Young adult apparel retailer Tilly’s (NYSE:TLYS) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell by 13.8% year on year to $143.4 million. On the other hand, next quarter’s revenue guidance of $152.5 million was less impressive, coming in 9.5% below analysts’ estimates. Its GAAP loss of $0.43 per share was 16.2% below analysts’ consensus estimates.

Is now the time to buy Tilly's? Find out by accessing our full research report, it’s free.

Tilly's (TLYS) Q3 CY2024 Highlights:

- Revenue: $143.4 million vs analyst estimates of $140.8 million (13.8% year-on-year decline, 1.8% beat)

- Adjusted EPS: -$0.43 vs analyst expectations of -$0.37 (16.2% miss)

- Adjusted EBITDA: -$10.77 million vs analyst estimates of -$8.71 million (-7.5% margin, 23.7% miss)

- Revenue Guidance for Q4 CY2024 is $152.5 million at the midpoint, below analyst estimates of $168.5 million

- EPS (GAAP) guidance for Q4 CY2024 is -$0.38 at the midpoint, missing analyst estimates

- Operating Margin: -9.8%, down from -0.5% in the same quarter last year

- Free Cash Flow was -$25.05 million compared to -$10.79 million in the same quarter last year

- Locations: 246 at quarter end, down from 249 in the same quarter last year

- Same-Store Sales rose 3.4% year on year (-9% in the same quarter last year)

- Market Capitalization: $136 million

"Our third quarter results included our best quarterly comp sales performance since fiscal 2021, our first month of positive comp sales since February 2022 during fiscal August, and our second consecutive quarter of year-over-year store traffic growth," commented Hezy Shaked, Co-Founder, Executive Chairman, President and Chief Executive Officer.

Company Overview

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

Tilly's is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

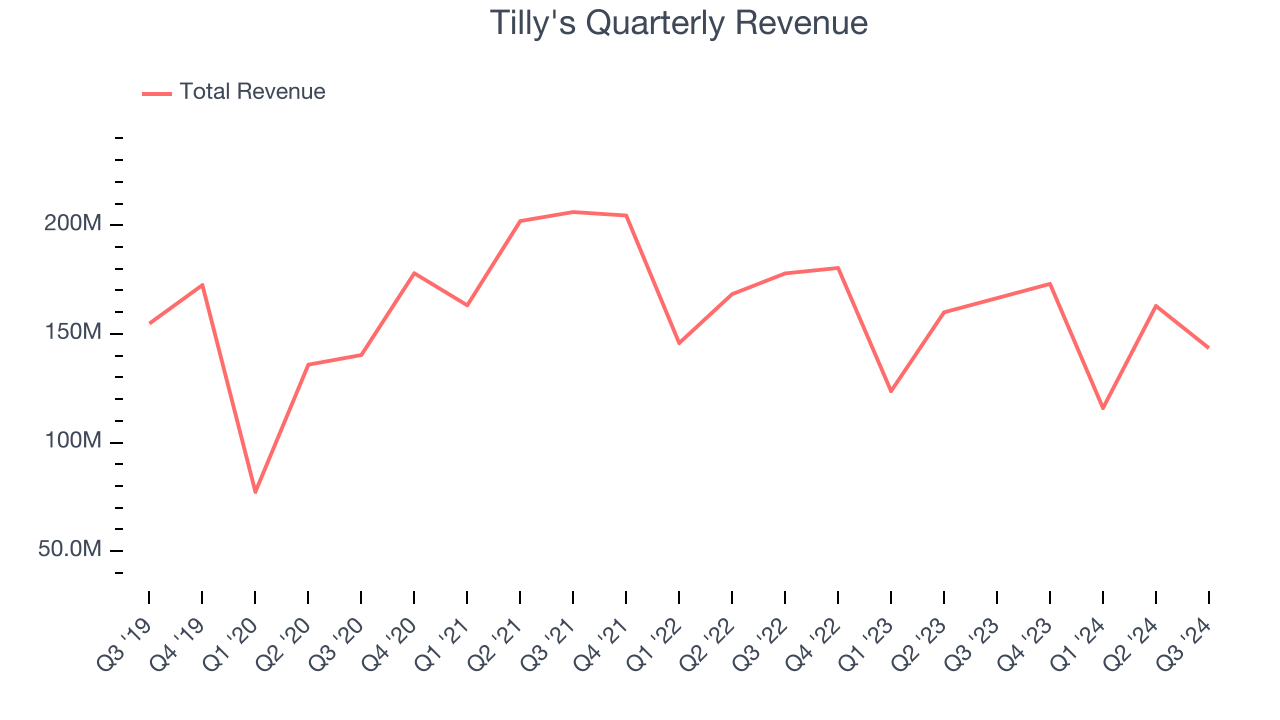

As you can see below, Tilly's struggled to increase demand as its $595.2 million of sales for the trailing 12 months was close to its revenue five years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Tilly’s revenue fell by 13.8% year on year to $143.4 million but beat Wall Street’s estimates by 1.8%. Company management is currently guiding for a 11.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. While this projection indicates its newer products will catalyze better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

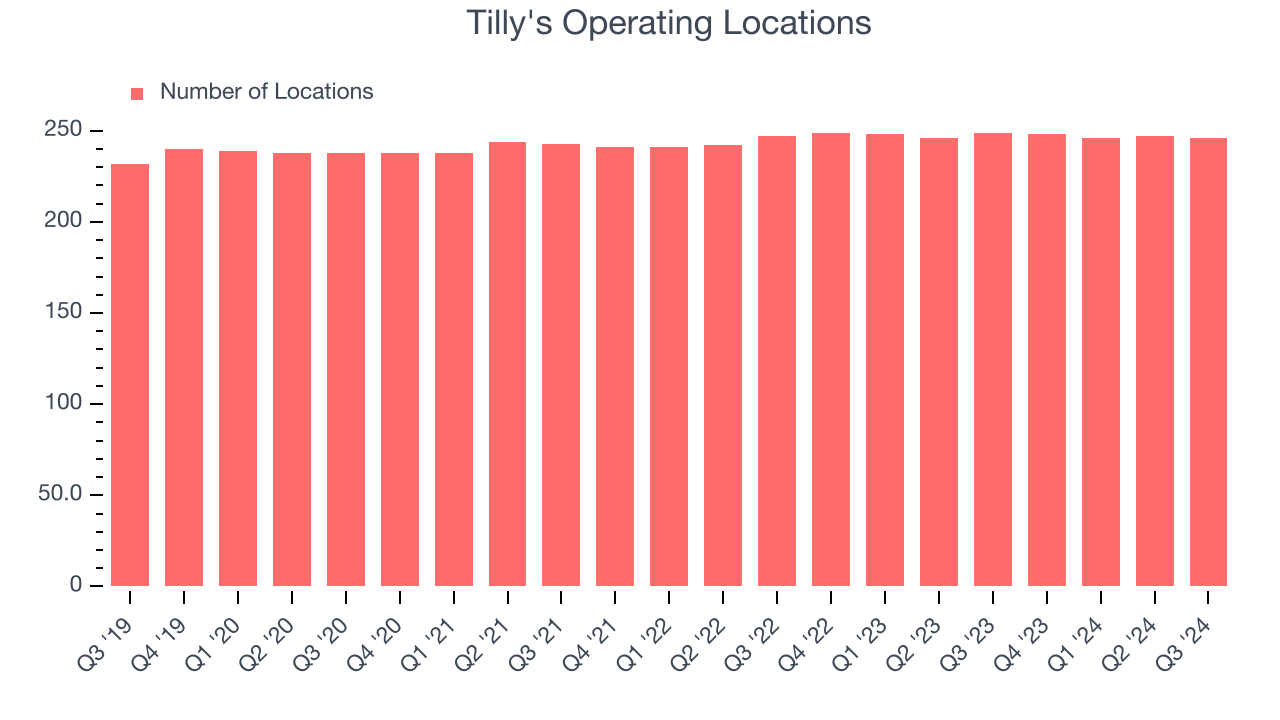

Tilly's listed 246 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

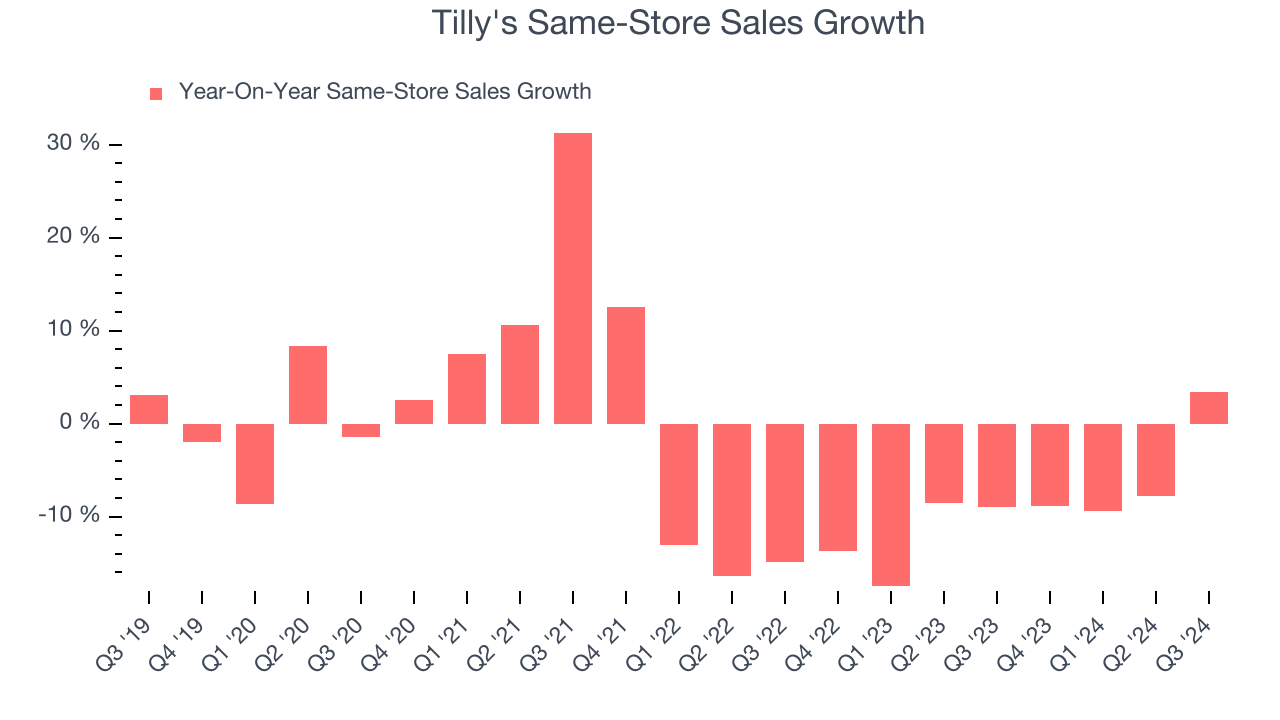

Tilly’s demand has been shrinking over the last two years as its same-store sales have averaged 8.9% annual declines. This performance isn’t ideal, and we’d be concerned if Tilly's starts opening new stores to artificially boost revenue growth.

In the latest quarter, Tilly’s same-store sales rose 3.4% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Tilly’s Q3 Results

It was encouraging to see Tilly's beat analysts’ revenue expectations this quarter. On the other hand, its operating profit fell short of Wall Street’s estimates and its revenue guidance for next quarter missed significantly. Overall, this was a mixed quarter. The stock traded up 3.7% to $4.48 immediately following the results, showing that expectations were likely low.

So do we think Tilly's is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.