Snowflake Inc. (NYSE: SNOW) is a cloud-native data warehouser in the computer and technology sector, offering companies cloud-based data platform-as-a-service (PaaS) solutions. Snowflake's shares collapsed over 20% on its fiscal Q4 2024 earnings release. Despite beating consensus estimates, it delivered a one-two punch to the gut with the surprise retirement of its CEO of 5 years, Frank Slootman and soft fiscal 2025 guidance.

The New CEO May User in the AI Era for Snowflake

Its new CEO, Sridhar Ramaswamy, was a senior vice president of AI and search at Alphabet Inc. (NASDAQ: GOOGL), which Google owns. CEO Slootman was often criticized for being behind the curve in integrating and offering artificial intelligence (AI) functionality and tools. The appointment of an experienced AI executive to usher in the AI era for Snowflake is a bullish move. Former CEO Slootman will remain chairman of the board. On March 27, 2024, CEO Ramaswamy disclosed the purchase of nearly $5 million of stock or 31,542 shares at $158.52 in an SEC filing. This brings the total ownership in his Ramaswamy Trust to 224,181 shares.

Centralized Data Warehouse

Snowflake is a one-stop shop to store, manage and analyze massive amounts of data efficiently and scale elastically within the cloud infrastructure of Amazon.com Inc. (NASDAQ: AMZN), AWS, Microsoft Co. (NASDAQ: MSFT) and Google Cloud. Snowflake customers can leverage artificial intelligence (AI) and machine learning (ML) within the data platform thanks to data sharing capabilities, scalable infrastructure and integration capabilities with popular AI and ML frameworks. Check out the sector heatmap on MarketBeat. Get AI-powered insights on MarketBeat.

Blazing Growth

Snowflake reported its fiscal Q4 2024 EPS of 35 cents, beating the 18 cents consensus analyst estimates by 17 cents. Revenues surged 32% YoY to $774.7 million versus $761.04 million consensus estimates. Its remaining performance obligations (RPOs) rose 41% YoY to $5.2 billion. Its net revenue retention rate was 131% in the quarter. It grew its trailing 12-month customers with over $1 million in product revenues to 461, up 39% YoY. The company serves 691 of the Forbes Global 2000 companies as customers, up 8% YoY.

Soft Fiscal 2025 Guidance

Snowflake expects fiscal Q1 2025 product revenues of $745 million to $750 million, or 26% to 27% growth. Non-GAAP operating margins are expected to be around 3%. Fiscal full-year 2025 revenues are expected to grow 22% to $3.25 billion. This is down compared to the 38% full-year 2024 growth rate. Non-GAAP operating margins are expected to be around 6%, down 200 bps.

Former CEO and Chairman Slootman commented, "Snowflake finished fiscal 2024 with a 38% year-over-year product revenue growth, totaling $2.67 billion. Non-GAAP adjusted free cash flow was $810 million, representing 56% year-over-year growth." Slootman concluded, "We are successfully campaigning the largest enterprises globally as more companies and institutions make Snowflake's Data Cloud the platform of their AI and data strategy."

Analyst Actions

The analysts were busy with ratings and price target changes. On February 29, 2024, Morgan Stanley cut its rating to Equal-Weight from Overweight and lowered its price target to $175, down from $230. Macquarie upgraded SNOW to Outperform from Neutral. HSBC Securities downgraded SNOW to a Reduce from Hold. On March 15, Guggenheim upgraded SNOW to Neutral from Sell. On March 18, 2024, Mooness, Crespi & Hardt upgraded to Neutral from a Sell rating. On March 19, 2024, Redburn Atlantic downgraded shares of SNOW to a Sell from Neutral, cutting its price target to $125 from $180.

Snowflake analyst ratings and price targets are at MarketBeat. Snowflake peers and competitor stocks can be found with the MarketBeat stock screener.

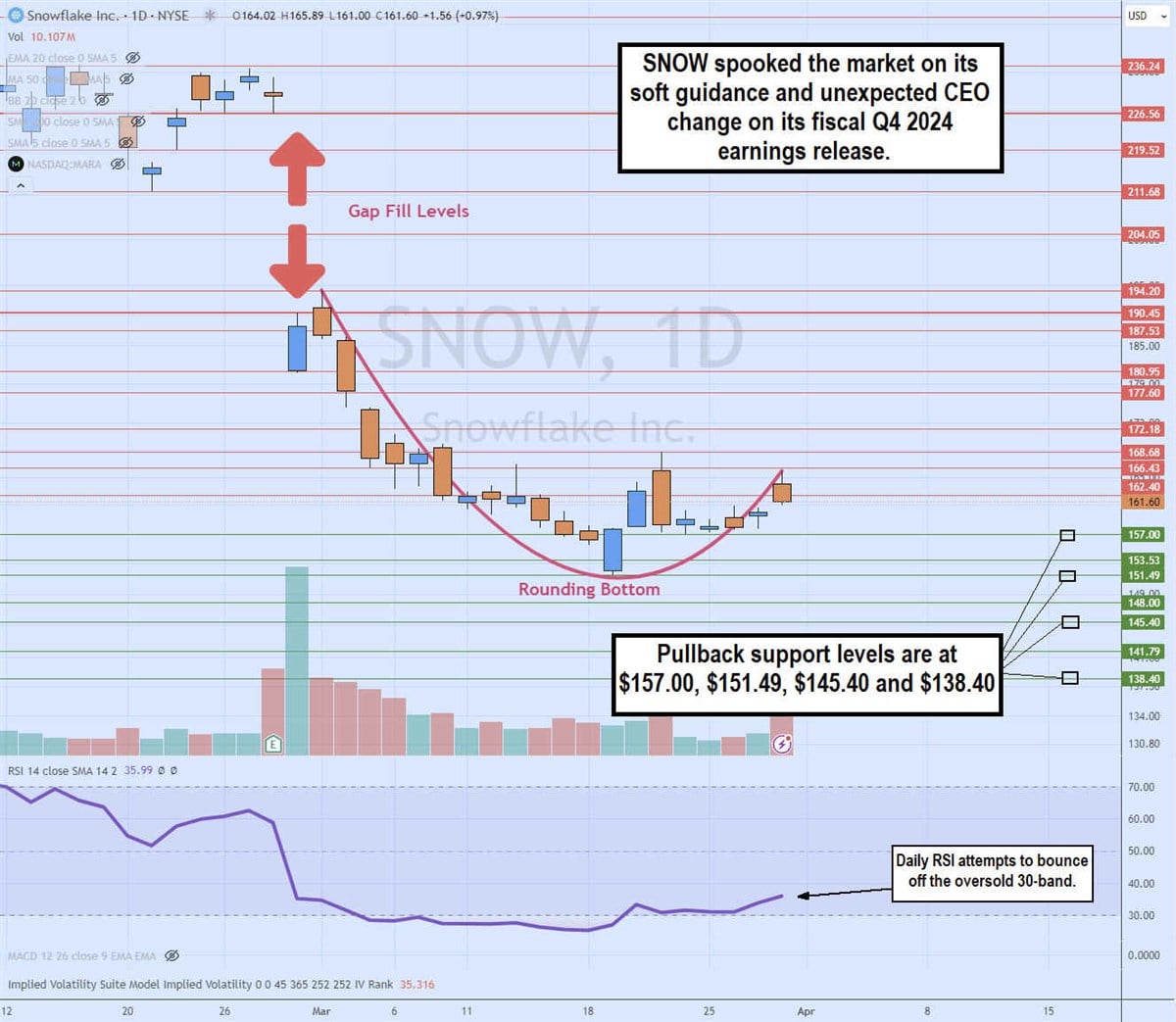

Daily Rounding Bottom

The daily candlestick chart for SNOW illustrates a rounding bottom pattern. SNOW gapped down from $226.56 to $194.20 on its soft guidance and abrupt and unexpected CEO change announced during its fiscal Q4 2024 earnings release on February 29, 2024. Shares continued to fall to a low of $151.49 on March 19, 2024. A rounding bottom formed off the lows as shares attempted to climb back up, powered by the daily relative strength index (RSI) bouncing off the 30-band. Pullback support levels are at $157.00, $151.49, $145.40 and $138.40.