Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Torrid (NYSE:CURV) and the best and worst performers in the apparel retailer industry.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 0.5% below.

While some apparel retailer stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.7% since the latest earnings results.

Torrid (NYSE:CURV)

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

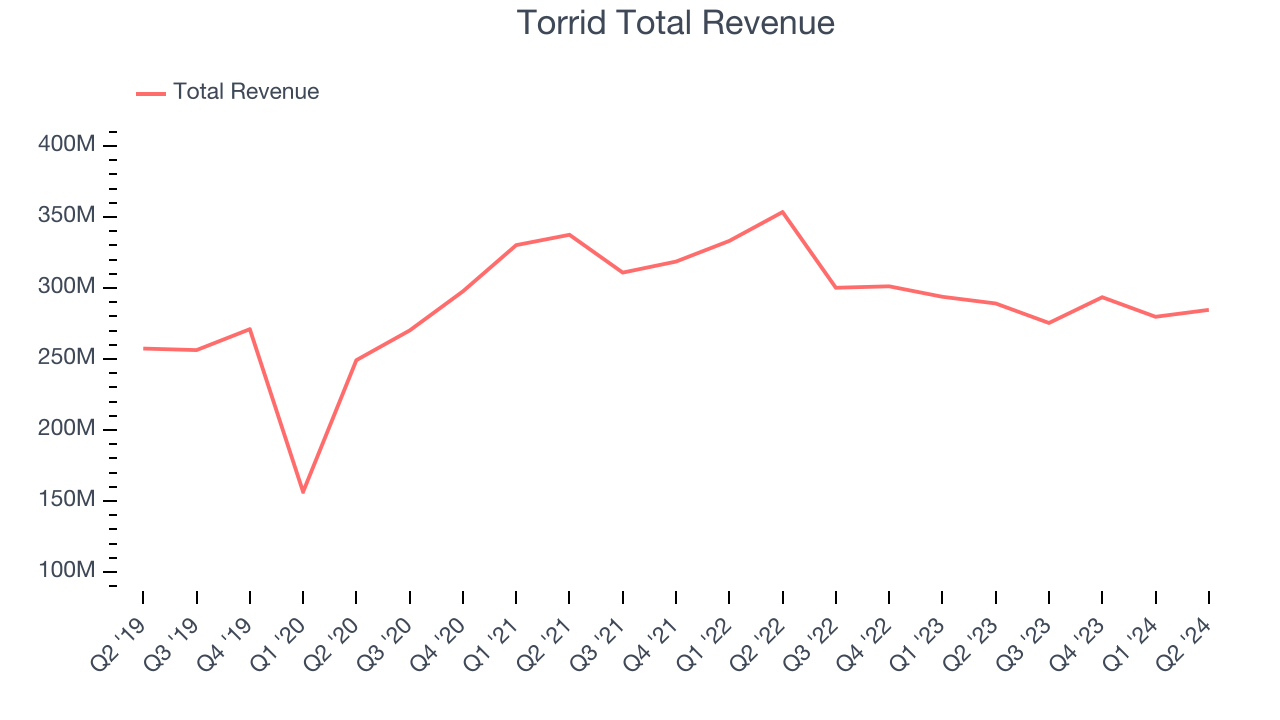

Torrid reported revenues of $284.6 million, down 1.6% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with optimistic EBITDA guidance for the next quarter and a solid beat of analysts’ EBITDA estimates.

Lisa Harper, Chief Executive Officer, stated, “We are very pleased with our second quarter performance, which came in at the high end of sales guidance and exceeded our adjusted EBITDA expectations.”

Torrid pulled off the highest full-year guidance raise but had the slowest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 34% since reporting and currently trades at $4.05.

Is now the time to buy Torrid? Access our full analysis of the earnings results here, it’s free.

Best Q2: Gap (NYSE:GAP)

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GAP) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

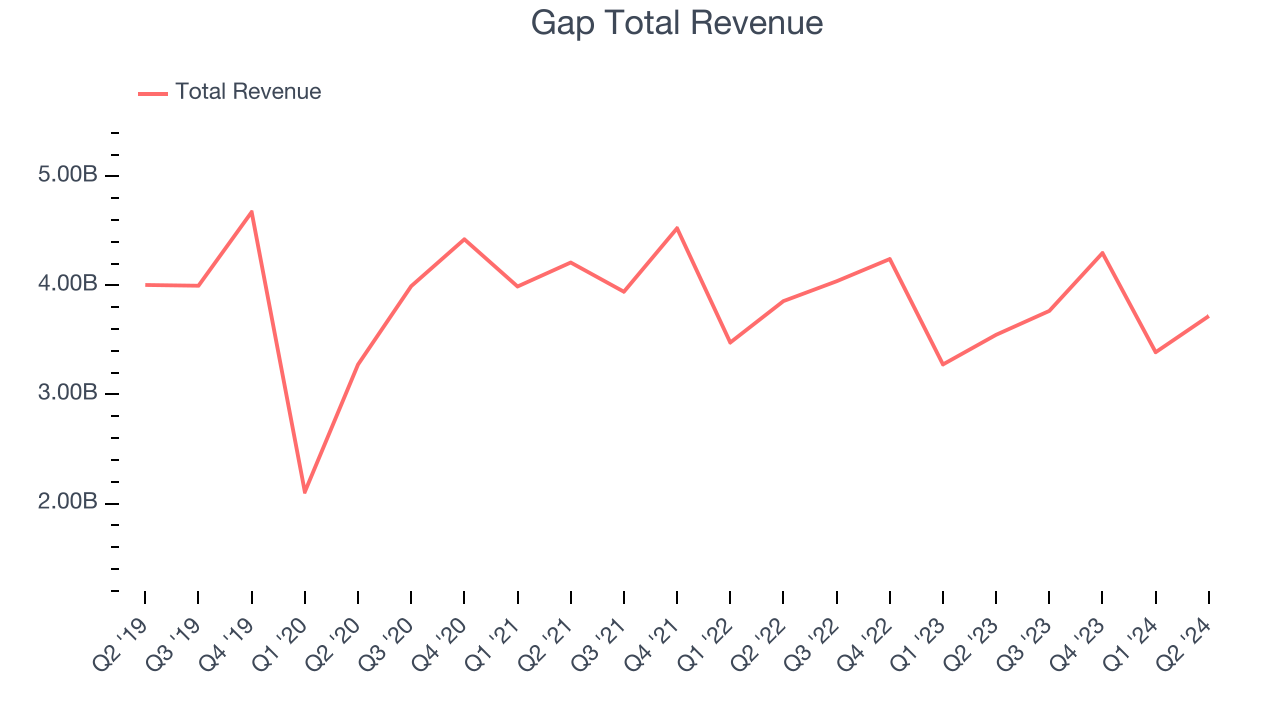

Gap reported revenues of $3.72 billion, up 4.8% year on year, outperforming analysts’ expectations by 2.6%. The business had a stunning quarter with an impressive beat of analysts’ earnings and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.4% since reporting. It currently trades at $21.90.

Is now the time to buy Gap? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: American Eagle (NYSE:AEO)

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

American Eagle reported revenues of $1.29 billion, up 7.5% year on year, falling short of analysts’ expectations by 1.4%. It was a slower quarter as it posted a miss of analysts’ EBITDA and gross margin estimates.

As expected, the stock is down 17.3% since the results and currently trades at $17.94.

Read our full analysis of American Eagle’s results here.

Tilly's (NYSE:TLYS)

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Tilly's reported revenues of $162.9 million, up 1.8% year on year. This result met analysts’ expectations. It was a strong quarter as it also put up an impressive beat of analysts’ earnings and gross margin estimates.

The stock is down 14.9% since reporting and currently trades at $4.04.

Read our full, actionable report on Tilly's here, it’s free.

Abercrombie and Fitch (NYSE:ANF)

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Abercrombie and Fitch reported revenues of $1.13 billion, up 21.2% year on year. This print beat analysts’ expectations by 4.1%. It was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ earnings estimates.

Abercrombie and Fitch delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 16.2% since reporting and currently trades at $139.80.

Read our full, actionable report on Abercrombie and Fitch here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.