factors discussed in the Company’s disclosure documents which can be found under the Company’s profile on http://www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

____________________________

3 https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/16bb713e-7fa8-4ca4-8d1b-cce773efc024

https://www.globenewswire.com/NewsRoom/AttachmentNg/37c4e278-e7bd-4ec8-875c-63799c74f8bc

https://www.globenewswire.com/NewsRoom/AttachmentNg/b1dca34e-43dd-4ab1-8cc1-cf2241826bea