Cross border payment processor Flywire (NASDAQ: FLYW) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 27.2% year on year to $156.8 million. Guidance for next quarter’s revenue was optimistic at $125 million at the midpoint, 2.3% above analysts’ estimates. Its GAAP profit of $0.30 per share was also 90.8% above analysts’ consensus estimates.

Is now the time to buy Flywire? Find out by accessing our full research report, it’s free.

Flywire (FLYW) Q3 CY2024 Highlights:

- Revenue: $156.8 million vs analyst estimates of $146.4 million (7.1% beat)

- EPS: $0.30 vs analyst estimates of $0.16 ($0.14 beat)

- EBITDA: $42,200 vs analyst estimates of $39.45 million (99.9% miss)

- Revenue Guidance for Q4 CY2024 is $125 million at the midpoint, above analyst estimates of $122.2 million

- EBITDA guidance for the full year is $78 million at the midpoint, above analyst estimates of $75.86 million

- Gross Margin (GAAP): 65.2%, in line with the same quarter last year

- Operating Margin: 12.9%, up from 9.6% in the same quarter last year

- EBITDA Margin: 0%, down from 22.3% in the same quarter last year

- Free Cash Flow was $188.8 million, up from -$21.72 million in the previous quarter

- Market Capitalization: $2.25 billion

“Our third quarter results highlight our ability to capture higher payment volumes with new and existing clients, signaling the growth potential within our accounts and verticals.” said Mike Massaro, CEO of Flywire.

Company Overview

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

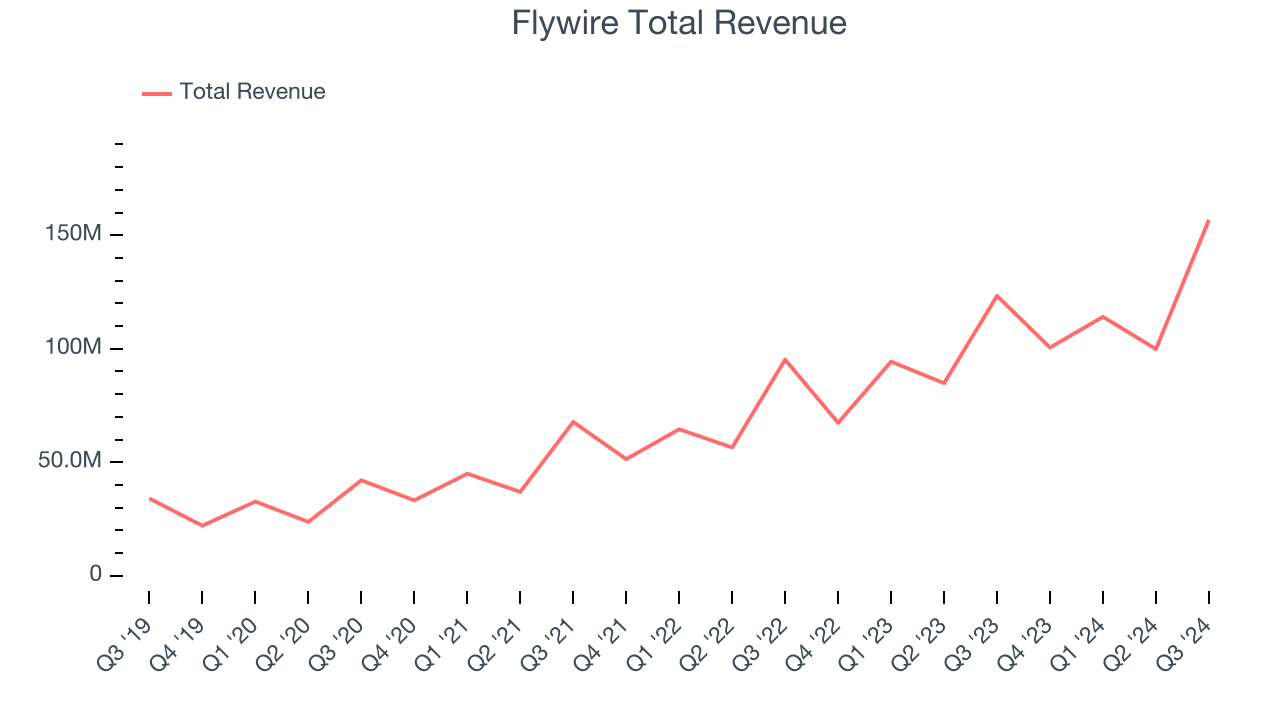

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Flywire grew its sales at an exceptional 37.1% compounded annual growth rate. This is encouraging because it shows Flywire’s offerings resonate with customers, a helpful starting point.

This quarter, Flywire reported robust year-on-year revenue growth of 27.2%, and its $156.8 million of revenue topped Wall Street estimates by 7.1%. Management is currently guiding for a 24.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.9% over the next 12 months, a deceleration versus the last three years. This projection is still noteworthy and illustrates the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

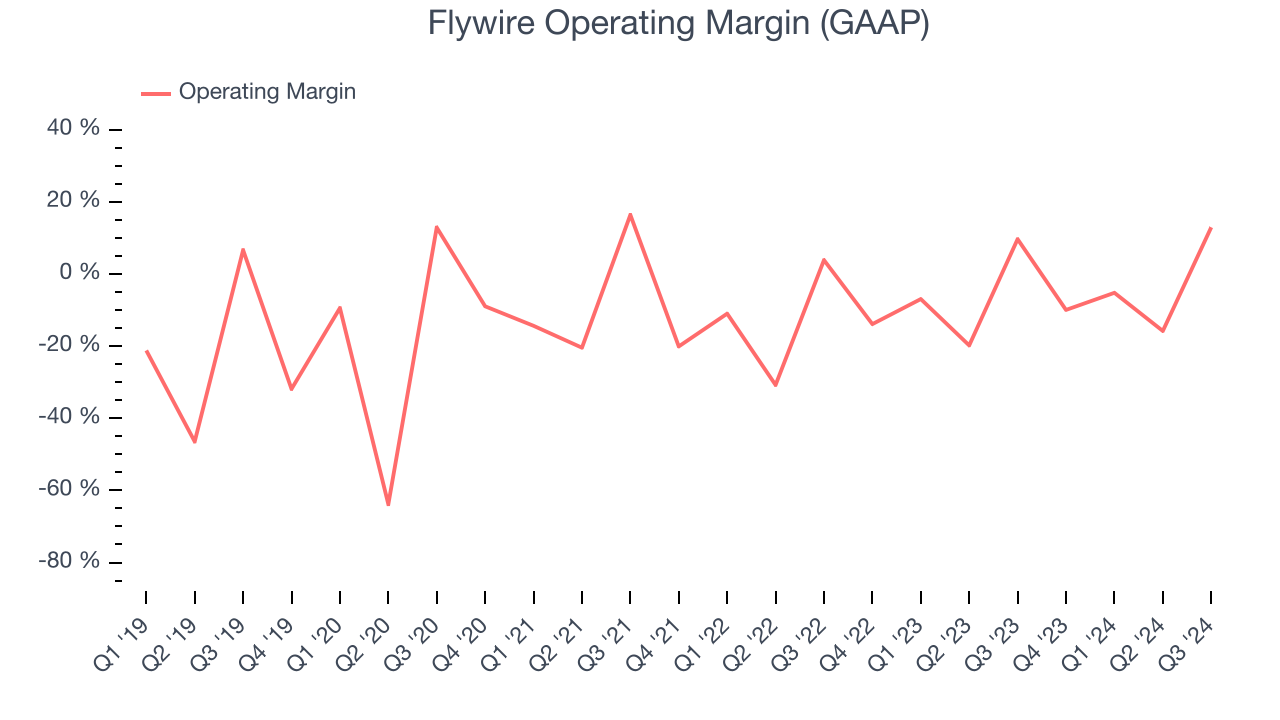

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to sales and R&D. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Flywire was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.4% over the last year. Unprofitable, high-growth software companies require extra attention because they spend loads of money to capture market share. As seen in its fast revenue growth, however, this strategy seems to have paid off so far, but it’s unclear what would happen if Flywire reeled back its investments. We’re still optimistic the business can continue growing and reach profitability once maturing.

Over the last year, Flywire’s expanding sales gave it operating leverage, and its annual margin rose by 3.2 percentage points. Still, it will take much more for the company to show consistent profitability.

This quarter, Flywire generated an operating profit margin of 12.9%, up 3.3 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Key Takeaways from Flywire’s Q3 Results

We were impressed by Flywire’s strong gross margin improvement this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter was mixed but still had some key positives. The stock traded up 5.1% to $19.23 immediately after reporting.

Flywire had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.